Capital Vs Equity – All You Need To Know About

Both capital and equity look similar, but they are not the same at all. These terms are used to describe the ownership of the company owners. In this article, you will get to know in detail about capital Vs Equity. Now, let’s proceed with the same.

Equity and capital are the two terms that can explain the financial interest shareholders or owners have in a business via shares, assets, or funds.

Yes, you can benefit from understanding the difference between equity and capital whether you work in the financial industry, private equity, or investment banking. These determine the financial health of your firm, and you must understand this at the earliest.

What Is Capital?

Capital refers to the business’s financial assets. For example, the funds that are present in a business bank account or via a business loan. This term usually focuses on the financial resources available to conduct daily business operations.

Moreover, there are primarily four types of business capital, and this includes:

i) Equity Capital

Firms can receive equity capital in various forms, such as public equity and private equity. A business can raise equity by selling shares of stock in a company. Private equity is raised by a group of closed investors whereas, public equity is raised by listing a company’s shares.

ii) Debt Capital

A business can increase debt capital by borrowing funds from a government institution or a bank. Smaller businesses may also gain this capital by borrowing money from their close ones or online programs.

iii) Trading Capital

Trading capital refers to the number of funds a firm allocates to selling and buying securities. These all have a minimum amount of trading capital set before a firm can start trading.

iv) Working Capital

The working capital of a company estimates for all liquid assets and available cash used to cover daily accounts payable and operations. Financial experts utilize this to know whether a company has the capacity to pay for any expected debts.

What Factors Influence Capital?

There are various factors that influence capital either in a positive or a negative way, and this include:

- Payables

- Taxes

- Money owed to vendors

- Funding

- Short term accounts receivable

- Cash is presently available to the business.

Capital is one of the most important parts as it highlights the company’s available funding and whether the company can pay for the ongoing production of its goods and services.

What Is Equity?

Equity is an owner’s share of the assets of a business. It represents the amount of money a shareholder or a business owner would receive. Equity represents shareholder’s equity or owner’s equity. It determines the overall financial health of a business.

Now, let’s discuss the common two types of equity used by businesses.

i) Shareholder’s Equity

Shareholder’s equity is also known as stockholder’s equity. This refers to the number of assets shareholders have in a company after reducing all liabilities. This type of equity is used by businesses that are structured as corporations.

ii) Owner’s Equity

Another type of equity is Owner’s Equity. It refers to the company’s owner control in the company, and it represents how much capital a business has. This type of equity is commonly used by business partners and sole proprietors.

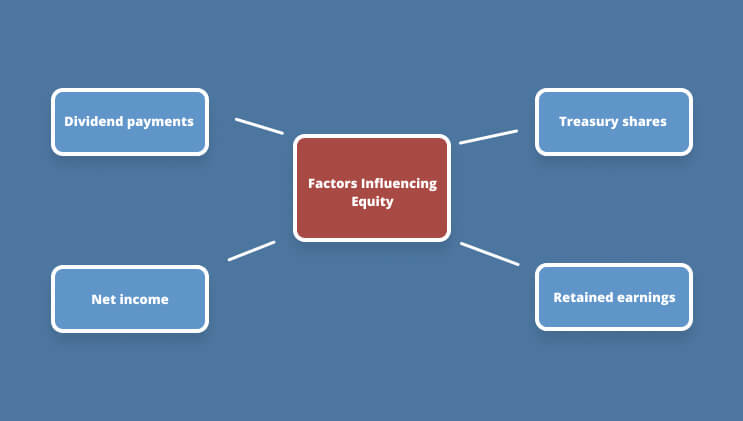

What Factors Impact Equity?

Changes in a company’s liabilities or assets consist of loses or gains from investments or operations, other transactions, the payout of cash dividends, etc., which can affect equity.

Now, let’s discuss some of the common items that impact the equity of the company.

- Dividend payments

- Net income

- Treasury shares

- Retained earnings.

Capital Vs Equity – Some Major Differences

The above information will help you to understand the detailed overview of capital and equity. However, to make your concept more clear, we have prepared a comparison chart to describe the difference between Capital Vs Equity.

The Final Thoughts

Capital Vs Equity or Equity Vs Capital is all the same. The important differences between these two terms are the job role and their responsibilities. Therefore, this is all about capital and equity that you should know especially if you are related to these two fields.

Read Also: