- Introduction

- Banks Want You To Be a Co-Applicant to Your Home Loan

- Scenario:

- The Banks may be Interested in:

- Banks Favor the Following Combinations for a co-applicant home loan.

- Does it matter who’s the borrower and who’s the co-borrower?

- Disadvantages of Co-Applicant in Home Loan You Can Easily Avoid!

- Disputes between spouses

- Legal Inheritance

- Beneficiary of WILL is different.

- Solutions You Can Try

Co-applying for Home Loans Could be Misleading: Disadvantages of Co-Applicant in Home Loan

- Home Loan Interest rates for Today: 7.0% for 30 years

- Time taken for Approval: 30 to 60 days

- Average Home Loan tenure: 30 years

Introduction

Co-applicant, co-borrower, and co-owner are some of the terms you’ve heard if you bought your home recently or are planning to buy your first home soon. But I’d say you’re fortunate that your home loan is approved, and you are going for the deal. In the US, 10% of home loan applications are rejected outright.

Going ahead, we will scrape out the causes. But know that co-applicants are one of the prime causes. Outright loan rejection is one of the disadvantages of co-applicant in home loan. Well, there are others.

The same happened with my brother last year. But he onboarded his partner in the loan deal with a sane mind. Even I was on the same page when he said- “if Sara becomes my co-applicant, maybe our loan eligibility would increase!”

When I put my head together with some people under 35 planning to buy a home, I learned they have the same mindset. But it dawned on me later that we were all missing a vital blind spot. Indulging in co-applying for a home loan could actually ruin your finances.

That’s what we will explore in detail in this article.

Banks Want You To Be a Co-Applicant to Your Home Loan

Banks like it when clients share fiscal liabilities with others. The same also applies to your home loan. Meanwhile, the same might not be suitable for your finances. It sure reduces your chances of loan rejection. However, the personal liabilities of your co-applicant could damage your fiscal health big time.

Scenario:

Suppose you took a 30-year fixed home loan at 7.10% interest. Now, your co-applicant cannot pull off repayment EMIs after 10 years. What will happen?

You will have to share the burden. What’s worse? You miss an EMI. It harms both of your credit scores without any fault of your own. There may be many other scenarios.

Usually, banks prefer you to take in your partner as a co-applicant. And trust me, that may be the worst decision to make. You and your partner doing good making money are all fine.

Things may go the wrong way when you file a divorce. Your partner may pledge to bail out the loan if they cannot handle personal finance and then EMIs. The court may excuse the person from the liability of repayment.

You’ll have no option but to buy out the other spouse’s share. Eventually, you will have to refinance the loan, with the rest of the repayment on you only!

The Banks may be Interested in:

The bank will earn extra through penalties on late payments, missed EMIs, etc. According to the American Psychological Association, the divorce rate of marriage is 41% this year. Don’t you think banks are already aware of that?

When you refinance your loan, you don’t get it for free. You have to pay the closing cost. The price is paid to nullify your outstanding and channel the remaining principal under a fresh scheme. On top of that, your credit score will take a heavy blow.

Even, your new interest rate could be at least 0.7 to 1.0% higher than your shared interest rate. When that happens, the bank will earn more on an ongoing loan. Consequently, your monthly repayments would increase as well.

There are more disadvantages of co-applicant in home loan. We’re only getting started. But I won’t discourage you from applying for a home loan with a co-applicant. All I am saying is to be more cautious. For that, you need to have a clear idea of all the disadvantages of co-applicant in home loan.

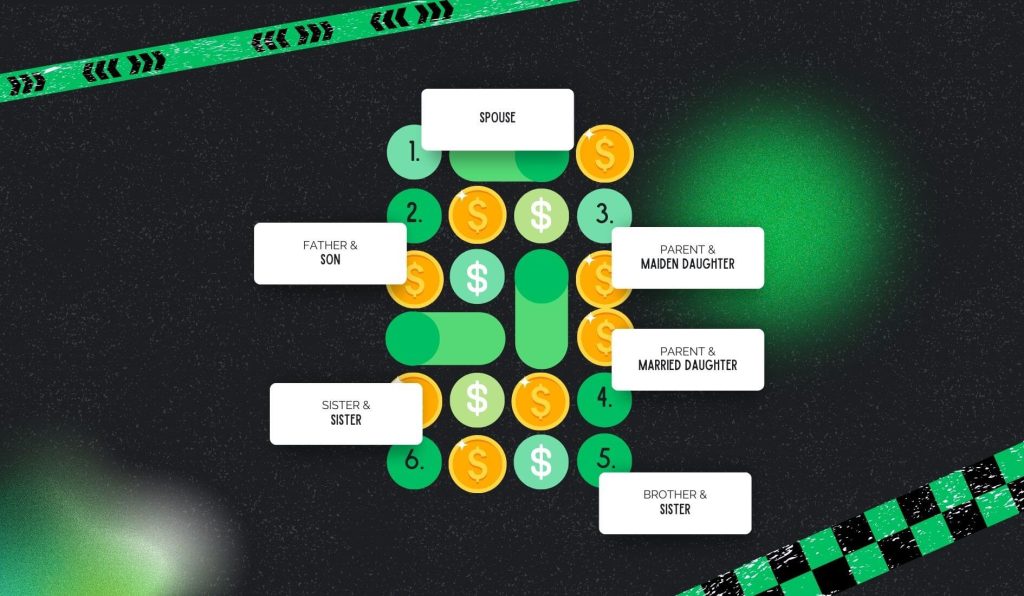

Banks Favor the Following Combinations for a co-applicant home loan.

- Spouse: This is the most common combination. And banks love it, too. The reason, you know now.

- Father and Son: If you are the only child (son), the bank prefers the father be tne owner of the property. Meanwhile, a son should be the potential owner if there are multiple children. Around 58% of families have inheritance issues. Therefore, I can see various disadvantages of co-applicant in home loan, if we’re going with a father-son duo.

- Parent and maiden daughter: For this duo, the bank lets the daughter be the owner of the property mainly. In case the daughter is incapacitated or especially abled (mentally or physically), the parent can be a supervisor owner.

- Parent and married daughter: The responsibilities are similar when this duo becomes co-applicants for home loans.

- Brother and sister: A carousal of conflicts may ensue when this duo becomes co-applicants. Among property dispute cases, at least 30% of the cases involve siblings fighting over the share of ownership. In fact, more siblings clinch battles to shed off their shares of loan repayment liability, citing miscellaneous reasons.

- Sister and Sister: The consequence is similar when two siblings are involved.

The bottom line is that numerous weak links and points may ignite conflicts. And I think you understand clearly that any conflict after you’ve signed up for a joint home loan will have a negative impact on your financial strength and future credit eligibility.

On the other hand, it will only make the bank richer. All banks and credit unions can ooze out at least 5 to 7% more repayment value than the original projection when any dispute breaks in.

Does it matter who’s the borrower and who’s the co-borrower?

I don’t think it matters. The borrower (applicant) and the co-applicant(s) are equally responsible for the home loan repayment. In fact, they also have an equal claim over the property. So, it is only rational that the tag of an applicant or co-applicant is mere jargon here. I’ve seen that co-applicants are merely people whose names appear on the paper in addition to that of the applicant.

However, credit unions like The USC Credit Union, First Source Federal Credit Union, and others need a primary borrower. But here’s the catch. The person with a higher income or better financial stability may be named the primary borrower. On the other hand, there are no added advantages for the primary owner. In fact, the repayment liability is also the same on their shoulders.

While the nature of the applicant does not matter, the tag may be a reason for a dispute between them. So, I would treat it as one of the potential disadvantages of a co-applicant in home loan.

Disadvantages of Co-Applicant in Home Loan You Can Easily Avoid!

Some of the cons are unavoidable. Your fate’s linked irrevocably to them whenever you enter a joint deal with your co-signee. However, you can know the primary disadvantages of co-applicant in home loans. You can even avoid most of them with a bit of caution.

Disputes between spouses

As US law goes, any property bought after marriage is split equally in terms of ownership between the spouses. But what about the liability of the asset? Usually, the husband and wife can mutually decide the terms to share the liability. In most cases the Gen-z couples or partners are skeptical about putting the burden on one pair of shoulders only.

However, the issue arises when there is a dispute between the two. A co-applicant, let’s say the wife, will have to bear the burden of repayment, just like her counterpart. Moreover, she will face unnecessary harassment if the husband stops paying the EMIs henceforth.

In most cases, husbands think- why will I pay the whole of the remaining EMIs if my wife has 50% of the ownership? Relatable? But the reality is different.

Legally, the wife doesn’t have hands-on rights in the home. She is just a co-applicant here. Meanwhile, she is entitled to pay the home loan, though.

Legal Inheritance

The intestate succession law of the US says that a distributor will decide the fair share of the property for each lawful inheritor if the parent dies without leaving a will.

Meanwhile, the liability of repayment is a tricky deal. If you earn more and are my younger brother, you must take charge of more EMIs than me. At least the court functions like that.

You can now contest the trial court’s decision with the circuit court. Meanwhile, the repayment will be at a standstill. However, when the payment process resumes, you must count a horde of fines and additional taxes, and your repayment rate may also change.

Beneficiary of WILL is different.

Let’s say the husband died, making the wife and his parents (aged above 60) equal owners of the home. Sorted, right? Actually, no. In this case, the wife will become the only home loan co-applicant responsible for paying back the rest of the EMIs.

No doubt it would be genuine trouble for her.

Solutions You Can Try

There are numerous disadvantages of co-applicant in home loan. But you can now remedy the problem. I thought of these two easy ways to overcome the issues without breaking much sweat.

Firstly, go for online term insurance. You might wonder what would happen if the bank pesters you into getting a home loan co-applicant to sign your deal. It’s only natural that the bank may insist on hedging the risk of repayment issues.

So, what would be your approach in that situation? Yes, you got that right. Just buy an online term insurance plan. Meanwhile, the primary borrower or applicant should submit a copy of the insurance to the bank.

It is a token that says I am insured against a Home Loan. But you must now buy an entire home loan protection plan. Besides, check which type of home loan is the best for you.

Secondly, all home loan applicants would agree on a proper stand. It is the best way to avoid any legal tussle in the future. You may sign a legal liability agreement with others. Therefore, the liability and rights of the parties would be protected and documented.

In conclusion, don’t accept the lenders’ terms blatantly. Instead, safeguard the interests of your close ones. Life is an uncertain stage. So, take your guard and be alert before you act.