- Current Udaipur Cement Share Price

- Udaipur Cement Share Price Prediction

- 1. Historical Data

- 2. Predicted Future Data

- 52 Week High And Low Of Udaipur Cement Share Price

- 1. Historical Data

- 2. Predicted Future Data

- Bullish Or Bearish?

- Udaipur Cement Share Performance By 2027

- Frequently Asked Questions (FAQs):

- The Verdict - Is Udaipur Cement Share Worth Investing?

Udaipur Cement Share Price 2022 – Present Price, Forecast, Statistics, Verdict, More

Udaipur Cement Works Limited (UCWL) is a renowned cement production corporation. It originates in the city of lakes in the Rajasthan state of western India. The concept is founded on long-term progress and a developmental framework that strives for a better and happier tomorrow.

To get more deets on Udaipur Cement Share Price, keep reading the sections below:

Current Udaipur Cement Share Price

The Udaipur cement Share price today, which is on May 24, 2022, is 31.200 INR.

Udaipur Cement Share Price Prediction

This section will let you analyze past Udaipur Cement share price trends as well as forecast patterns over particular time periods. You’ll discover information about Udaipur Cement NSE Share Price’s history, present, and future health.

Historical and anticipated data may be seen in the graphs below:

1. Historical Data

| Date | Opening | Closing | Minimum | Maximum |

|---|---|---|---|---|

| 2023-09-27 | 32.290 | 32.290 | 32.290 | 32.290 |

| 2023-09-26 | 32.680 | 32.680 | 32.680 | 32.680 |

| 2023-09-25 | 33.810 | 33.810 | 33.810 | 33.810 |

| 2023-09-22 | 31.750 | 31.750 | 31.750 | 31.750 |

| 2023-09-21 | 32.110 | 32.110 | 32.110 | 32.110 |

| 2023-09-20 | 31.280 | 31.280 | 31.280 | 31.280 |

| 2023-09-18 | 31.880 | 31.880 | 31.880 | 31.880 |

| 2023-09-15 | 32.060 | 32.060 | 32.060 | 32.060 |

| 2023-09-14 | 29.650 | 29.650 | 29.650 | 29.650 |

| 2023-09-13 | 31.930 | 31.930 | 31.930 | 31.930 |

| 2023-09-12 | 31.610 | 31.610 | 31.610 | 31.610 |

| 2023-09-11 | 33.180 | 33.180 | 33.180 | 33.180 |

| 2023-09-08 | 33.890 | 33.890 | 33.890 | 33.890 |

| 2023-09-07 | 34.440 | 34.440 | 34.440 | 34.440 |

Analysis:The HFCL NSE share price data shown above is historical. This indicates a pattern in the stock's financial health. Between the 4th to the 23rd of May 2022, prices decreased. Positive outcomes are, nevertheless, possible.

2. Predicted Future Data

| Date | Price | Min Price | Max Price |

|---|---|---|---|

| 2022-9-29 | 32.605 | 31.374 | 33.854 |

| 2023-10-2 | 33.088 | 31.854 | 34.346 |

| 2023-10-3 | 32.497 | 31.317 | 33.555 |

| 2023-10-04 | 32.298 | 31.072 | 33.552 |

| 2023-10-5 | 32.550 | 31.347 | 33.766 |

| 2022-10-6 | 32.613 | 31.477 | 33.835 |

| 2023-10-9 | 33.096 | 31.950 | 34.285 |

| 2023-10-10 | 32.505 | 31.286 | 33.620 |

| 2023-10-11 | 32.306 | 31.164 | 33.478 |

Analysis:The predicted data set above is depicting the upcoming Udaipur Cement Share Price forecast from 25th May to 6th June.

52 Week High And Low Of Udaipur Cement Share Price

The table below provides Udaipur Cement Share’s 52-week high and low data. The difference between the highest and lowest yearly measurements is represented by this range. Take a look at the tables below.

1. Historical Data

| 52 Week High | 52 Week Low |

|---|---|

| 51.75 | 24.55 |

2. Predicted Future Data

| 52 Week High | 52 Week Low |

|---|---|

| 47.514 | 32.020 |

Bullish Or Bearish?

Analysis:Udaipur Cement Works Ltd shares and maybe its market situation is in a bullish cycle in the previous 12 months, according to current data. Stocks in the Other Quarrying, Mining, Gas and Oil Extraction sectors appear to have been popular recently.

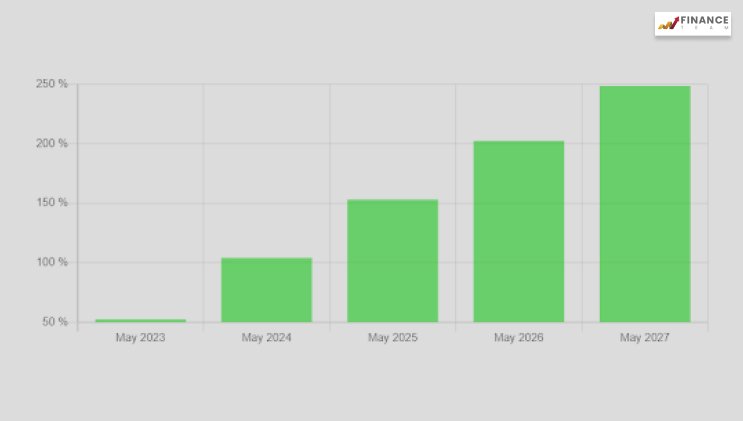

Udaipur Cement Share Performance By 2027

Analysis:You’ll gain a complete picture of the stock performance from the above Udaipur Cement Share Price prediction diagram. As you can see, stock prices will continue to rise until 2027. Between 2023 and 2027, the share price of the company will certainly rise, with a sustained ROI.

Frequently Asked Questions (FAQs):

Ans: The Udaipur Share Cement Price NSE India is $31.200 INR.

Ans: Yes, The Udaipur Cement Share Price may rise from 31.200 INR, to 47.514 INR in a single year.

Ans: Yes, the earning potential in the long term from Udaipur Cement Share Price NSE is +52.29% in one year.

Ans: The Udaipur Cement Share Price target of 2022 can reach 108.784 INR in 5 years.

Ans: No, as per Udaipur share news, this won’t happen.

The Verdict – Is Udaipur Cement Share Worth Investing?

In the future, there will be a favorable trend. Udaipur Cement Share Price may be a suitable place to invest for profit. We advise considering this stock in your portfolio due to its optimistic outlook. Trading is simpler in the bull markets always. So you may want to prioritize this stock under certain situations.

But if you are new to investing, always study up on the best investment tactics. If you’re excellent with money and want to invest, the Udaipur Cement Works is listed on the BSE LTD stock exchange.

Disclaimer:Respected Readers, the Udaipur Cement price facts, and the data we presented above are all assumptions. All the data refers to those present on the leading cryptomarket websites. The actual values might be different on the basis of the market situation. Please note that share/stock prices are subject to market risks. Read all the documents and examine them carefully before investing.

Read Also: