Net Income Formula – Discover How To Calculate Net Income

What is the net income formula?

Net income is one of the fundamental processes for accounting and finance. It has grave importance for both personal and business-level finance management.

By calculating net incomes, a business can understand its profitability and strategize for the future. Similarly, individuals can better manage their finances and spending with a clear outline of personal net income.

That is why it is crucial to understand the net income formula and how to use it to calculate net income. If that is why you are here, read this article quickly. Here, I have outlined net income and how to calculate it in simple words.

What Is Net Income?

The net income of a business refers to the amount a business makes after the cost, allowance, and taxes are deducted from the revenue. If we see it from the perspective of commerce, then the answer would be more elaborate. A company’s net income is leftover after all the expenses during the business process are deducted.

These expenses include – employee salary, wages, cost of raw materials or goods, and taxes. This is the definition from the business perspective. But from an individual perspective, net income is usually called take-home salary. This is the money after the deduction of taxes, health insurance, & retirement contributions.

Usually, the net income of a business or an individual is comparatively greater than the expenses deducted.

Read More: How To Calculate Gross Profit? – Explore With Example

Net Income Formula

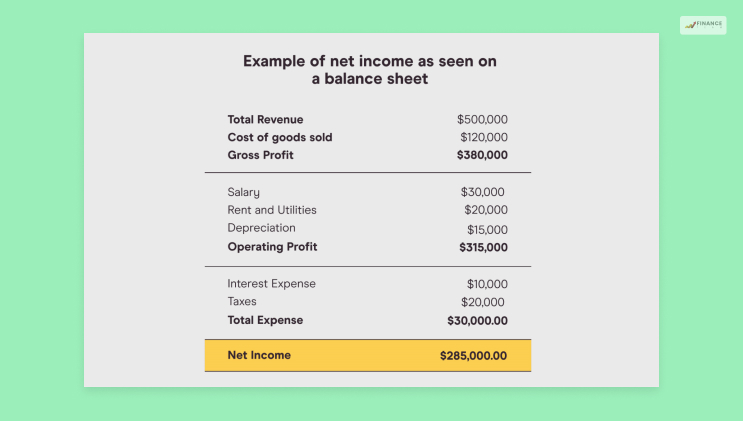

As explained before, your company’s Net income is your business’s complete profit after deducting all the expenses. Many people refer to net income as net profit or net earning. Here is the simple process for calculating the net profit of a business –

| Revenue – Cost of Goods Sold – Expenses = Net Income |

The formula can also be calculated by following another variation of the formula mentioned below –

| Gross Income – Expenses = Net Income. |

How To Calculate Net Income?

When calculating the net income of an individual or a business, you will need different elements, such as gross revenue and expenses. The expenses usually include taxes and interest payments.

Net income for individuals usually includes the money an individual earns through their paycheck every month. The earning sources can also be investment, social security, or side hustles.

But net income for businesses is usually measured every quarter. GO through the passages below to have an idea about how net income works for businesses and individuals.

Net Income For Businesses

It is crucial for businesses to calculate net income accurately. The proper calculation of NI also concerns the investors since the earnings per share of a publicly traded company depends upon its net income. Sometimes revenues can be inflated, or expenses may remain hidden. Business analysts recommend the proper calculation of NI for better evaluation of a company’s shares.

So, how to determine the net income of a company? Here is an example that might help you –

Let’s say that a small company has made $5 million in revenue during its first quarter of 2023. They have also earned $1 million in interest, equities, and other incomes. They have spent 1.5 million in the cost of goods sold, $0.75 million in administrative and general expenses, and $0.25 million in different operating expenses. The company has also incurred another $1 in interest payments and tax liabilities.

According to the available data, their net income calculation would be as follows –

| Net Income = ($5 million + $1 million ) – ($1.5 million + $0.75 million + $0.25 million + $1 million) Net Income = $6 million – $3.5 million = $2.5 million |

Net Income For Individuals

Individual net income is what we call take-home salary. Let’s say John earns $5000 through his monthly paycheck. He pays $350 in federal tax and $55 in Medicare tax. The social security tax deducted from his paycheck is $175. The state tax deducted from his paycheck is $125, and $150 for insurance deduction. So, according to these data, if we apply the net income formula, his net income would be –

| Net Income = $5000 –$350 –$55 –$125 –$150 =$4145 |

In this case, the take-home salary for John would be $4145.

Why Is It Important To Understand Net Income Formula?

Both from a business perspective and an individual level, understanding net income has a huge impact. Understanding net income allows an individual to outline their potential for living expenses. It also helps them regulate discretionary expenses.

Here are some importance of calculating net income –

Financial Health

The net income of a company offers a clear overview of a company or individual’s financial health. It helps businesses determine whether they will be able to take on other financial responsibilities. Also, on an individual level, net income helps an individual manage their expenses, save and invest for future necessities.

Investment Decisions

The price of each of the shares of a publicly traded company is directly related to net income. It offers investors an idea about a company’s profitability, their expenses over time, thereby influencing their investment decisions. High net income is suggestive of good business financial health. On the other hand, if a company has a meager net income, then it is a potential red flag when it comes to buying its stocks.

Tax Liabilities

Net income also influences the tax liabilities of an organization. It plays a crucial role when filing taxes. Businesses can estimate their payable amount of tax liabilities on a yearly basis. So, clearly, net income has a considerable effect on tax liabilities.

Tracking Financial Performance

A business evaluates its financial performance in each of the quarters of the year. This calculation allows them to track properly and compare their performance on a quarterly and yearly basis. The evaluation of net income can also help strategize a business for future profitability and growth.

Bottom Line

The net income of a business and an individual offers valuable, necessary metrics. Both individuals can utilize the insight received from net income to regulate their future performances.

I hope that this article was able to provide you with a clear idea about net income. However, if you have other queries, please let us know in the comment section below. We value your feedback and would love to answer them.

Read More:‘

- How To Calculate Net Sales? – A Step By Step Guide

- How To Find Marginal Revenue? – Discover With Example

- How To Find Marginal Cost? Why Is It Important For Businesses?