- Happiest Mind Company Profile:

- Happiest Minds Share Price Rising Statics:

- Future Statics Analysis Of Happiest Minds Technologies Limited Stock

- Frequently Asked Questions (FAQs):

- 1. Is The Happiest Minds A Good Company For Investing?

- 2. Is This Good Stock To Buy Now?

- 3. What Is Big Happening With Happiest Minds?

- 4. Are The Happiest Minds A Big Cap Or Small cap?

- Wrapping Up:

Happiest Minds Share Price 2022 – History, Happiest Minds Share, Analysis

Just the middle of the conflicting situations between Russia and Ukraine. This high rise of the Happiest Minds Technologies is like a small bliss of fresh air. We all know in war-time, the share prices are hitting significant changes. There is always a win-win and lose-lose situation. But this 20% hike in the happiest minds share price is giving us another single chance to make a considerable profit.

In reality, I don’t wait for the 10% rise. I often sell the share when it is just hitting the level of a 6% rise. When I see the statistics of the 17th February Wednesday. I just can not believe my eyes. This is a 20% rise after brokerage firm Nomura initiated coverage of the buy rating of the company share.

So let’s take a look through the company profile first. After the company profile, we are going to describe the happiest minds share price.

Happiest Mind Company Profile:

- Founder Is Ashok Soota

- Company Founded in April 2011

- Headquarters Are In India

Happiest Mind technology limited is a mindful IT service-providing Service Organization. The headquarters is in Bangalore. The main branches are operated from India. But other service operations are also available in the U.S., UK, Canada, Australia, and the Middle East.

The seamless customer experiences, business efficiency, and innovative project works are the biggest advantages of this service company.

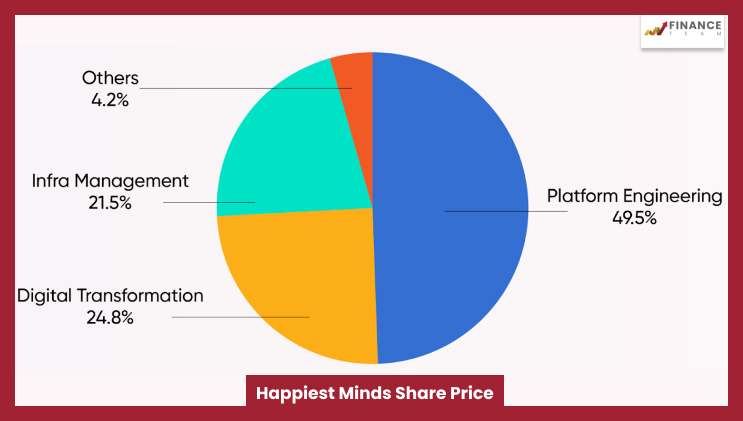

If you like to forecast, the happiest minds share price rates for the future. You have to know the services of the company. And all about the upcoming projects.

- Blockchain

- Data Science

- Software Development

- SDN and NVF

- Cloud Computing

- IOT

One year ago, in 2021, they were first on the newspaper front page after they announced high rises in the company share prices. In 2021 Happiest Minds Technologies rose 2.62% to Rs 767.75. This company successfully executed the digital transformation project for CoCa cola bottling company. This rise news for the share price of happiest minds is giving you the exact idea about how fast this company grows.

Happiest Minds Share Price Rising Statics:

In 2021, the share prices of the Happiest Minds are maintaining a very steady growth curve. Even for the traders, a single-day holding of the share also gives you at least a 1.2% upper limit rise.

In 2022 February 17th, the happiest minds share price nse is touching the 20% rise higher limit.

Let’s have a look at the chart of the share prices growth.

| Trimester | Happiest Minds Share Price (upper limit and lower limit) |

| 2021 | On the 16th of August 2021, Happiest Minds Limited was trading INR 1,386.80. This is a big start. |

| 2022 | 19.82 % upper limit at Rs 483.55 on the BSE. At the same time, it finished 19.99% at Rs 484.05 on the NSE. |

| Happiest Minds Share Price Today | Rs. 1,026.5540.75 with 4.13% upper limit For Volume: 1,85,040 |

Now you can see the actual statics of happiest minds technologies share price. But if you are a new trader, then forecasting the future market prospects is essential to know the exact market scenarios. And the most important part is how much profit you are going to make through the happiest minds share price and investment?

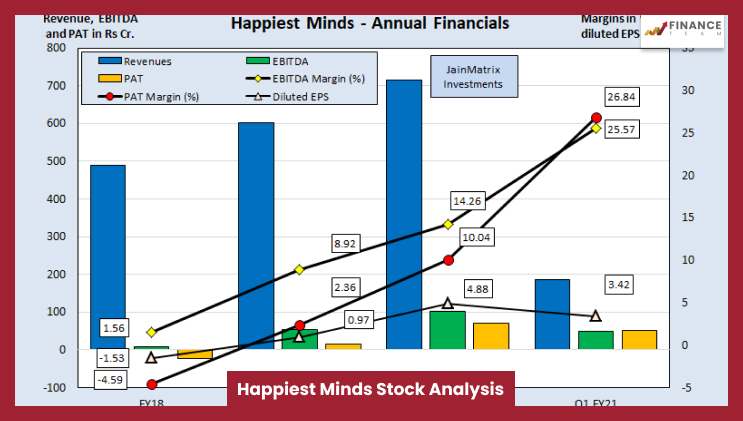

Future Statics Analysis Of Happiest Minds Technologies Limited Stock

Every trader and investor likes to have an eye that has nice forecasting quality. But it is very unfortunate that we are not gifted by magical eyes. Hence you can analyze all the data factors. These data are going to help you to predict the future. And you will know how much profit you can make by analyzing the happiest minds share price.

Happiest Minds Technologies Limited Stock Prices

28.95 (3.03%)

Open with 973.95

Higher limit – Lower limit: 992 – 969

Previous Closing: 956.85

Total Value Of Trading: 320493

Financial Information Summary

| Trimester | Total Asset | Total Revenue | Profit After Deducting Tax |

| 30-Jun-20 | 5,730.8 | 1,869.9 | 501.8 |

| 31-Mar-20 | 5,081.5 | 7,142.3 | 717.1 |

31-Mar-19 |

4,135.2 | 6,018.1 | 142.1 |

| 31-Mar-18 | 3,869.9 | 4,891.2 | 224.7 |

Frequently Asked Questions (FAQs):

1. Is The Happiest Minds A Good Company For Investing?

The returns of the Happiest Minds are around 258%. The stock has outperformed the BSE Sensex. This outperformance rate is more than 250% within 12 months. These moves start with a 200-day average which is lower than 5,20, and 100 days.

2. Is This Good Stock To Buy Now?

My suggestion is currently, this stick price is overvalued. And it is trading above its expected value. The stock’s current trading value is 135. That value is much higher than the industry peer value. Right now, the industry peer value is around 33.

3. What Is Big Happening With Happiest Minds?

The net profit is jumping from 16% to 49 cr. You can compare the revenue-generating potentials of the company. From October to December 2021, the profit grew from 47.2 percent to Rs 283.94 cr.

4. Are The Happiest Minds A Big Cap Or Small cap?

Happiest Minds Technologies Ltd started its journey in 2011. Undoubtedly this is a large-cap company. Having a market cap of Rs 20908.23 Crore is not a sign of a small-cap IT company.

Wrapping Up:

This is the present scenario of happiest minds share price statistics. You can carefully analyze the future potential of this company. Then plan for the next part of the investments. But my suggestion is as this company is a big cap company and the services are all new technology and digital concepts based.

The chances of loss are minimized. Hence for beginner traders, the low volume is the best suggestion. Always go for the low volume and sell the share just after reaching the 5% rise. In the money market, this 5% rise is very valuable. The low volume means the loss will be minimal.

Do you have any specific share market analysis techniques? Do not forget to share your tricks and tips in the comment sections.

Read Also:

- LIC IPO Review: LIC IPO Launch Date & IPO Price

- Aditya Birla Sun Life AMC IPO Review, Date & IPO Price

- Policy Bazaar IPO Review: Policy Bazaar Launch Date & IPO Price