- How Is Your Credit Score Calculated?

- How To Check Your Credit Score For Chase Sapphire Reserve?

- 1. Free Scoring Websites

- 2. Credit Card Provider

- 3. Nonprofit Credit Counselors

- Do You Need A Good Credit Score For The Chase Sapphire Reserve?

- How Do I Increase My Chances Of Getting Approved By Chase Sapphire Reserve?

- 1. Pay Off Debts

- 2. Reduce Your Credit Utilization

- 3. Patience Is Key

- 4. Following The 5/24 Rule

- How Do I Improve My Credit Score?

- 1. Pay On Time

- 2. Verify Credit Reports

- 3. Minimize Credit Usage

- 4. Avoid Applying For Multiple Credit Cards

- Final Words

Do You Need A Good Credit Score For The Chase Sapphire Reserve?

Like most high-end travel rewards credit cards, the Chase Sapphire Reserve typically requires an excellent or superior credit rating to be approved. To learn more about why do you need a good credit score for the Chase Sapphire Reserve, keep on reading this post.

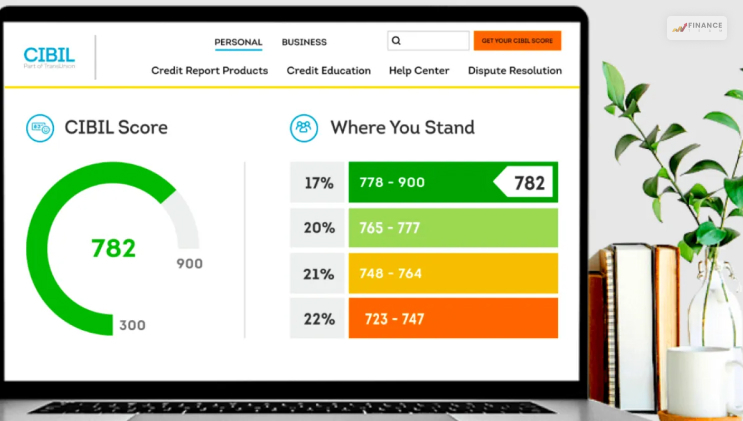

This indicates that potential candidates for the card should have a FICO score of roughly 700 when contemplating applying, even though Chase has never specified specific score criteria, and no score ensures an acceptance.

How Is Your Credit Score Calculated?

If you wish to know whether do you need a good credit score for the Chase Sapphire Reserve, then you must learn how it’s calculated.

Most lenders, including those that issue credit cards, employ a FICO Score, which examines the data in your credit report. This data is used to forecast the likelihood that you will pay a bill 90 days or more past due during the next 24 months.

FICO scoring methods typically assign scores between 300 and 850. You have an excellent credit score if it is at the higher end of the range. Your risk is reduced in the eyes of prospective lenders the better your score.

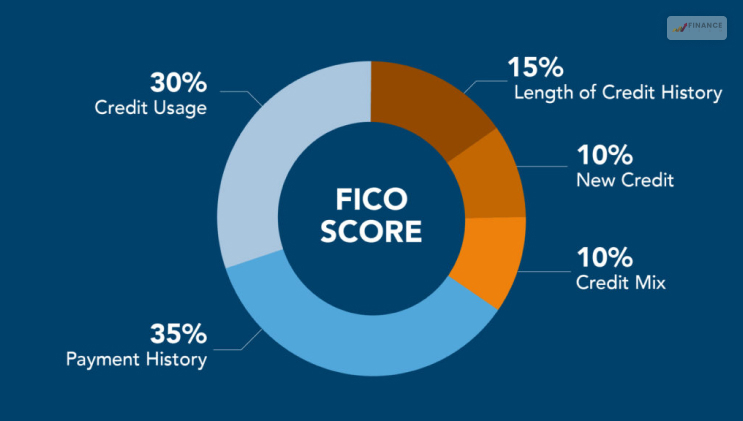

The FICO model that determines your credit score is based on various factors, like

- Credit Mix: 10%

- New Credit: 10%

- Credit History: 15%

- Amount Owed: 30%

- Payment History: 35%

How To Check Your Credit Score For Chase Sapphire Reserve?

If you wish to know whether do you need a good credit score for the Chase Sapphire Reserve, then you must learn how to check your credit score first.

However, how do I check my credit score?

There are various ways to check your credit score. The methods that I have used so far to check my credit score are:

1. Free Scoring Websites

Many websites offer users complimentary checks of their credit scores. Most of these websites allow you to see basic information regarding your credit scores. If you decide to use them, you will get a credit report showing details about your credit scores, like bills paid and dues remaining.

The three primary national bureaus that can provide you with an annual report of your credit standing are:

- Equifax

- TransUnion

- Experian

However, note that they will not provide you with a credit score. They will only show you your credit standings. You can get these reports from annualcreditreport.com.

2. Credit Card Provider

You can get a free credit report from your credit card provider if you are lucky. However, do note that not all credit card providers will offer you a free credit report.

If you do get to see your credit score report from your credit card provider, then they will mainly present you with information like your credit review and credit history.

3. Nonprofit Credit Counselors

Various nonprofit credit counselors are willing to offer their services for free. In addition, they might be willing to work with you to provide you with multiple solutions and strategies to increase your credit score.

In this regard, one of the most reputable credit report providers is the National Foundation for Credit Counseling. You can visit their official website to get in touch with them!

Do You Need A Good Credit Score For The Chase Sapphire Reserve?

Like most banks, Chase has not formally indicated where it draws the line between excellent and fair credit. Lenders often see a FICO score of 670 or more as a respectable score. Still, you should be aware that other criteria, including the debt you presently carry, will affect a lender’s decision to accept you for a particular card.

Most banks will only disclose the precise cutoff point when credit is deemed excellent rather than merely good. Lenders often see a FICO score between 740 and 799 as very good and anything between 800 and 850 as exceptional.

How Do I Increase My Chances Of Getting Approved By Chase Sapphire Reserve?

Here are some actions you may take if you’re actively attempting to boost your chances of being approved for a premium rewards card:

1. Pay Off Debts

Your credit rating will be impacted if you have any past-due or overdue bills, reducing your chances of being accepted for a new card.

2. Reduce Your Credit Utilization

The ideal amount to utilize across all credit cards and on individual account is 30% or less of your available credit.

3. Patience Is Key

If your credit score could be more excellent or superior, understand that establishing a solid credit history takes time. It can be beneficial to hold off on applying for a few months until your score rises.

4. Following The 5/24 Rule

Chase has an unofficial guideline known as the 5/24 rule regarding credit card applications. According to the “5/24 rule,” any Chase credit card products will be automatically rejected if you have received approval for five or more personal credit cards in the previous 24 months.

According to speculation, this rule was put in place by Chase to stop people from applying for credit cards just to get the welcome bonus and then cancel the account before the annual fee is due.

How Do I Improve My Credit Score?

The following are some strategies you may use to raise your credit score:

1. Pay On Time

The most significant determinant of your score, accounting for 35% of your overall FICO score, is your track record of on-time payments.

2. Verify Credit Reports

Checking your credit report provides you the chance to find any errors that could be negatively influencing your credit score and take action to fix them.

3. Minimize Credit Usage

Credit usage, sometimes called your debt-to-credit ratio, is a factor in your credit score that makes up 30% and is calculated as the ratio between your current bills and the total credit card limit. Lenders can deem it too dangerous to grant you another line of credit if you use up less of your currently available credit.

4. Avoid Applying For Multiple Credit Cards

Lenders can assume you’re in financial problems or trying to churn their cards if you apply for several cards quickly.

Final Words

Borrowers with established credit and a high credit score are often the target audience for a premium card like the Chase Sapphire Reserve.

Even though there isn’t a formal score requirement, it’s doubtful that someone who has never used credit before has a fair credit score or has applied for more than five cards in the previous 24 months will be accepted.

If you don’t think you’ll be approved for the card based on your existing credit situation, focus on enhancing it and give it another shot later. An excellent initial step is picking the appropriate card to assist you in achieving that objective. So do you need a good credit score for the Chase Sapphire Reserve? Yes, you do.

Read Also: