- What Is the Housing Market?

- Housing Market Prediction 2022 To 2023

- Signs That House Market Crash Is Coming

- 1. Home Prices Going Down

- 2. Inventory Spikes

- 3. Less Confidence

- 4. Mortgage Interest Rates Grow Higher

- When Will The Housing Market Crash? Or Will It Crash?

- 1. Growing Population

- 2. Supply Demand Chain

- Frequently Asked Questions (FAQ):

- 1. Is The US Housing Market Up Or Down?

- 2. Why Is The House Market Price Not Going Down?

- 3. When Is The Best Time To Buy A House?

- Bottom Line

House Market Predictions 2022: When Will The Housing Market Crash?

When will the housing market crash?

Or rather, will the housing market crash? To get a proper answer, we need to analyze the housing market and predict whether it will crash in 2022 or the coming years.

This should not come as a surprise, but the housing market faced a terrific boom last year during the pandemic. Although the borrowing rate was historically low, the housing market followed a boom during the second half of 2020 and had the highest number of home sales in the history of the past 15 years.

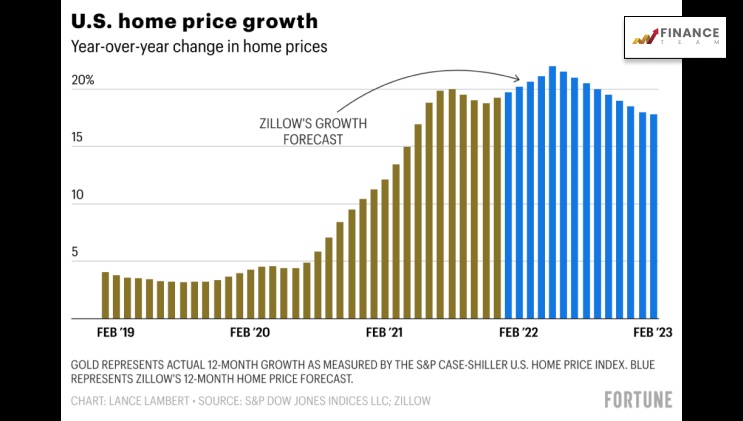

According to Sep 2021 statistics, the house price grew to an all-time high of 18.4%. Although several predictions before the pandemic foreshadowed the number of sold houses to hit a whopping 7 million by 2023; But, the USA already reached that goal in 2021, selling 6.9 million homes amid the pandemic.

Now, as for the question– When will the housing market crash? I have but one answer, The Housing market price will not crash anytime soon, at least not in 2022.

As per the 2021 housing market data, the housing market is not likely to stay robust this year as well. However, across several US states, the housing price for single homes grew by 20%. On the other hand, the income of the US citizens from these states has not seen the same hike.

The rising inflation has caused the federal reserve to increase the interest rates. As a result, borrowing money is more difficult than ever. So, how will all these affect the housing market in 2022? Will it crash or remain robust? Let me give you an overview of the housing market in the following article–

What Is the Housing Market?

The housing market is a market of properties for purchase and sale directly to the buyers or through real estate brokers. Also known as the real estate market, the housing market brings together homeowners who want to sell their properties, home renters, and real estate brokers who buy and sell these properties.

Read more: 5 Ways to Buy a House With Little-to-No Savings.

Housing Market Prediction 2022 To 2023

We cannot predict when the housing market will crash unless we go through a housing market prediction for the current and upcoming years.

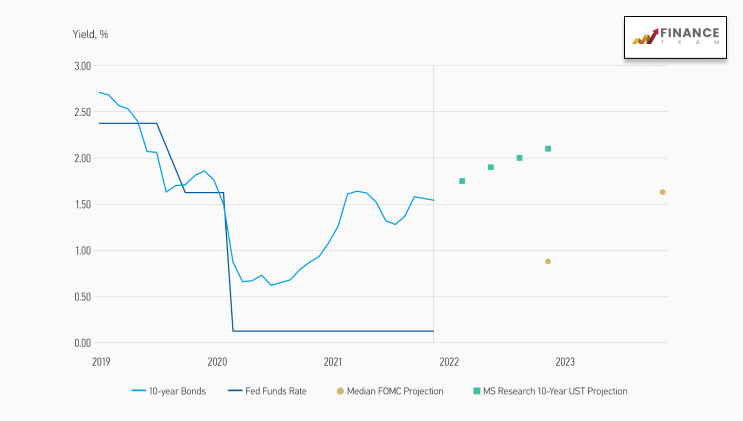

According to Fannie Mae’s predictions, the housing market price will increase until mid-2022. But there is no sign of home value appreciation recovering to the pre-pandemic rate of 5% until 2023. This may make the prospective customers a little worried about the 2023 house market.

Also, the predictions forecast that the 30 years mortgage rate may rise to a modest 3.5% by the end of 2023. The buyers will minimally benefit from the low borrowing cost as the prices rise. For investors who are trying to flip their properties, it is good news.

Fannie Mae also predicts that the price growth will be slower in 2023 than the previous year. A slow rate of home price appreciation may result in increased inventory saving the real estate market from a crash in 2023.

Also, in 2023, the volumes of purchase mortgage origination volumes are likely to increase to $2.1 trillion in 2023. Also, predictions expect the refinance origination to stay around $1.1 trillion in 2023 due to the impact of higher interest rates and strong home prices offsetting each other.

According to the predictions of Mark Zandi (chief economist of Moody’s Analytics), home prices will increase in certain states of the country while decreasing in others.

You may like to read: Three Ways to Sell Your House Fast.

Signs That House Market Crash Is Coming

When will the housing market crash? Indeed this is an important question. Although the pricing for the housing market remains robust in 2022, there are signs that a market crash is approaching soon. There are four such reasons supporting an imminent crash in the housing market–

| Summary | 2021 | 2022 | 2023 |

| 30 Years PMMS | 3.0 | 3.6 | 3.9 |

| Total Home Sales | 6.9 | 6.9 | 7.0 |

| House Price Growth (%) | 15.9 | 6.2 | 2.5 |

| Total Origination ($B) | $4651 | $3269 | $3143 |

1. Home Prices Going Down

Although there have been soaring price results for the housing prices, we have sited significant softening of home prices at several locations. For instance, the price is down by 1.8% in Peoria and Illinois. In Gulfport and Mississippi, that price has gone down by 5%, whereas Texas and Beaumont have seen a 1.4% fall. It may not seem to concern us at the moment, but it is still noticeable.

2. Inventory Spikes

Supply chain and demand are at the heart of any market. In a market with less supply of homes, the buyers are likely to take out larger mortgages.

During the pandemic, the interest rate was historically low. The millennials took this opportunity to buy their dream houses. The rate of buying houses increased to buyers getting caught up in bidding wars.

Since the demand for more homes spiked, so did the selling rate. As a result, new houses are made with inventory picking up. When there is ample supply, the bidding wars are lily to cool off. And the cool heads pay the price cautiously– presumably, the housing market price crashing down.

3. Less Confidence

According to a Fannie Mae survey in February, 70% of people believe buying a house in today’s time is a disaster. 43% of people expect the home price to go up within twelve months, while 58% are afraid that the mortgage rate will go up (and it is going up). 17% are afraid of losing their jobs. When there is less confidence, the demand may lower, making the home prices fall. Declining affordability is probably easing the gravity-defying rise in the house market price.

4. Mortgage Interest Rates Grow Higher

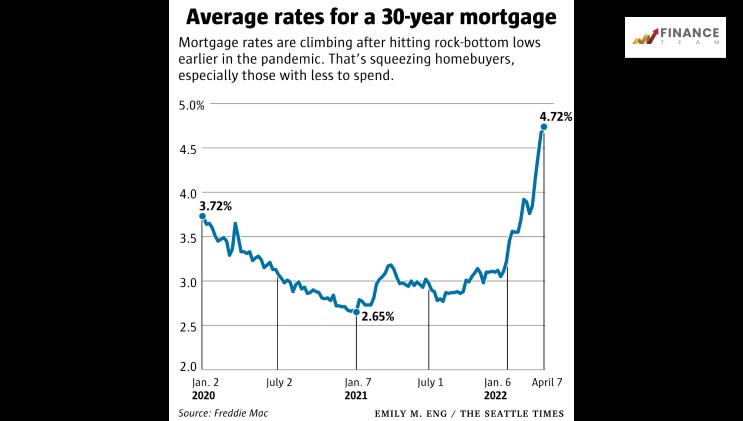

From being slightly above 3%, the mortgage rate has jumped up to 5%. While this is still remarkably low, The New York Times predicts that the buyers will probably pull away from the market following high prices, high mortgage rates, and low affordability criteria. From this, anyone can predict that the housing market price will soften.

When Will The Housing Market Crash? Or Will It Crash?

Now, following the signs of the housing market crashing down, you may hope to hit the jackpot and buy a house at a lower price. But, major predictions show that although the housing market price may get slightly moderate from mid-2022 to 2023, it will remain robust and continue to soar.

Here are some facts which I based my analysis upon–

1. Growing Population

The millennials and Gen Z, who cover 166 million (according to 2019) US citizens, need new houses. The US population is increasing, with more people ready to buy homes every year. The millennials who are buying houses already have the Gen Z behind them in line to buy houses in the coming years. So, usually, the housing market price will remain hot.

2. Supply Demand Chain

Although various predictions suggested that the US citizen would be a pessimistic sign to buying homes following the sheltering during the pandemic, it was proven wrong.

Instead, the demand for buying homes grew with the low mortgage being a stimulator. The sellers are real estate and cannot keep up with the increasing demand. So, if you are thinking about when the housing market will crash again– think again.

You can also check: 4 Signs You’re Ready To Sell Your Home.

Frequently Asked Questions (FAQ):

Here are some frequently asked questions about the housing market price –

1. Is The US Housing Market Up Or Down?

The average annual growth in the US market price has been 4.6% since 1989. However, the housing market price may crash following the significant growth in the mortgage rate. In 2022 alone, the mortgage rate has spiked up to 5%.

But, following the increasing demand for homes in the USA, home prices may not go down so soon. The inventory of the real estate industry is incapable of matching the growing market demands.

2. Why Is The House Market Price Not Going Down?

There are several reasons for the housing marketing price not going down. Here are some of the reasons–

- The economy is Hot, due to which the price may stay robust.

- The mortgage rate is slightly higher but historically low; this will not affect the buyers to keep away from the real estate market.

- There is a consistent demand pushing the housing market price upwards.

- The house price and rate may go down compared to 2021, but it may only be a moderate fall.

- Most US citizens are recovering from their jobs after the pandemic. So, joblessness will not hinder the need for new houses as we expected.

3. When Is The Best Time To Buy A House?

The best time to buy a house will be when the prices are low. However, it will be better if you follow these factors–

- You need to have a stable career.

- Ready a down payment.

- Not have any debt.

- Understand all the costs of having a home.

- When the mortgage is low.

Bottom Line

However, all the predictions are based on guesses following existing data patterns.

The inventory of the real estate industry is still not able to match up with the demand for houses which puts the sellers at an advantage; however, the buyers can still benefit from the competitive interest rates. Due to consistent demand, the housing market remains to be a seller’s market.

I hope the information regarding housing market prices helped you understand it in detail. Please comment if you have any further queries regarding the same.

Read Also: