- What Is Gross Income?

- Why Is It Important To Calculate Gross Income?

- How To Calculate Gross Income As An Annually Salary Employee?

- Determine Annual Income

- Divide Your Earning By Twelve

- How To Calculate Gross Income For Hourly Waged Employees?

- Step 1: Determine The Hourly Pay Rate

- Step 2: Determine Weekly & Yearly Income

- Step 3: Divide Yearly Gross Income By Twelve

- Bottom Line

What Is Gross Income and How Is It Calculated Monthly?

One thing is how much money you can keep after all the deductions from your paycheck. But how much you make is another question – the answer you must know. Here is a clear and full definition of what gross income is and how it gets calculated monthly.

A clear understanding of your monthly gross income helps you better manage your finances. Most importantly, if you plan to take a loan, the loan will be contingent on your gross earning at the end of the month.

Gross income also gives you an idea of how to determine the amount you can save after your retirement. So, how to determine your gross income? If you are looking for an answer to this question, then you have arrived on the right page.

Read More: Net Income Formula – Discover How To Calculate Net Income

What Is Gross Income?

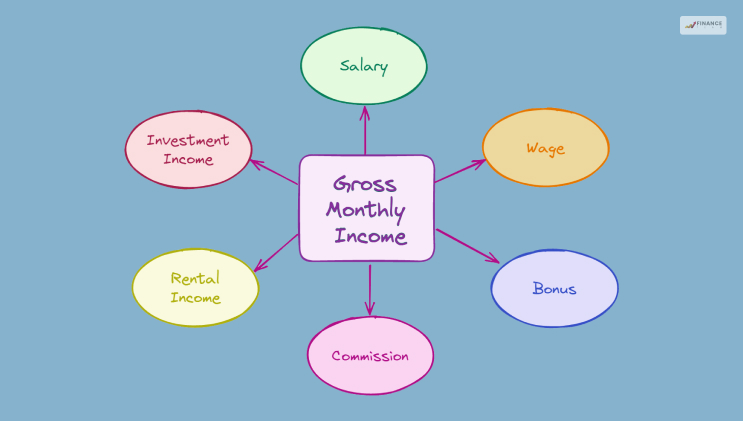

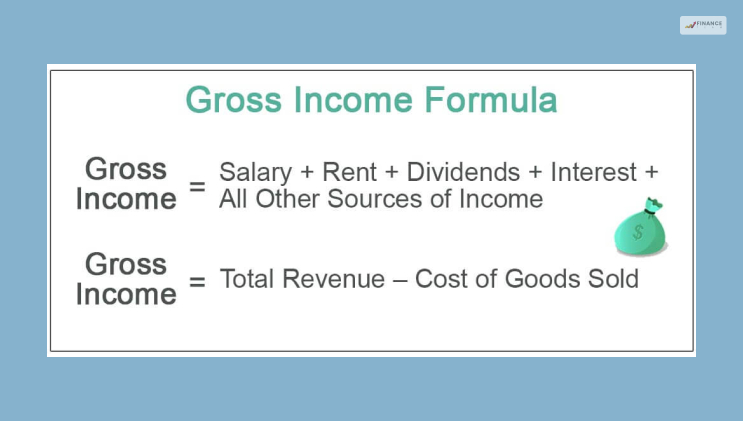

Gross income is the total amount an individual makes in a month. This amount includes all the deductions and tax obligations of the earning individual. The gross monthly income is the sum of earnings from different earning sources that include –

- Monthly or regular wages.

- Bonuses or commissions for overtime work.

- Earnings from side hustles and freelancing work.

- Bank account Interest

- Dividends from different types of investments.

- Private sales

- Rental income

- Social security

- Child support

Here is an example of how this works. Let’s say that an employee of a retail store makes $3000 per month through their salary. They also sell $1000 worth of products monthly through their personal store. So this means that their monthly gross income is $4000.

Why Is It Important To Calculate Gross Income?

There are different reasons for tracking one’s monthly gross income. The primary reason is to apply for loans. When applying for loans, applicants need to attach the information of their monthly gross income to the application. This is one of the requirements of the loan providers that must be met for the loan to be credited.

The gross income gives the lenders insight into the amount the applicants have. It also helps the lenders calculate if the applicants can repay their loans.

How To Calculate Gross Income As An Annually Salary Employee?

The process for calculating an individual’s gross income depends on the type of income they generate. Do they make money on an hourly wage basis? Or are they salaried individuals?

However, you can follow the steps mentioned below if you make money through an annual salary. But you should also know that this method does not apply to additional income sources.

Determine Annual Income

Determining your annual income before its deduction will let you know how much you make annually. Usually, if you are a salaried individual, this information should already be clear to you. However, if you still do not know how much you make annually, try going through your employment documents.

Divide Your Earning By Twelve

If you have already gone through your employment documents, then you should know how much you earn annually. But, if you want to know about your monthly gross income, you have to divide that earnings by twelve. Once you divide the annual salary by the total number of months in a year, you will have your monthly gross income (without tax and other deductions).

For example, if your annual salary is $50000, then your monthly gross income should be –$50000 ÷ 12 = $4167

How To Calculate Gross Income For Hourly Waged Employees?

If you want to calculate the gross income for a waged hourly employee, then you have to follow a more complex method.

Step 1: Determine The Hourly Pay Rate

You need to first determine the hourly wage rate first. This is the amount you get paid for working an hour. If you already do not know the rate you are getting paid, try looking into your employment documents. You must find the hourly wage rate there. However, if the rate is not there, you can ask a manager or a supervisor and get the information on your hourly wage rate.

Step 2: Determine Weekly & Yearly Income

Once you have the hourly wage rate, you can use it to calculate your weekly earning. Multiply the hourly wage by the number of hours you work in a day. That way, you will get the amount you make in a day. Next, multiply a day’s earnings by the number of days you work in a week.

So, let’s say that you work 8 hours a day and the work week consists of six working days. This means that the workweek has 48 hours of work. If the average work hour per week is estimated at 40 hours, then your weekly gross salary would be (on a $12 hourly rate) –40 x $12 =$480

This amount is the weekly earning before the deduction of taxes. Next, you can multiply your weekly gross income by 52 to calculate the yearly salary.

In that case, your yearly gross income would be – $480 x 52 = $24960

Step 3: Divide Yearly Gross Income By Twelve

Once you have gone through all the steps mentioned previously, you are ready to calculate your monthly gross income. By dividing the yearly gross income by the total number of months in a year, you will get the monthly gross income.

Here is what you should do – $24960 ÷ 12 = $2080

So, if your hourly wage is $12 and if you have to work 40 hours a week for 52 weeks of a year, then your monthly gross salary would be $2080.

Read More: How To Calculate Gross Profit? – Explore With Example

Bottom Line

You can calculate your gross monthly income, whether you are an hourly wage employee or a salaried one. I have provided the process for calculating the monthly gross income for both types of individuals who earn on an hourly basis or are annually salaried employees. You can take the examples given here to calculate the salary you earn.

Hopefully, this article was helpful to you. However, if you have any queries, you can let us know through the comment section below. Thank you for reading.

Read Also: