- What Is The Mobikwik IPO?

- What Are The Goals And Objectives Of The Mobikwik IPO?

- How Does Mobikwik Recent Financial Evaluation Look Like?

- What Will This New Mobikwik IPO Bring?

- If You Are A New User To The Application These Are The Pros And Cons You Should Consider

- Pros

- Cons

- Always Be Careful When It Comes To Money

MobiKwik IPO Review: MobiKwik Launch Date & IPO Price

‘Buy Now Pay Later’ does seem like an idea in fantasy but with Mobikwik’s new IPO you can conjure that dream to reality.

Since demonetization in the year 2017, Digital Wallet has been a common term used everywhere. It has been claimed to be the safest form of a money transaction. Needless to say, today we have an endless number of such digital wallets, but what makes Mobikwik stand out?

It’s a new and reformed Buy Now Pay Later scheme. The name itself will attract customers left and right. It is like a minimum credit offering that allows users to pay bills, clothes, or other necessities.

On top of that, in the latest Mobikwik IPO they have come up with a new Zaakpay to ease the procedure of online transactions.

Here are the latest Mobikwik IPO reviews.

What Is The Mobikwik IPO?

Mobikwik IPO is the latest reformation (after Paytm IPO, Nykaa IPO, Zomato IPO, LIC IPO) that the application is trying to bring about. Buy Now Pay Later known as Mobikwik zip is one of its latest credit-based schemes.

Its first Red Herring Prospect suggests that the IPO price is a total of ₹1900 crore with a reformed share of ₹1500 crore. It consists of a sale amount of ₹400 crores by his fellow promoters and stakeholders.

In its latest review filed with SEBI, Mobikwik IPO is estimated at $ 1 billion. The stakeholder who is qualified will be given 75% of the IPO share and the other non-institutional or retail investors will be given a share of 15% and 10% each respectively.

The first draft was filed on 12th July 2021 but the official launch date for this IPO hasn’t been decided yet.

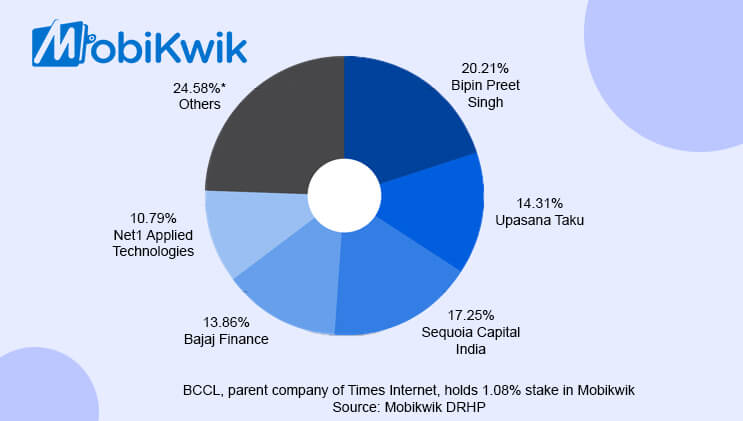

Sequoia Capital [17.25%], Bajaj Allianz [13.86%], and Net Applied Technologies [10.79%] are a few of its notable investors.

What Are The Goals And Objectives Of The Mobikwik IPO?

- Firstly, it has a goal to address all the corporate objectives.

- Secondly, having a few organic growth initiatives to gain more customers. It stands at an amount of 107 million users.

- Lastly, to repay all the outstanding borrowings.

How Does Mobikwik Recent Financial Evaluation Look Like?

Mobikwik’s income after the last financial end of March 13 is 18% to 302.2 crores. The loss counted at 11.3 crores.

Mobikwik has also suffered a tremendous loss in the last two financial endings. Being 84.6 crore and 141.8 crores in 2020 and 2019 respectively.

What Will This New Mobikwik IPO Bring?

- The new IPO has revealed that with the new BNPL [Buy Now Pay Later] credit scheme, critical work is being put forward to eradicate any risk associated with it.

- Identification of suitable users is done through efficient development in the collection strategy to protect the company from any sought of fraudulent activities which later can bring loss to the shareholders.

- MobiKwik has always strived through data collection that was beyond any traditional or surface methods. In the recent Mobikwik IPO, they are planning to make the procedure of data collection much more stringent.

If You Are A New User To The Application These Are The Pros And Cons You Should Consider

When investing your money into something, always evaluate the pros and cons.

Pros

- The overall rating is 86% out of which the user rating is 83%.

- It is a trusted and established entity with Big Fortune 500 backing as shareholders.

- It supports many third-party trading platforms. Therefore, opening access to a variety of markets worldwide.

- They are a pioneer when it comes to new-age innovation

- They have customer service to help in installment. Also, they have live chat support and email communication.

- The replies to any customer query are fairly quick.

Cons

- It has free sign up but with the premium features don’t have a free trial

- It doesn’t have a refund/cancellation system. Once an erroneous payment has been made by you to someone else’s wallet, the money can’t be refunded.

- The new reformed application has gotten a little complicated.

- They have fewer discounts after payment.

Always Be Careful When It Comes To Money

As a new investor if you are planning to buy a share in this new Mobikwik IPO then it is a good choice you can go forthwith. With the new reformed security measures that are being taken after two consecutive years of heavy loss, your investment will be in much safer hands.

On the other hand, if you are a user then there are numerous advantages that you will be gaining from this application. With smooth bank payments and now coming up with solving credit requirements, you won’t have to look elsewhere.

However, while investing in any shape or form to an entity that deals with the constant transaction of money you should always be careful. Always observe and complain about any fraudulent behavior. This in return helps you to avoid huge losses and also assists the company to investigate questionable activities going through their application.

Read Also: