- About Income Funds

- Income Funds Meaning

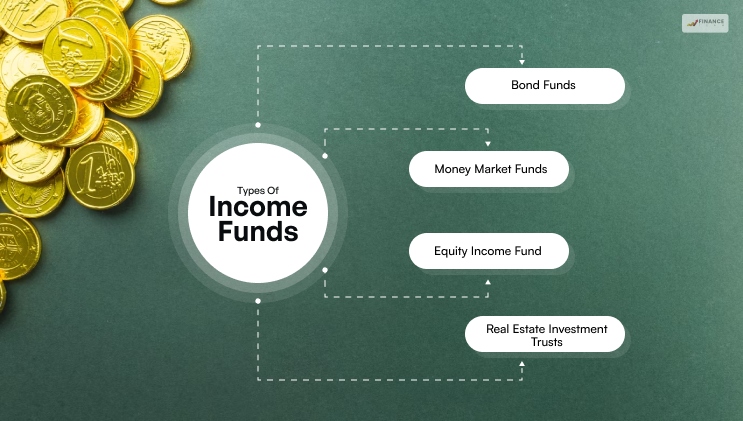

- Types Of Income Funds

- Bond Funds

- Equity Income Fund

- Money Market Funds

- Real Estate Investment Trusts

- How Does The Income Fund Work?

- Features Of An Income Fund

- Diverse

- Professional Management

- Income

- Liquidity

- Tax Considerations

- Advantages Of An Income Fund

- Are Income Funds Safe Investment Options?

- What Is The Difference Between An Income Fund Vs Growth Fund?

- Considerations Of Investing In Income Funds

- Risk

- Return

- Cost

- Investment Period

- History Of The Funding House

- Taxation

- Income Fund Example

- The Bottom Line

Income Funds – Overview, Types, Advantages And Disadvantages

The main aim of any income fund is to produce regular and consistent returns for any investor who is investing in government securities, high dividend generating stocks, and debt instruments. In this article, we will discuss all the intricacies associated with an income funds and if they are at all safe for investors.

However, they are not as easy as you may think them to be. So, it is always better to learn more about them before investing.

About Income Funds

- Income funds mainly invest in corporate bonds, government bonds, high dividend paying organizations, and other securities which generate high dividend income and interest. Their aim is to offer investors everyday income through dividends or interests.

- Income funds do this by holding the investments till they mature to earn earnings or selling the investments if the prices rise to produce profits.

- Bond funds invest in both corporate and government bonds. Government bonds are a bit safer as they do not carry any default risk. But they may have lower returns in comparison to other investments.

Income Funds Meaning

Income funds are those funds that provide the investors with regular income in the form of interest or dividends by way of making investments in government bonds, corporate bonds, high dividend earning stocks, and other securities yielding high interest and dividend incomes.

An income fund belongs to that category of debt mutual funds that prioritize offering a consistent return source to the investor. Income funds invest in a concoction of corporate bonds, certificates of deposits, and money market instruments. The returns one gets under income funds depend on the condition of the market and how the fund performs.

It tries to deliver steady returns by generating interest income by holding the item till its maturity date. Income funds are highly liquid in nature. They offer better flexibility for redemption and withdrawal.

Types Of Income Funds

An income fund can be further divided into multiple forms. For anyone investing in an income fund, it is necessary that they know of its different types as well.

Bond Funds

As per its name, bond funds are the kind of income funds that specialize in government and corporate bond investments. Most investors have a sheer preference for government bonds as they practically do not hold any risk at all. They are the ultimate save heaven for people who prefer playing it safe.

Due to the reduced risk, these types of bonds come with lower dividend yields in comparison to corporate bonds.

As for corporate bonds, investors prefer them as they bring in a higher yield to make up for all the extra risk that the investor takes.

Equity Income Fund

Equity income funds are types of income funds that invest in dividend-paying stocks from businesses. It aims at all the investors who prefer receiving an anticipated monthly earning from their portfolio.

Money Market Funds

A money market fund is the type of fund that invests in short-term Treasury bills, commercial papers, and certificates of deposit.

Monet market funds do not carry any federal deposit insurance like any other bank product would do. They offer a safer option to the investors through a low yield rate.

Real Estate Investment Trusts

A real estate investment trust or REIT is a legal unit that owns real estate investments like commercial office buildings, housing, hotels, and retail locations.

The basic advantage of a REIT income fund is to understand the advantages of real estate ownership without actually owning or maintaining the property.

How Does The Income Fund Work?

The net asset value of income funds is calculated in four decimal places. The fund tries to deliver returns when there are fluctuating rates of interest cases. This may be done in either of the two cases given below:

- Generating interest income by holding all the instruments till they mature.

- Selling the instruments in the debt market when the interest rises.

The focal objective of a fund manager is to deliver high returns by assigning funds towards money market instruments and debts. This depends on the rate of interest risk and the investment grade of specific instruments.

Features Of An Income Fund

Here are the features of a regular income fund:

Diverse

Income funds hold an array of income-generating assets. They help spread the risk of investment across multiple options.

Professional Management

An experienced fund manager goes through the portfolio. They make smarter investment decisions to manage risks and maximize profits.

Income

The main aim of an income fund is to offer a line of income through dividends, capital gain distributions, and interest payments.

Liquidity

Investors may easily sell shares of their income funds on any working day. This offers them with flexibility and fast access to their investments.

Tax Considerations

It is vital to note that the income from income funds may change depending on factors like income type and the tax bracket of the investor. In area-specific types of income like municipal bonds, interest may even be exempted from taxes. Investors must have a clear understanding of the tax allegations associated with their investments within income funds and take advice from a tax consultant.

Advantages Of An Income Fund

Investing in an income fund offers you a range of benefits:

Income funds offer you high liquidity. The money you invest in can be simply withdrawn whenever you feel like.

These funds are vigorously managed by fund managers who take advantage of the shift in interest rates to bring in better returns.

An income fund is considered way better than any fixed deposit, both in the spectrums of returns for a short time period and liquidity. In comparison to fixed deposits, which have a secure lock-in period, an income fund allows the investor to have a more flexible cash flow.

The tax rate of an income fund is just the same as that of a debt fund. Therefore, the short-term capital gains incur a tax according to the applicable slab rates, while the long-term capital gains have a tax of 20 percent with indexation benefits.

Are Income Funds Safe Investment Options?

Income funds are comparatively safe investment options in equity as an asset class. These kinds of funds prioritize producing regular income for investors by investing in dividend-yielding securities. These securities may be government securities or company stocks. They may also be corporate bonds, certificates of deposit, debentures, or money market instruments.

These funds produce returns in both rising and falling rates of interest scenarios through active portfolio management. Historically, they used to offer better returns in comparison to bank fixed deposits. Unlike a fixed deposit in a bank, income funds are way more flexible. These funds also bring flexibility for improvement and withdrawal.

Income funds are best suited for investors looking for regular and stable income. For example, a retired investor might think of investing in income funds as they require money for their everyday needs.

What Is The Difference Between An Income Fund Vs Growth Fund?

A growth fund aims to produce capital appreciation via high levels of growth and capital reinvestment. In contrast, an income fund produces regular and steady income for the investors. They put their investment in securities that offer dividend payouts to the investors. Also, these kinds of funds are way less risky in comparison to other funds. Therefore, they are a good option for investors who have a low-risk tolerance and prefer earning regular incomes.

Growth funds are stock investments that aim to achieve high growth. Therefore, the gains of these companies will further be reinvested for expansion and growth of the company. Growth funds are a bit riskier due to their sensitivity to the market conditions. However, a long-term investment in growth funds can be quite beneficial to investors.

Income funds are security investments and stock investments that distribute the profits in the form of dividends to shareholders. These funds particularly invest in high-quality bonds, shares that pay dividends, and other securities that generate income. Therefore, both of these funds provide financial benefits to the investor. Furthermore, depending on the knowledge of the objectives and risks of investments, investors may choose which fund is best suited for their specific requirements.

Considerations Of Investing In Income Funds

While the whole concept of an income fund may seem interesting and profitable to any investor, there are a few things that they would have to consider before making an investment.

Risk

Credit risk and rate of interest have a high influence on income funds. A slight change in the rate of interest may result in a change in the entire value of the bond price. This will further have an impact on the fund’s value.

Moreover, there is always an underlying risk of default when it comes to repayments. This will also have a degree of impact on the returns an investor gets from the fund.

Return

Fund managers take full advantage of the volatility of interest rates to produce returns for investors. An income fund may offer way better returns if there is a falling rate of interest scenario.

These funds offer better returns in comparison to a traditional investment in a fixed deposit. However, it is also to be kept in mind that no one can guarantee returns when it comes to an income fund.

Cost

Just as it is with other fund categories, income funds also charge a fee for managing an investor’s funds. This is what we call the expense ratio.

For instance, if the investor invests $1,000 in a fund with an expense ratio of 2%, then he would have to pay $200 to the funding house to help manage his fund.

The expense ratio is not constant. Different fund houses will have different rates.

Investment Period

Usually, one must have an investment horizon of more than three years to actually get the benefit from these kinds of funds. The fund managers benefit from the interest rates to provide better returns. But, this needs better management skills.

One needs to consider this investment mode as an alternative to fixed deposits and is best suited for investors who are willing to take a mild amount of risk.

History Of The Funding House

As a primary practice, people mostly choose the fund that offers the best returns. Apart from examining the expense ratio, it is also necessary to do a bit of background research on the funding house.

Just go through the history of the fund managers, how long the fund house is functional, etc.

Taxation

As I have already mentioned, the tax rate of an income fund is the same as the one in a debt fund. Therefore, if an investor falls in the 20 percent or above slab rate, then the long-term capital profits are taxed at 20 percent. However, you get an indexation benefit in such a case.

Income Fund Example

The T. Rowe Price Income Fund has in net assets worth $17.51 billion as of 2021 Q1. It seeks a high growth rate via high dividend-paying stocks with capital appreciation. The fund, that allocates payouts quarterly, paid dividends of $0.18 per share in December. The fund has performed quite in line with its benchmark. A $10,000 investment in the T. Rowe Equity Income Fund initially in 1985 would have a worth of approximately $2,45,100 as of February 2021.

The Bottom Line

In conclusion, it is evident how an investment portfolio benefits from an income fund. It is especially so if the investor looks for diversity, expert management, and consistent income.

They are a desirable choice for retired investors as they get the benefit of a steady and consistent income. Moreover, by scattering the risk, the variation of assets within income funds may improve portfolio stability. While these funds are a great investment choice, they are also subject to risks. Income fund is majorly affected by fluctuations in interest rates. Even a minor change in the rate may impact the entire value of the fund. So, for investors with low-risk tolerance, this may not be the best option for you. But, if you are ready to take the risk, I would suggest you jump right in and fetch as much money as you can.

Read More For More Financial Information Click Below!!