- Current Price Of BHEL Share

- Prediction Of BHEL Share

- 1. Historical Data

- 2. Predicted Future Data

- 52 Week High And Low Of BHEL Share Price

- 1. Historical Data

- 2. Predicted Future Data

- Bullish Or Bearish?

- BHEL Stock Performance By 2027

- Frequently Asked Questions (FAQs):

- Should You Invest In BHEL Shares In 2022? - The Verdict

BHEL Share Price 2022 – Present Price, Forecast, Statistics – Should You Invest In It In 2022?

BHEL share comes from Bharat Heavy Electricals Limited. It’s a public sector firm owned by a manufacturing and engineering firm based in New Delhi, India, under the ownership of the Ministry of Heavy Industries, Government of India. BHEL is one of the largest manufacturing and engineering companies in India engaged in engineering, design, construction, and testing.

Based in New Delhi, India, this enterprise is under the Ministry of Heavy Industries, Government of India. Established in 1956, BHEL is now the largest power generation equipment manufacturer in India.

Read the segment below to know the latest BHEL Share price.

Current Price Of BHEL Share

The BHEL Share price today, which is on May 12, 2022, is 46.000 INR.

Prediction Of BHEL Share

Below, I have illustrated a clear forecast of the share price of BHEL. In order to determine the forthcoming prices, it’s necessary to know the historical trends as well. Check out the tables below.

1. Historical Data

| Date | Opening price | Closing price | Minimum price | Maximum price |

| 2022-05-10 | Open: 49.650 | Close: 48.150 | Low: 48.150 | High: 49.650 |

| 2022-05-09 | Open: 49.500 | Close: 49.400 | Low: 49.100 | High: 49.650 |

| 2022-05-06 | Open: 52.000 | Close: 51.250 | Low: 50.550 | High: 52.250 |

| 2022-05-05 | Open: 53.050 | Close: 53.800 | Low: 53.050 | High: 54.450 |

| 2022-05-04 | Open: 52.800 | Close: 52.500 | Low: 52.500 | High: 53.850 |

| 2022-05-02 | Open: 51.550 | Close: 52.400 | Low: 51.550 | High: 52.400 |

| 2022-04-29 | Open: 54.400 | Close: 52.600 | Low: 52.600 | High: 54.400 |

| 2022-04-28 | Open: 52.800 | Close: 54.000 | Low: 52.700 | High: 54.000 |

| 2022-04-27 | Open: 52.650 | Close: 52.500 | Low: 51.800 | High: 52.650 |

| 2022-04-26 | Open: 52.000 | Close: 52.950 | Low: 51.950 | High: 52.950 |

| 2022-04-25 | Open: 52.000 | Close: 51.800 | Low: 51.350 | High: 52.000 |

| 2022-04-22 | Open: 54.900 | Close: 53.900 | Low: 53.900 | High: 54.900 |

| 2022-04-21 | Open: 54.450 | Close: 54.900 | Low: 54.350 | High: 54.900 |

| 2022-04-20 | Open: 54.150 | Close: 54.000 | Low: 53.400 | High: 54.150 |

Analysis: From the historical BHEL stock price data, it’s quite observable that from 20th April to 10th May 2022, the BHEL stock price has gone down. This indicates a thin shadow of bearishness, but it’s expected that there is much potential in the future.

2. Predicted Future Data

| Date | Price | Min Price | Max Price |

| 2022-05-12 | Price: 48.440 | Min: 47.198 | Max: 49.656 |

| 2022-05-13 | Price: 47.929 | Min: 46.737 | Max: 49.258 |

| 2022-05-16 | Price: 45.706 | Min: 44.514 | Max: 46.950 |

| 2022-05-17 | Price: 45.621 | Min: 44.396 | Max: 46.787 |

| 2022-05-18 | Price: 45.390 | Min: 44.146 | Max: 46.670 |

| 2022-05-19 | Price: 46.951 | Min: 45.758 | Max: 48.212 |

| 2022-05-20 | Price: 46.441 | Min: 45.208 | Max: 47.626 |

| 2022-05-23 | Price: 44.218 | Min: 42.986 | Max: 45.439 |

| 2022-05-24 | Price: 44.132 | Min: 42.869 | Max: 45.361 |

| 2022-05-25 | Price: 43.902 | Min: 42.695 | Max: 45.067 |

Analysis: From the forecasted BHEL share price table above, it’s possible to mention that from 12th May 2022 to 25th May 2022, the BHEL Share price will drop to a great extent. However, it’s expected that the price will rise again in the future.

52 Week High And Low Of BHEL Share Price

The 52-week High and Low values of BHEL share price determine the health of the stock pretty well. It’s basically the yearly trading range that tells you the highest and lowest price of a security or share or stock.

1. Historical Data

| 52 Week High | 52 Week Low |

| 80.35 | 44 |

2. Predicted Future Data

| 52 Week High | 52 Week Low |

| 62.612 | 47.142 |

Bullish Or Bearish?

Analysis: As you can see from the diagram above, the BHELshare price NSE is just in between the bullishness and bearishness. It’s maintaining a perfect equilibrium. Although the present statistics are indicating a downfall; with the passage of time, it’s expected to bring more returns in the near future.

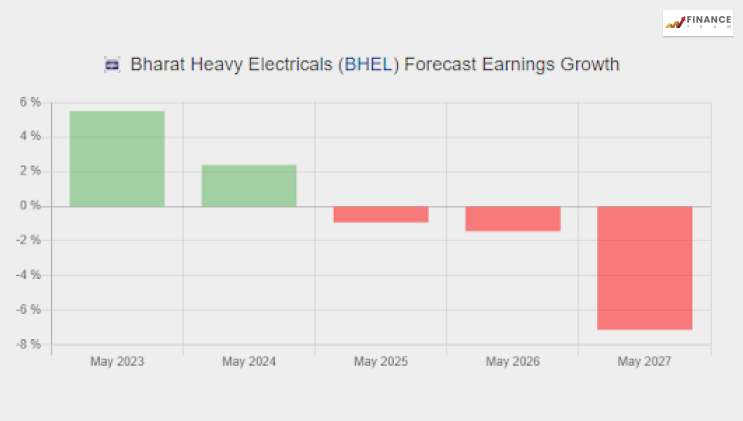

BHEL Stock Performance By 2027

Analysis: The graph above denotes the future growth of BHEL Stock. The stock performance from May 2024 is going to move down till May 2027. The long-term earning potential is a little blurry, but you can expect better returns from it.

Frequently Asked Questions (FAQs):

The Bharat Heavy Electricals stock price is 46.150 INR today.

Yes, according to the latest stock market news, the BHEL share price will go upwards from 45.700 INR to 48.208 INR within a single year.

Considering the future price trend and the BHEL share price prediction, the long-term earning potential is +5.49% in a single year.

In the next 5 years, the BHEL share price might be 42.447 INR.

As per our analysis, there won’t be a crash in the BHEL share price.

Should You Invest In BHEL Shares In 2022? – The Verdict

From the share price BHEL analysis above, it’s possible to say that there might be a positive trend in the future. BHEL shares could be a pretty good investment in order to make money. Because of the positive outlook, we are advising you to make it a part of your portfolio.

Let’s meet in the comment section below in case you have something to share with us.

Disclaimer: Respected Readers, the BHEL Share price facts, and the data we presented above are all assumptions. All the data refers to those present on the leading cryptomarket websites. The actual values might be different on the basis of the market situation. Please note that share/stock prices are subject to market risks. Read all the documents and examine them carefully before investing.

Read Also: