- What Is A Bond Fund?

- Types Of Bond Funds

- 1. Government Bond Funds

- 2. Corporate Bond Funds

- 3. Municipal Bond Funds

- 4. High Yield Bond Funds

- 5. International Bond Funds

- 6. Emerging Market Bond Funds

- 7. Convertible Bond Funds

- 8. Inflation-Protected Bond Funds

- Benefits Of Using Bond Funds

- 1. Diversification

- 2. Professional Management

- 3. Accessibility

- 4. Liquidity

- 5. Income Generation

- 6. Professional Monitoring

- 7. Risk Management

- How Bond Fund Works?

- 1. Investors Buy Shares

- 2. Fund Manager Makes Investment Of Money

- 3. Income Generation

- 4. Net Asset Value

- 5. Controls The Price Fluctuations

- 6. Offers Redemptions

- What Are The Special Considerations In Relation To Bond Funds?

- What Are The Risks With Bond Funds?

- Final Take Away

What Are Bond Funds? A Complete Overview

Most of the time, the bond funds are also referred to as the debt funds. These are the pools for the investment vehicle that you can invest in bonds primarily. Government, municipal, debt, and convertibles are the other instruments of debt that you must know at your end.

Bond funds can make things easier to use and get returns on time. Bond funds come in two forms one is static, and another is volatile. You should decide which one suits you the best as per your budget constraints.

For many investors, bond funds are quite an efficient way of making investments than buying individual securities. This will assist you in reaching your requirements with complete ease. Most of the time, bonds do not comprise the maturity date. Sector-specific funds can help you in attaining your objectives with ease.

What Is A Bond Fund?

A bond fund can be a type of investment fund that pools money from various investors. You need to have a diversified portfolio of funds that can make it easier for you to attain your needs. Most of the time, bonds are the debts and securities that the government and securities take care of. When you are making investments in a bond, then you usually buy shares of the portfolio that comprises the bond.

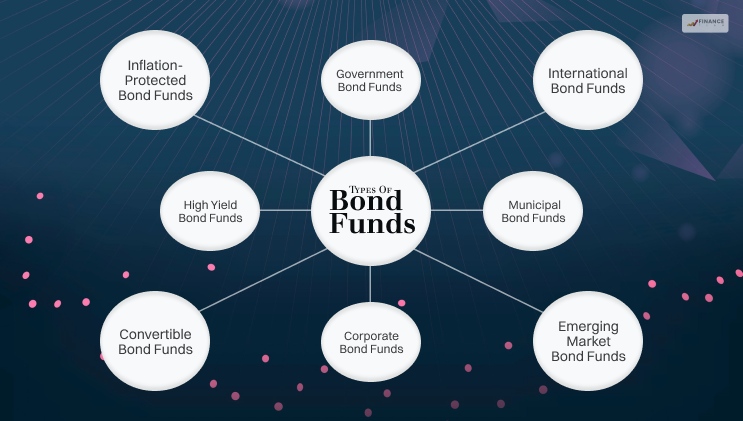

Types Of Bond Funds

There are usually eight types of bond funds that you must know at your end. Without knowing the details of the different types of bonds, your knowledge of them will remain incomplete. So, let’s get through the bonds first and then move on to other matters later.

1. Government Bond Funds

These funds invest bonds issued by governments, such as U.S. Treasury bonds. They are among the safest bond funds because they are backed by the government’s ability to tax and print money. Fixed Income ETFs can help your business to grow at a rapid pace.

You will receive steady returns from your investments once you make the investments in government bonds. Government bond funds are not dependent on the vulnerability of the market fluctuations. So, a steady rate of return is guaranteed here.

2. Corporate Bond Funds

Corporations issue these bonds. You will get higher yields from these bonds than government bonds, but they also carry higher risks. Especially for lower-rated bonds. The burning example of this type of bond is the junk bond. Reduce the fractional shares as much as possible.

One of the most crucial aspects of corporate bond funds that you must be well aware of is its rate of volatility. You will never get any assurance of getting a steady rate of returns from your investments from Bond funds.

3. Municipal Bond Funds

These funds are part of bond funds issued by local and state governments. The interest income from these bonds is often exempt from federal income tax and, in some scenarios, local and state taxes, making this bond attractive to investors in high tax brackets.

The Municipal bond funds can offer you the opportunity to make things work for you in the correct order. This can boost your business to the next level. Once you follow the process of the municipal bond funds, things can become easier for you in the correct order.

4. High Yield Bond Funds

HYB funds are also known as trash bond funds, and these funds invest in the bond issuance of companies with poor credit ratings. They offer higher yields to compensate for the higher risk of default. You should not make a proper analysis of the bond funds to make things work in your way.

High-yield bonds can help your business to grow at a faster pace. Try to follow the perfect solution that can make things easier for you to reach your requirements with ease. Effective planning can boost your brand value to the next level. This is one of the highest dividend stocks.

5. International Bond Funds

Governments and corporations issue international bond funds outside the investor’s home country. They provide diversification benefits but also expose investors to currency risk and geopolitical risk.

The chances of risk in international bond funds are huge. The volatility rate can be higher in this case. You need to track the global market scenario to estimate the rate of returns that you can receive from the market.

6. Emerging Market Bond Funds

Emerging market bond funds for governments and corporations in emerging market scenarios. They offer higher yields but also higher risk due to the less stable economic and political environments in these countries.

Emerging market bonds can offer you higher returns from your investments. They have less stability in the initial phase. You need to follow the correct process in this case while attaining your requirements with ease.

7. Convertible Bond Funds

These funds invest in convertible bonds, which can be transformed into a specific number of shares from the issuers common stock. They offer the potential for capital appreciation if the stock price rises but also provide downside protection if the stock price falls.

The convertible bond funds can help the issuer to increase or decrease the rate of conversion. Additionally, you can stay protected with the help of this bonds. This can boost your business to the next level.

8. Inflation-Protected Bond Funds

These funds invest in bonds that you index to inflation. They provide protection against inflation but may offer lower yields than traditional bonds.

You must know the inflation-protected bond funds. This can boost the chances of your returns to a great extent. However, you must consult a market expert before making your investments in any type of bond.

Benefits Of Using Bond Funds

There are several benefits of using bond funds. You must be aware of it while attaining your needs and requirements easily. Some of the key benefits that you should know at your end are as follows:-

1. Diversification

Bond funds hold various bonds in their portfolios, including government, corporate, and municipal bonds. This diversification helps spread risk across different issuers and types of bonds, reducing the impact of any single bond defaulting.

You can diversify your business within a certain period. Without knowing the process of diversification of bond funds, things can become difficult for you in the long run.

2. Professional Management

Bond funds are managed by professional fund managers who make investment decisions on behalf of the fund. These managers conduct research and analysis to select bonds that meet the fund’s investment objectives.

Thus, potentially leading to better returns than individual investors could achieve on their own. Without professional management, things can become difficult for you later. So, you must try to meet the needs with ease.

3. Accessibility

Bond funds allow individual investors to access the bond market with relatively small amounts of money. Instead of purchasing individual bonds, which can require a significant investment. Investors can buy shares of a bond fund, which typically has lower minimum investment requirements.

If you are a beginner in a trading business, then accessibility of the funds plays a vital role in it. Try to adopt the best practices that can boost the chances of your brand value to the next level.

4. Liquidity

Bond funds are generally more liquid in comparison to bond funds. Making it easier for investors to buy and sell shares. This liquidity can be especially beneficial in times of market volatility. As it may be difficult to find buyers for individual bonds.

The rate of liquidity can be higher if you follow the right process from your counterpart. Beauty of the bond funds is that it can offer you a higher liquidity rate within a stipulated time.

5. Income Generation

Bond funds provide a regular income stream through interest payments on the bonds held in the fund’s portfolio. This can be attractive to investors seeking a stable source of income, such as retirees.

You can generate income at a faster pace through bond funds. Ensure that you select the right bond funds so that you can generate steady revenue from them consistently.

6. Professional Monitoring

Bond funds are actively managed, which means that the fund manager continuously monitors the bond market. Thus, adjust the portfolio as needed. This active management can help optimize returns and manage risk over time.

Professional monitoring can greatly reduce the risk. You need to get through the facts that can assist you in attaining your requirements with ease.

7. Risk Management

This fund can help you manage risk through diversification and professional management. By spreading investments across various bonds and relying on a fund manager’s expertise. Investors can reduce the risk of losses due to defaults or market fluctuations.

Risk management is an essential part of bond funds that can help you grow your business on the correct way. Ensure that you know the risk in advance, this will reduce the chances of your loss after making the investments in bond funds.

How Bond Fund Works?

Bond funds work by pooling huge amounts of money from multiple investors. You need to get through the complete details of it if you want to gain the maximum revenue from Bond funds. Some of the essential things that you need to identify here are as follows: –

1. Investors Buy Shares

An investor purchases shares of a bond fund from the fund company. Each share represents a portion of ownership in the fund. This will help the investors to buy the shares within a particular time. Furthermore, investors must make the buying decisions after knowing the market conditions in detail.

2. Fund Manager Makes Investment Of Money

The fund manager, appointed by the company, uses the pooled money to buy various bonds. The manager selects bonds based on the fund’s investment objectives. This could include generating income, preserving capital, or achieving a specific level of risk.

Most of the time, the fund manager makes proper investments of money. This can mostly boost your earnings chances. After making a proper analysis of investments, it can become easier for you to make use of bond funds.

3. Income Generation

The chances of income generation are quite high while you make use of the bond funds. Once you generate the income in the correct end, things can become easier for you in all possible ways.

The bonds in the fund’s portfolio pay interest, known as coupon payments. This income is collected by the fund and distributed to shareholders as dividends. Some funds may also reinvest this income to purchase additional bonds, increasing the fund’s holdings.

4. Net Asset Value

The value of a bond fund’s shares is determined by its net asset value (NAV). NAV is calculated by subtracting the fund’s liabilities from the total value of its assets and dividing it by number of shares outstanding. NAV is typically making calculations from the end of each trading day.

The application of Net Asset Value can help your business to grow at a faster pace. Effective planning can assist you in reaching your objectives with ease. Try to make things work in perfect order.

5. Controls The Price Fluctuations

The price of a bond fund’s shares can go up and down based on changes in the value of bonds in its portfolio. Factors such as interest rate changes, credit quality of the bonds, and market conditions can all impact the fund’s NAV.

The price fluctuations of your investments will be negligible when you opt for bond funds. Ensure that you follow the best practices that can make things easier for you in all possible manners.

6. Offers Redemptions

Investors can redeem their shares of the bond fund at any time. The fund company will buy back the shares at the current NAV per share. However, value of an investor’s shares may be higher or lower than their original purchase price, depending on market conditions.

Ensure that you follow the right process from your endpoints while attaining your goals with ease. However, you need to track the offers that will provide you with redemptions on bond funds.

What Are The Special Considerations In Relation To Bond Funds?

There are certain special considerations in relation to bond funds. You must know these factors from your end while making investments in bond funds. Some of the key factors that you should know from your counterpart are as follows: –

- Interest rate risks are inversely related to all the interest rates. When the interest rate rises, the bond falls.

- Bond funds that invest in lower-quality or “junk” bonds carry higher credit risk.

- The risk duration shows the market sensitivity greatly.

- Some bond funds invest in less liquid bonds, which may be difficult to sell quickly at a fair price.

- Inflation erodes the purchasing power of fixed-income investments like bonds.

These are some of the special considerations that you must take care of while you make use of the bond funds. Ensure that you follow the perfect solution from your counterpart.

What Are The Risks With Bond Funds?

There are several risks associated with bond funds. You need to identify the risks here as well while making investments in bond funds. Some of the key factors that you should know at your end are as follows: –

- Interest rate risk is another vital risk comprised with bond funds. If the bond prices fall, then it leads to a decrease in its value.

- Lower-quality junk bonds comprise higher credit risk.

- Duration is a measure of the sensitivity of the bonds.

- Some of the bond funds invest in lesser liquid bonds.

- Inflation can erode the purchasing power of the bond investor.

Final Take Away

Hence, if you want to purchase the bond funds, then you must consider the above points to have a better idea of it. Some of the key factors that you should know from your end are mentioned above.

You can share your views and comments in our comment box. Once you follow the best options, things can become easier for you in all possible ways. Try to keep things in perfect order while attaining your goals with ease.

It’s important for investors to understand these risks and consider their risk tolerance and investment goals before investing in bond funds. Diversification and professional advice can also help mitigate some of these risks.

For Best Financial Information: