- What Is Goodwill In Accounting?

- Important Features Of Goodwill

- Types Of Goodwill

- Purchased Goodwill

- Inherent Goodwill

- How To Calculate Goodwill?

- GOODWILL FORMULA

- Goodwill Valuation

- Method Of Goodwill Valuation

- Importance Of What Is Goodwill In Accounting

- Boosts Brand Loyalty

- Inspires Forgiveness

- Improves The Value Of Your Business

- Factors Affecting Goodwill

- Bottom Line

What Is Goodwill In Accounting? – Let’s Discuss

If you are someone that belongs to a commerce background or your work is closely related to accounting, you will probably be accustomed to the term goodwill.

If you are not, no worries then either, because I am here to explain to you what is goodwill in accounting and how it plays a significant role in counting the assets of a business.

In straightforward terms, goodwill in any business is the intangible asset that is only associated with when one company is being bought by another.

One can also define goodwill as the portion of the purchase price that exceeds the aggregate net value of the other assets that are involved in the acquisition, assuming all the liabilities.

Some of the critical factors that define the core of goodwill include a strong customer base, brand value, fair customer relations, healthy employee relations, and proprietary technology.

What Is Goodwill In Accounting?

In accounting, goodwill is the increased value of the assets of a company after deducting its liabilities. Intangible assets like brand image, internal management, and customer relationships are considered to be the goodwill of a company.

Every year, goodwill is to be evaluated for impairment.

The amortization period of goodwill for private organizations may only be ten years.

According to the US GAAP and IFRS standards, a company’s goodwill has an infinite lifespan; therefore, it does not require to get amortized.

Read More: When Does Goodwill Restock?

Important Features Of Goodwill

The importance of what is goodwill in accounting can be defined through these particular features.

- Although goodwill does not come under the category of tangible assets does not mean that they are hypothetical or imaginary. They may not have any physical presence, but their intangible presence is an essential contribution to the value of a company.

- Goodwill cannot be separated from the business; hence it can’t be sold independently like other tangible assets.

- Goodwill is the only asset that provides ROI without even having to invest or bear extra costs.

Types Of Goodwill

There are mainly two types of goodwill available –

- Purchased

- Inherent

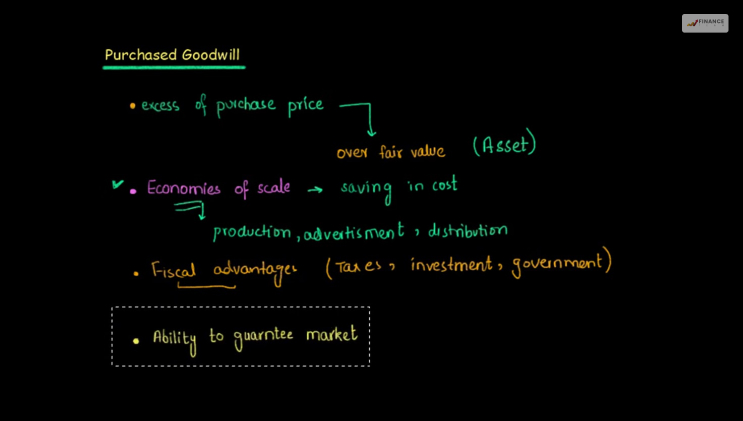

Purchased Goodwill

To explain in simple words, purchased goodwill is the surpassing amount that a company pays as a premium. This means the amount that a company pays while acquiring a company that surpasses the value of its tangible liabilities is known as purchased goodwill.

The purchased goodwill is shown on the balance sheet.

Inherent Goodwill

Contradicting to purchased goodwill, inherent or non-purchased goodwill is the goodwill that a company generates over a period of time due to its good reputation or other contributing factors.

It is also called self-generated goodwill, as companies generate this goodwill with their own efforts and are not purchased from other outside sources.

How To Calculate Goodwill?

Now that you know what is goodwill accounting, let me introduce you to how you can calculate goodwill while doing your accounts.

The formula for goodwill incorporated three key factors-

- Purchase price of the company

- The fair market value of the assets

- The fair market value of the liabilities

GOODWILL FORMULA

| Goodwill = Purchase Price Of The Company – (A-L) |

where,

A= market value of the assets

L= market value of the liabilities

Goodwill Valuation

Previously in this article, I talked about the various aspects as to what is goodwill in accounting, but in this section, I will particularly be focusing on the necessity and importance of the valuation of goodwill.

The valuation of goodwill must be carried out for the following reasons:

- When multiple partners are involved in the business, goodwill valuation is necessary for a fair division of profit and for generating the Profit Sharing Ratio (PSR).

- When a new partner or a new member is included, the valuation of goodwill is a mandate.

- Goodwill valuation is also necessary when an organization dissolves, and the sales are to be accomplished.

- In case of the death of a partner, goodwill valuation is needed to be done.

- Goodwill valuation is also required when one or multiple partners retire from the company.

Method Of Goodwill Valuation

There are three known methods that are used for valuing goodwill:

- Super Profits Methods

- Average Profits Method

- Capitalization Methods

Importance Of What Is Goodwill In Accounting

Goodwill doesn’t just come to business; there are a number of steps that a business has to take in order to generate goodwill for itself.

These steps may include the implementation of customer appreciation programs to offer extra services. This will help business owners reap several benefits in return.

Here is how goodwill is an important factor in fetching several benefits for business owners.

Boosts Brand Loyalty

Customer satisfaction increases customer interaction with a brand. Building goodwill with your customers will help you gain the confidence of your customers, and they will be more consistent while doing business with you. Goodwill will make customers loyal to your brand.

This way, they will insist on purchasing more products and services from your brand when they are in need of it.

Inspires Forgiveness

Imagine being upset with your partner for their mistakes, and they suddenly bring you a gift as a small token of love. Maybe the next time, your partner will be less likely to commit the same mistake that upsets you.

The same goes for companies as well. If you go that extra mile for your customers and pamper them a little by exceeding their expectations or making them feel appreciated, they might choose to overlook your mistakes.

Improves The Value Of Your Business

Goodwill fetches a company a positive reputation. When a company has a positive reputation, it grows in value. This will help in attracting more investors.

Goodwill will also help you get easy credits when you plan on expanding your business.

Also, when you decide to sell your business, goodwill will contribute to making greater profits.

Factors Affecting Goodwill

The factors that affect the goodwill of a company are:

- Quality of products or services

- Business Location

- Risks in business

- Efficiency

- Nature of the business

- Capital

- Trademark and patents

- Favorable contacts

Read More: How To Start A Trust Fund? – Let’s Find Out

Bottom Line

By now, you must be accustomed to what is goodwill in accounting and how it operates in a business.

Goodwill is the representation of definite value that a company obtains when it purchases another. It is the exact purchase amount that surpasses the market value of the assets minus the liabilities.

It is an intangible asset that is mostly concerned with the value of a company’s reputation, employee relationships, customer loyalty, etc.

Goodwill has an indefinite lifespan; impairments may be done to check its value from time to time. If the value of goodwill decreases, so will its amount on the balance sheet, and it will be considered a loss on the income statement.

Read Also:

All Comments

Edwardarord

11 July, 2023

Regional Communications Minister Bridget McKenzie has defended the federal government's national program to fix mobile phone black spots following a Victorian exit. blacksprut com The Victorian state Labor government has announced it will go it alone in building mobile phone towers in regional areas after dumping the commonwealth's program. The state government blamed the decision on the Turnbull government failing to properly consult over site choices and a lack of transparency. Senator McKenzie defended the national program. "We made those commitments in the federal election on areas of need for regional communities and I'm really looking forward to making sure those communities get access to that infrastructure ASAP," she told ABC Radio. She said places like Aireys Inlet and Anglesea in Victoria see an eight-fold increase in population from tourism over summer and the infrastructure that covers 1000 people in the district can't support the influx. The minister declined to say whether there would be a fourth round of funding for the program in this year's federal budget. Labor frontbencher Stephen Jones said the Victorian decision was an indictment of a failed program. "In rounds one and two, 80 per cent of the locations announced were in Liberal or National Party electorates," he said. "Critical locations in areas of Victoria, particularly bush fire prone areas, have missed out." Mr Jones said round three funding was based on 2016 election promises not community needs.