- What Are Budgeting Worksheets?

- Why Are Budgeting Worksheets Important?

- How To Make Budgeting Worksheets?

- Step 1: Create The Worksheet

- List The Metrics That You Want To Keep A Track Of

- Include Budgeting Estimates

- Track Your Actual Numbers

- Update Your Budget Regularly

- Components Of Budgeting Worksheets

- Budgeting Worksheets Template

- Wrapping Up

Mastering Your Finances: Unlocking The Power Of Budgeting Worksheets

Do you have the habit of spending money unnecessarily and then regretting it later? Let us only go through some nooks and crooks of budgeting worksheets.

Do you struggle to save your hard-earned money, and every month is a big financial challenge for you? Well, I was on the same path and learned it the hard way.

Something that reduced my overspending habits and will indeed reduce yours too.

Budgeting worksheets are your ultimate saviors if you are struggling to save money. Take it from someone that has been there and done it; budgeting worksheets are the exact solutions that you can rely on.

In this article, I will be discussing with you the effectiveness of budgeting worksheets, and together we will figure out if they are best suited for you or not.

Budgeting worksheets are incredibly effective for tracking your Income and expenses alongside any savings that you want to deposit. Adequate budgets also help in monitoring your costs, that in turn identifies the pattern in your spending habits.

You can also keep track of your overspending, which helps to improve your budget and control ways to save money each month.

What Are Budgeting Worksheets?

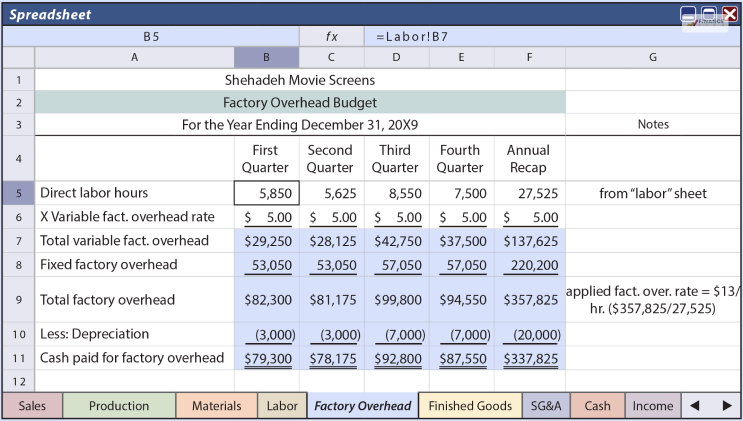

Budgeting worksheets for beginners is a productive tool that helps to list, track and evaluate every single source of your Income, expenses and savings. You may use spreadsheet software to make budgeting worksheets or use a notebook to make handwritten records of your financial transactions.

If you are going for spreadsheet software, you can add or remove rows and columns to reflect your financial situation.

Read More: Top 3 Ways To Manage Your Budget Effectively

Why Are Budgeting Worksheets Important?

Budgeting worksheets are simple charts or spreadsheets that can help you record all your financial transactions, which reflect the financial situation you are currently in.

Using budgeting worksheets to maintain your finances has many mentionable benefits:

- It tracks all your Income and expenses in one single place. This means you can easily evaluate the balance in your budget and accordingly increase your Income or cut down on your expenses.

- It makes you spend within your means. Adding up all the sections in your budgeting worksheet will help you measure if your anticipated Income would be enough to pay for your planned expenses or savings.

- It will tally your expenses, Income, and savings as accurate numbers for each category. With budgeting worksheets, you can spot disparities and identify which areas you need to put more focus on.

- It will yield a disposable income at the end of every budgeting period. This will help you determine if you would want to put money into savings or if you need to cut down on your expenses.

- It reveals the pattern in which you spend your money. The division of multiple categories helps you look into the areas where you are spending more money than the others and where the major part of your Income is unnecessarily going.

How To Make Budgeting Worksheets?

To make a budget worksheet that works effectively, you must follow the undermentioned steps.

Step 1: Create The Worksheet

You may choose to use a notebook or a spreadsheet application, but make sure to incorporate multiple rows that will include each of the items that you want to have a record of.

Draw three columns-

- First, for your list of items.

- Second, for your budget amounts.

- This is for your actual spending and savings.

The number of rows in your worksheet may vary depending on the number of items that you want to include.

List The Metrics That You Want To Keep A Track Of

The first column of your worksheet must always include the items that you are tracking. It starts with Income and is followed by sections that include your expenses, savings, and any other costs that you want to include.

You may want to use bold styling or colors to separate different sections if you are using spreadsheet software.

Include Budgeting Estimates

In the second column that you create for your estimated amounts, you can list the amount that you anticipate spending or saving for each category on your budget.

Let us say you are planning on spending $300 on your monthly EMI. When you include this amount on your budgeting worksheet, it tells how much you are expecting to spend.

You must also be aware that the actual amounts will vary from the estimated amounts on your budgeting worksheets.

Track Your Actual Numbers

While you continue to spend and save every week, you must also keep track of the actual amount on the third column of your monthly budget sheet.

These values, if not all, may differ from what you originally expected in column two; however, unadjustable expenses remain the same, like Income, insurance, or rent payment.

Yet again, the cost of groceries, gas, etc., might fluctuate on a monthly basis.

Update Your Budget Regularly

While recording your expenses, Income, and savings, do not forget to keep your budgeting worksheets updated.

One of the most effective ways to keep your budget updated is through weekly evaluations and adjustments according to the actual amounts that you are spending and saving.

Components Of Budgeting Worksheets

Creating an accurate budgeting worksheet may be overwhelming at the beginning; however, after making one multiple times, it becomes a habit.

Although the components of your budgeting worksheets may differ according to your needs, there are a few general components that you must include in budgeting worksheets to get maximum effectiveness from the tool.

Here are the general components that you must include in your budgeting worksheets:

- Income

- Transportation Costs

- Housing And Utilities

- Food And Groceries

- Personal Care

- Health Care

- Financing

- Family

- Miscellaneous

- Savings

Budgeting Worksheets Template

Here is a blueprint of the format that you may use as a budgeting worksheet. You can either follow the same pattern or customize it according to your personal needs.

| Items | Budgeted | Actual |

|---|---|---|

| Income | ||

| Regular Pay | ||

| Expenses | ||

| Rent | ||

| Insurance | ||

| Utilities | ||

| Savings | ||

| Savings Account | ||

| Miscellaneous | ||

| Gas |

| Totals | ||

|---|---|---|

| Total Income | ||

| Total Savings | ||

| Total Expenses | ||

| Total Disposable Income |

Read More: Big Budgeting Problems You Should Fix

Wrapping Up

This was everything that you needed to know about budgeting worksheets. They are effective tools that help in balancing your Income and expenses and help you make savings.

If you have any more questions regarding budgeting worksheets, you are free to drop a comment below, and I will be happy to solve any query that you have.

Till then, happy budgeting!

Read Also: