- Current JP Power Share Price

- JP Power Share Price Prediction

- 1. Historical Data

- 2. Predicted Future Data

- 52 Week High And Low Of JP Power Share Price

- 1. Historical Data

- 2. Predicted Future Data

- Bullish Or Bearish?

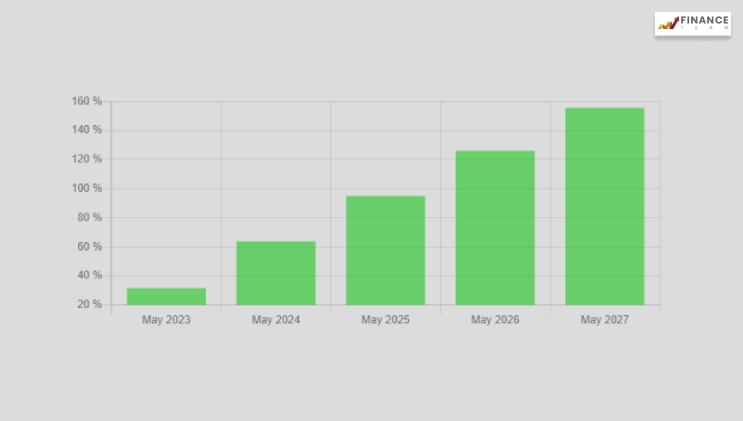

- JP Power Share Performance By 2027

- Frequently Asked Questions (FAQs):

- The Verdict - Is JP Power Share Worth Investing?

JP Power Share Price – Present Price, Forecast, Statistics – Should You Invest In It In 2022?

JP Power Share Price comes from an Indian Power Company named Jaiprakash power ventures limited. Incorporated on 21st December 1994, it’s a part of India’s leading infrastructure conglomerate named Jaypee Group. Jaypee Group is a multidimensional infrastructure conglomerate in India with interests in construction, Engineering, Cement, Power, Real Estate, Expressways, etc. They develop, implement, and operate India-based power projects.

To learn more about JP Power Share Price, keep reading this guide till the end.

Current JP Power Share Price

The JP Power Share Price today, which is on June 20, 2022, is 5.750 INR.

JP Power Share Price Prediction

Before investing in any share, you must know what its future behavior is and how it’s going to perform in the coming years. That’s why I have come up with the historical and predicted future data in relation to JP Power Share Price.

1. Historical Data

| Date | Opening price | Closing price | Minimum price | Maximum price |

| 2022-06-17 | Open: 6.200 | Close: 6.100 | Low: 6.100 | High: 6.200 |

| 2022-06-16 | Open: 6.750 | Close: 6.350 | Low: 6.300 | High: 6.750 |

| 2022-06-15 | Open: 6.700 | Close: 6.650 | Low: 6.650 | High: 6.750 |

| 2022-06-14 | Open: 6.800 | Close: 6.700 | Low: 6.700 | High: 6.850 |

| 2022-06-13 | Open: 6.850 | Close: 6.750 | Low: 6.750 | High: 6.850 |

| 2022-06-10 | Open: 7.000 | Close: 7.050 | Low: 7.000 | High: 7.100 |

| 2022-06-09 | Open: 6.950 | Close: 7.100 | Low: 6.900 | High: 7.100 |

| 2022-06-08 | Open: 7.050 | Close: 6.900 | Low: 6.900 | High: 7.050 |

| 2022-06-07 | Open: 7.100 | Close: 7.050 | Low: 7.050 | High: 7.100 |

| 2022-06-06 | Open: 6.900 | Close: 7.150 | Low: 6.900 | High: 7.200 |

| 2022-06-03 | Open: 7.100 | Close: 7.050 | Low: 7.000 | High: 7.150 |

| 2022-06-02 | Open: 7.200 | Close: 7.300 | Low: 7.150 | High: 7.400 |

| 2022-06-01 | Open: 7.100 | Close: 7.200 | Low: 7.050 | High: 7.200 |

| 2022-05-31 | Open: 6.750 | Close: 6.900 | Low: 6.750 | High: 6.900 |

Analysis: As you can see, from 31st May to 10th June, the JP power share was in an increasing trend. After 13th June, the JP Power share price started to drop and which you can consider a negative signal. However, since the overall outlook is positive, its’ recommendable.

2. Predicted Future Data

| Date | Price | Min Price | Max Price |

| 2022-06-21 | Price: 5.838 | Min: 5.515 | Max: 6.154 |

| 2022-06-22 | Price: 5.824 | Min: 5.507 | Max: 6.149 |

| 2022-06-23 | Price: 5.767 | Min: 5.437 | Max: 6.091 |

| 2022-06-24 | Price: 5.665 | Min: 5.367 | Max: 6.013 |

| 2022-06-27 | Price: 5.486 | Min: 5.162 | Max: 5.831 |

| 2022-06-28 | Price: 5.637 | Min: 5.305 | Max: 5.959 |

| 2022-06-29 | Price: 5.623 | Min: 5.295 | Max: 5.954 |

| 2022-06-30 | Price: 5.566 | Min: 5.227 | Max: 5.899 |

| 2022-07-01 | Price: 5.464 | Min: 5.141 | Max: 5.775 |

| 2022-07-04 | Price: 5.284 | Min: 4.941 | Max: 5.628 |

Analysis: The forthcoming share price chart above shows that the JP power share will be on a lowering trend from 21st June to 4th July 2022. A sharp decline in the profitability of the stock is clearly observable here leading to negative ROI.

52 Week High And Low Of JP Power Share Price

The 52 Week H/L is basically the highest price at which a share of stock or security trades during the time equating to one year. It’s nothing but a technical indicator framed on the regular closing price for the security.

Below is the 52 Week H and Low data aligned to the JP Power Share Price Target 2022.

1. Historical Data

| 52 Week High | 52 Week Low |

| 11.15 | 3.35 |

2. Predicted Future Data

| 52 Week High | 52 Week Low |

| 8.7 | 4.9 |

Bullish Or Bearish?

Analysis: The data above as well as the diagram proves that JP Power has been in a bearish cycle over the past 12 months. At present, there is a trend where the stocks in the Utilities sector aren’t much popular. Therefore, there is a high possibility that the stock won’t generate optimum ROI.

JP Power Share Performance By 2027

Analysis: The graph above shows that JP power share will be exhibiting an upward rising trend over the next 5 years. From June 2023 to June 2027, the health of the share will show positive growth. This makes the stock an investment-worthy share to include in your portfolio.

Frequently Asked Questions (FAQs):

The JP Power Share today, which is on June 20, 2022, is 5.750 INR.

Yes, the JP power share price could go up from 5.750 INR to 8.600 INR from 2022 to 2023.

Yes, it’s quite profitable to invest in JP power share. The long-term earning potential is +49.56% in a single year.

Within 5 years, the JP Power Share Price will be 16.541 INR. A positive earning potential is thus observable.

Taking into account our analysis, this is not going to happen, at least within the next 5 years.

The Verdict – Is JP Power Share Worth Investing?

To summarize, it’s quite observable that JP Venture power share has been in the bearish cycle for the past 1 year. Hence, the chances of price uplift are low, but according to stock analysis, a positive trend can be reflected in the coming year. As a result, JP shares could be a reliable stock in order to invest money.

Any questions? Leave them in the comment area below.

Wanna add your insights here? Do not hesitate to share with us in the comment area below. From the above

Disclaimer: Respected Readers, the JP Power share price facts, and the data we presented above are all assumptions. All the data refers to those present on the leading cryptomarket websites. The actual values might be different on the basis of the market situation. Please note that share/stock prices are subject to market risks. Read all the documents and examine them carefully before investing.

Read Also: