- Is Inventory A Current Asset Or Noncurrent Asset?

- What Are Current Assets?

- What Are Non-current Assets?

- Why Is Inventory A Current Asset?

- Things You Need To Know About Inventory As Current Assets

- Is Inventory Always a Current Asset?

- Some Examples Of Current Asset

- Example 1

- Example 2

- Example 3

- Example 4

- Bottom Line

Is Inventory A Current Asset? – Find Out The Answer

Is inventory a current asset or a non-current asset?

This question bothers many account managers and business owners when preparing their balance sheets.

Inventory is a set of goods, products, merchandise, or raw materials businesses store and plan to sell within a specific period. But are they current assets? How are they calculated during each accounting period?

If you are curious to know, go through this article.

Is Inventory A Current Asset Or Noncurrent Asset?

Inventory is reported as current assets since the businesses aim to sell these assets within the next accounting period. They are usually assumed to get sold out within the next twelve months of getting listed on the balance sheet.

It is one of the primary income sources for retail or wholesale store businesses. Therefore, the asset is listed as a current asset on the balance sheet. The idea will become much clearer once you learn more about existing and non-current assets.

Read More: How To Find Marginal Revenue? – Discover With Example

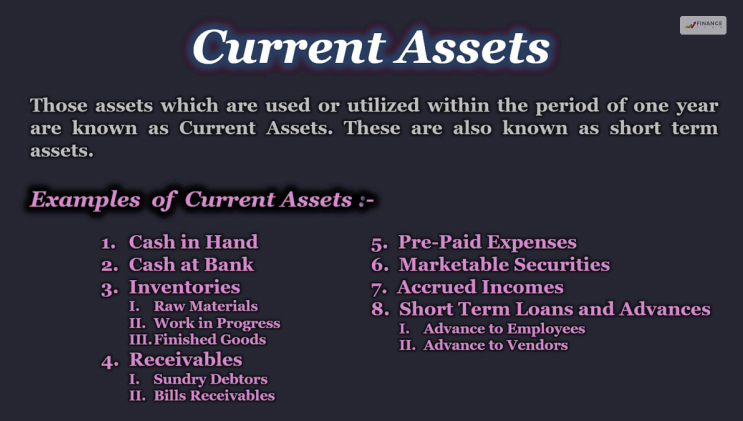

What Are Current Assets?

Current assets are usually cash, or assets owners can easily convert into cash for short-term payment or financial requirements. There are many current assets, and the balance sheet lists these assets based on the prospect of their liquidity.

Here is a list of examples for different current assets. More so, I have listed descending order of the current assets below –

- Cash & cash equivalents

- Temporary/short-term investments

- Accounts receivables

- Marketable securities

- Inventory

- Prepaid expenses

What Are Non-current Assets?

Long-term investments are also assets. But they come under non-current assets because the business cannot liquidate them anytime soon. Both fixed and intangible assets come under non-current assets.

Here are some of the non-current assets a company usually has –

- Property, plant & equipment

- Long-term investments

- Land

- Trademarks

So, clearly inventory is the current asset since the raw materials and the finished products can be sold for cash anytime.

Why Is Inventory A Current Asset?

Inventory is a current asset. But why? The answer lies in its liquidity. Businesses can sell off their inventories whenever they want. In the spectrum of liquidity, inventory takes the middle ground. Liquidity refers to the possibility of any business item or raw material to get sold.

Yes, there are other assets, such as cash and cash equivalent. But inventory is less liquid than those assets. However, inventories are surely more liquid than other assets like land or properties.

Things You Need To Know About Inventory As Current Assets

Here are some examples of inventories as current assets –

- Inventories can be sold within one year. That is why during accounting periods, they get calculated as current assets. However, it is common for companies not to receive an adequate amount of orders from time to time. This is why, due to consistent production and less number of orders, inventories become liabilities. Excessive inventory incurs storage costs and similarly related other costs for its future usefulness.

- Some inventories must be current assets and sold within 12 months. It is because of the shelf life of some of those inventories. We can take agricultural products, for instance. They become obsolete and stale if not used before their shelf life. Companies usually have to dispose of such inventories that become useless unless used before their shelf life expires. So, the inability to convert such inventories into cash before shelf life incurs losses.

- Having fewer inventories means having a lesser amount of current assets, possibly convertible into cash. When companies run out of inventory or have fewer inventories reserved, they might lose some business opportunities. It can result in disrupted business processes and a lack of cash inflow.

- Many businesses invest a good amount in setting up an efficient inventory management system. This way, they don’t have to risk stocking up excessive inventory or running out of inventory when needed. Also, a good inventory management system helps them reduce storage costs or wastage.

Is Inventory Always a Current Asset?

So, is inventory a current asset? You know for a fact that inventory is the current asset. But are they counted as current assets all the time?

Inventory is genuinely a current asset. That is because it is expected to be sold off or used up within twelve months or within the accounting period.

Also, according to the current asset formula, inventory comes as one of the key elements that makeup the current asset of a business. The formula of current assets includes –

Cash, cash equivalents, Inventory, accounts receivable, marketable securities, and prepaid expenses.

So, during the accounting period, it is impossible to count the current asset without inventory. Also, some of the assets have a limited shelf life, meaning they become obsolete easily and quickly. Those assets need to be sold off as soon as possible. That is why they are also counted among the current assets.

Some Examples Of Current Asset

The balance sheet has the current asset account o the firm. Here are some common examples of current assets included in the balance sheet.

Example 1

The first example includes cash and cash equivalents. Some examples in this category would be money markets and certificates of deposit.

Example 2

The marketable securities accounting principles. , Usually, these are debt securities or equities. Stocks or debt securities listed on different exchanges are also current assets.

Example 3

Accounts receivable include current assets in the form of money the company has yet to receive. These are usually money the company has not received for the sales of their products or assets. Usually, due to pay later or EMIs, companies have some accounts receivable listed in the current asset.

Example 4

Prepaid expenses accounts, or the goods or services the company has paid for and is about to receive soon, get counted as a current asset.

Read More: How To Find Marginal Cost? Why Is It Important For Businesses?

Bottom Line

During the accounting period, it is important to know which asset falls under the current asset category and which ones are under non-current asset. So, Is inventory a current asset? Once you have gone through this article, you should have a clear answer to the same. I have provided all the necessary explanations to help you understand the answer.

However, if you have more questions, please leave them in our comment section below. Will will come back to you in a while.

Read More: