- Which One Of The Following Statements Related To The Cash Flow To Creditors Is Correct?

- Explanation:

- Cash Flow To Creditors Definition

- Cash Flow To Creditors Formula

- How To Calculate Cash Flow To Creditors?

- How To Find Cash Flow To Creditors?

- Investing Activities

- Operating Activities

- Financial Activities

- Frequently Asked Questions (FAQ):

- 1. When Does Cash Flow To Creditors Increase?

- 2. What Does A Negative Cash Flow To Creditors Mean?

- 3. What Does A Positive Cash Flow to Creditors Increase?

- Final Note

Cash Flow To Creditors Calculator- Everything You Need To Know

Cash flow to creditors, one cannot deny that this is one of the most important elements of investors in a business.

For anyone not well-versed with finance terminologies, it is basically the extra money you will receive as a debt holder.

It is the profit; the best part, and it is exciting!

Which also means that you have to calculate it with perfection. Know about the concept of cash flow creditors through and through. It is only when you know all the formulas that no one can mislead you during an accounting period of the business.

In order to measure your knowledge about the subject, how about you answer one little question.

Which One Of The Following Statements Related To The Cash Flow To Creditors Is Correct?

If your answer is Option A, then congratulations; you have a fair amount of knowledge about the subject. However, if you still want to know more; or if you are among the crowd who failed to answer it correctly.

Then don’t worry because, in the excerpt below, I will be explaining the reasoning behind the correct answer and elaborate on a few of the other concepts related to the subject. So sit back and absorb all the knowledge you can!

Explanation:

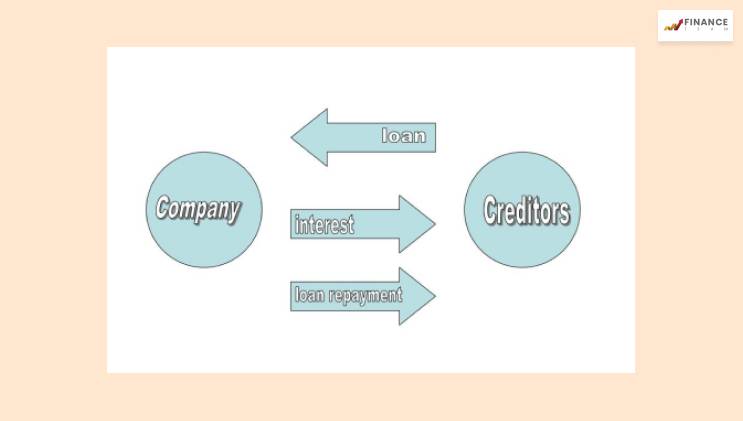

Cash flow is basically the income and expenditure flow in a business. However, the cash flow of creditors indicates the profit that is earned with the income of an investor.

Now for a business, a positive cash flow means that the capital generated by a company is essentially more than the outflow with which they initiated.

This implies that the company has good financial liquidity, and in terms of a loss, it can be mitigated with inflow as it is higher.

Cash Flow To Creditors Definition

Cash flow, in general, infers a business’s capability to generate revenue. Now, cash flow credit is the company’s ability to recover profit from this revenue.

Cash flow to the creditor is defined as a positive cash flow towards the investor. When the inflow increases, the outflow; indicates the growth of a company.

Cash Flow To Creditors Formula

If you are a budding accountant, then this calculation should be something you master. However, as a business owner as well, you cannot leave every trust in your accountant, especially when it deals with the profit generated by the company.

Because at times of crisis and miscalculation, simply knowing the problem will help you comprehend and then compensate for the problem much faster.

Therefore, it is essential to know.

How To Calculate Cash Flow To Creditors?

Formula:

I – E + B

Over here

- I mean Interest Paid.

- E is the Ending of the long-term debt. The ending period of the long-term debt will determine the interest rate of your business.

- B is the Beginning of the Long term debt.

If you calculate your cash flow to creditors, many accounting problems with the debt holders can be solved.

How To Find Cash Flow To Creditors?

In order to get a better overview of how, to begin with, cash flow to creditors. You should first understand the different cash flow activities (majority of outflow) for any business.

Investing Activities

These are non-current assets that could be investments done on other entities. This is a form of outflow, but the inflow will include the cash flow to creditors. These could also be property, plant, and equipment, loans, etc. All these investing activities will help you generate profit.

Operating Activities

This is more of an inflow through the net income. This is the capital growth of a company that is generated from the sales of goods. But, it also includes capital input like merchandise and other expenses on subtracting the income from it.

Financial Activities

This accounts for most of the cash flow to the creditors calculation for a company. However, because it includes all the liabilities, the principal amount of long-term debts to the investors, etc., they also include inflow through stock sales.

Frequently Asked Questions (FAQ):

Since this is such an intricate subject, everyone is bound to have questions and queries. So, to answer a few pressing ones over the internet.

1. When Does Cash Flow To Creditors Increase?

Ans. When a company pays all its debt in cash form and not any other liquid asset, it increases the cash flow to the creditors.

2. What Does A Negative Cash Flow To Creditors Mean?

Ans. When Cash flow for financing activities is more than the inflow, it is called a negative cash flow. This also means that a company has too many investors and is repurchasing stocks at a frequent rate to satisfy investors.

3. What Does A Positive Cash Flow to Creditors Increase?

Ans. A positive cash flow means a profit in the inflow for a company which can contribute to its growth.

Final Note

Cash flow to creditors can help you comprehend the condition of your company and whether you have the ability to borrow money from investors at times of debt. In addition, this accounting helps companies to access their liabilities and assets and what kind of financial need they are in.

A positive cash flow means that even in terms of a minor loss, the company has the capability to borrow capital to compensate it.

Read Also: