Minto Money Review: Is This Tribal Lender Any Good?

A tribal money lender called Minto Money provides loans in EMI up to $4,000. They are short-period loans created to help those who want quick cash yet need time to pay their debts. The Native Village of Minto, a recognized Native American Indian tribe in Alaska, was the reason Minto was initially founded.

What Makes Minto Money Different?

Minto Money is different from others because:

1. Transparency

There needs to be more information on interest rates and fees on their official website. With the exception of $20 late fees and $30 nonsufficient funds costs for returned payments, Minto’s website states in the small print that “our fees are revealed in your loan agreement.” Yet, it needs to provide more information about the fee range they charge before applying.

On paper, Minto Money also acknowledges that various financing choices, such as home equity lines of credit or credit card advances, could be a more practical, less expensive choice.

2. Online Applications And Approvals

Although Minto Money asserts that it complies with Internet and short-term lending rules, it may not be subject to regulation by state agencies like the Consumer Financial Protection Bureau or the Federal Trade Commission.

3. State Law Regulations

Minto Money loans are installment loans Putting Money First: The Complete Online Guide on Everything to do with Installment Loans, as opposed to payday loans, which require you to repay the amount borrowed by the time you receive your next salary. It implies you may refund the money over time, but Minto is secretive about how long its loans last and how many payments are necessary. According to the website, Minto Money will only assist you in creating a “manageable payment plan” that corresponds with your paychecks.

4. Options For Instalmanets

Minto Money loans are installment loans instead of payday loans that make you repay the amount borrowed by the time you receive your next salary. It implies you may refund the money over a period of time, but Minto is secretive about how long its loans last and how many payments are necessary. According to the website, Minto Money assists you in creating a “manageable payment plan” that corresponds with your paychecks.

Minto Money Personal Loans: What You Must Know

Remember the following additional information if you’re considering a loan from Minto Money.

- State Accessibility: If interested, determine whether yours is there before applying. Minto Money does not lend in all states.

- Not For The Military: The online application form asks if you are a current military member. Individuals who select “yes” are informed that no loans are currently being provided to them.

- Same-Day Funding: Depending on your bank, you might be able to get your money the same day if your application is accepted.

- Loan Cancelations: If, after approval, you decide that your loan could be better for you, you might not be forced to keep it. After you get the cash, Minto Money claims it will let you cancel, but you must do it by the next business day ends.

- No Prepayment Penalties: You might be able to pay off your loan early without incurring prepayment penalties. Call Minto customer services so they can handle processing your payment.

How To Apply For Minto Money Loans?

Because the lender will consider other criteria, such as your income and banking history, you could discover that it’s still feasible to get accepted for a Minto Money loan even if you have terrible credit.

For a loan from Minto Money, you must meet the following criteria:

- You must be at least 18 years old.

- You can’t be involved in bankruptcy.

- Share your name, address, income source, and account information.

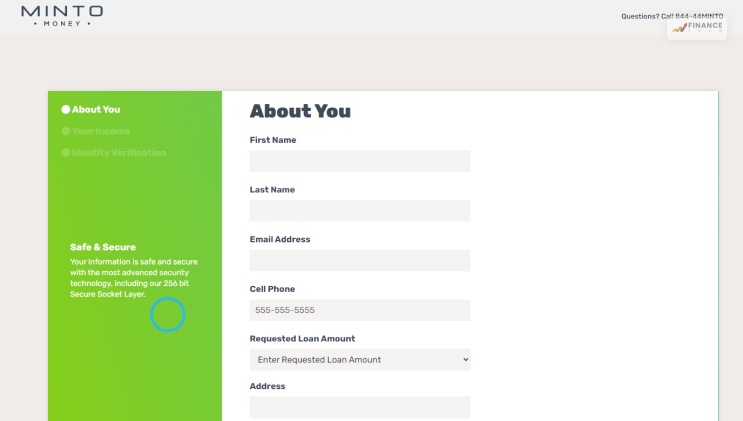

You can complete the brief application form on Minto Money’s website if, after weighing your alternatives, you decide it might be your best choice. Your name, state, email address, and the amount you wish to borrow will all be included.

There is also a part where you must disclose your income with other details. Also, you’ll need to interact with a customer care agent to finish the verification procedure.

Best Minto Money Alternatives

The best alternative banks to Minto Money with similar services are:

- OneMain Financial: OneMain Financial may be a choice if you’d want to qualify for a loan and examine your possible rate.

- NetCredit: If you don’t have the finest credit but want more extensive emergency loans up to $15,000 with the ability to prequalify, this could make sense.

Final Verdict: Is Minto Money Any Good?

Applying for a Minto Money loan may be dangerous. You will know the interest on your loan once you apply and get accepted, and obtain a loan agreement. This will help you understand its rates and fees still need to be discovered.

Consider alternative bad credit lenders before applying for a Minto Money loan to pay for unexpected bills. They may be more upfront about their rates, enabling you to quality on time without a short credit query and damage your score.

Investigating a state credit union or lending app for a payday alternative loan is another shrewd approach.If you choose to borrow a loan from Minto Money, read the agreement and understand their interest rates, costs, and payback schedule before signing. Minto understands they are pricey loans, so you should research them thoroughly before agreeing.

Read Also: