LIC IPO Review: LIC IPO Launch Date & IPO Price

When you are searching for the largest insurance corporation in India, the name of the LIC IPO is coming to your mind within seconds. LIC is the largest insurance corporation in India. It is the most trusted brand in the history of the insurance company. LIC is not only the trusted brand in the insurance sector. This brand is setting an example in the financial industry. For knowing the reviews of the LIC IPO, you have to go through the new price date and the IPO launch date of the LIC.

Now the LIC is slowly enhancing its functionality and starting its initial public offerings. As a result, many insurance companies are introducing their IPO activity like Nykaa IPO, Zomato IPO, Paytm IPO. But for the LIC, this is the most extensive IPO activity in the country’s history. Still, the planning is in progress, but as the pre-launched IPO, this planning is widely popular and counted as the most comprehensive IPO activity.

Let’s first look into details for the LIC company and know if LIC is private or government.

Is LIC A Private Or A Government Organization?

LIC started its journey in 1956. Initially, it was a state-owned insurance provider company. More than 245 companies were providing the insurance at that time, and the LIC was one of them. And as time passed, all these 245 companies are starting to merge to form this single entry.

In 1990 every state-owned insurance company was introducing itself as the private business sector. And LIC is one of them. After 1990 the LIC presented itself as the private insurance sector. The head office of the LIC is in Mumbai. And from this one office, the country has more than 2051 branches.

After 1990 the LIC maintained its monopoly holding in the Indian Insurance sectors. After 1992 the company is facing many challenges, which are barriers to their growth. But the LIC is maintaining its stronghold on the financial and the insurance sector.

In 2021 the Indian finance minister is sharing the speech about the LIC IPO. And she said that State is expecting around 90,000 cr rise with the LIC IPO. This is now the biggest news in the insurance finance sector. Let’s take a glimpse and know what precisely the IPO is.

What Is LIC IPO?

LIC IPO is an initial public offering that allows the company to get listed publicly. The IPO activity is not only going to help the company in the public listing, but its shares are trading in the stock exchanges. LIC IPO is going to be listed under the National Stock Exchange. In addition, some portions of the shares will be distributed for public share buying and trading.

When you are going through the details of the IPO, you will see that LIC is introducing itself for the first time as a state-owned insurance company. The government is holding more than 90% of the stake in the Life Insurance Corporation. Before the announcement of the LIC IPO date 2021, there is news about the IPO. And the news was IPO size reaching more than 1 lakh crores. And after the announcements, the IPO size is restricted anywhere below the 80 thousand cr.

Hence we told you before the LIC is doing the monopoly business in the finance sector. And as a result, you can expect the LIC IPO in the big surprise estimation.

What Is The Launch Date Of LIC IPO?

The biggest news of the LIC IPO as some of the portions of the stake are altering for the share exchange and the trading. So there is a chance that the company is going to burn the interest amount for the investors. And this is becoming serious news for the financial investors of LIC. In general financial overviews, the policyholders of the LIC are not going to be impacted if the LIC is going public. But for the investors, IPO news is different.

But in general, when you are going to check the process of the LIC IPO, you will see how the process is becoming more transparent and accurate. So this flexibility applies to everyone. And in the long term, it will be more beneficial while you are a policyholder or an investor.

As per the finance minister’s announcements, you can expect the LIC IPO launching date not earlier than March 2022. Before March 2022, the launching is pretty impossible as many systems have to be built individually. But the exact date of the launch is not confirmed.

What Is The Price Of LIC IPO?

The Indian Government is expecting to raise from $20 to $24 billion from the LIC IPO. As the IPO policy is indicating 10% of the shares which are being issued are reserved for the LIC policyholders. But still, now the exact IPO price of the LIC is not being announced. However, from June 2021, the investment banks of India are slowly starting to submit their proposal. And from June 2021, the initial public offerings are starting to materialize.

The IPO price of the LIC belongs in the order range of investors who are getting interested in investing in the LIC IPO. Depending upon your paid-up capital, the price range of the LIC IPO is entirely dependent. For the 26,000 cr of paid capital, you can expect the market valuations of 14 lakh to 15 lakh. Therefore, you can expect the LIC share prices to be in the range of Rs. 500 -700 /share.

Wrapping It Up:

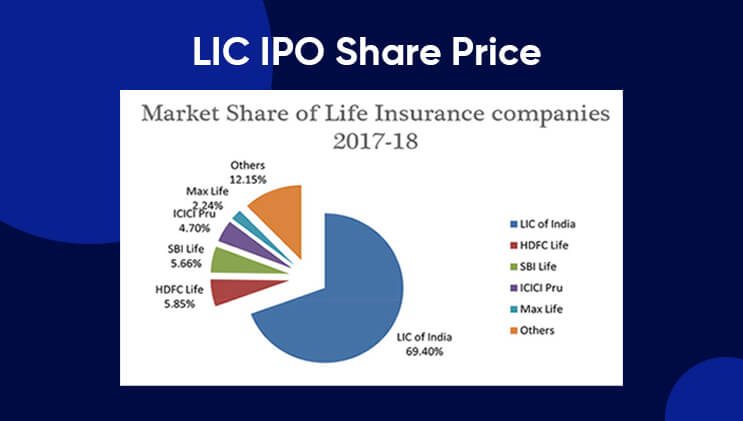

LIC IPO is a new approach for the LIC and the financial sectors. And this approach is going to be a more modern approach to deal with the current financial investments policy. As in the previous few decades, the LIC is running the Indian Investment market solely.

For the policyholders, these changes are not going to be impacted. But for the investors, these changes bring many new things in the financial sectors and the investment market. So are you planning to take part in the LIC IPO? Do not forget to share your option in the comment sections.

Read Also: