10 Best Personal Finance Apps in 2019

Finance Apps have been helping human beings to streamline and simplify several aspects of their lives. One of the most important wants is personal finances. These applications can assist you to get further in your financial journey faster. We can categorize personal finance Apps into three including budget tools and Apps, saving tools and Apps, finance Apps and tools for paying off debts, investing tools and Apps, and Apps and tools for insurance and wills. As we address the best finance Apps in this article, we will make sure that we focus on what stands out in all these categories. The reason is that all of them are important aspects of personal finance management that we cannot overlook.

1.Tiller

Tiller takes away the pain from the budgeting task. It has spreadsheets that allow people to budget, download transaction data from their bank automatically, track expenses, small business owners to estimate quarterly taxes, track net worth, and many more. It will give you a clear picture of your financial situation without having to do much. You can link your financial accounts and the App will use bank-grade security to import all your financial data. Therefore, you can import all the data in a preformatted spreadsheet. You will have a clear picture of your net worth, expenditure, and how to set up your budget given your past spending habits.

2. Mint

Mint is among the old budgeting tools that you can find in the market. It links financial accounts for users and generates reports for them. Mint has flexible and customizable spreadsheets and is known for doing an exemplary job. The App is free like the Truebill app and hence the ads in your email and those in the app itself fund it. Users have to link their financial accounts to this program and will get reports on their expenditure by category, net worth, and many more. You can either access the reports from your phone or PC.

3. Ibotta

This App allows people to save money on the places that are already shopping. If you don’t like clipping coupons, Ibotta will come in handy to assist you to save money without all the effort that comes with Sunday circulars and busting out the scissors. It is free to use the finance App. However, you will be charged a small inactivity monthly fee if your account is dormant for six months. The fee is usually credited against the user’s account balance. You won’t be charged anything if your bank balance is zero.

4. Chime

You can save money while shopping but may lack the discipline to channel those savings in your account. Chime is an App that makes the whole process easy. Once you begin to bank with Chime, you will set up a round-up feature that you prefer. It will automatically round what you buy to the nearest dollar and deposit the difference in google scholar automatically. The app has no overdraft fees and no monthly fees. Your paychecks can be deposited in the Chime bank account and then you use it to make purchases and pay your bills.

5. YNAB: You Need a Budget

This budgeting App has assisted several individuals to get out of debt. The highest number of users are people who are paying debts. It will assist you to get control over your finances. YNAB will cost you close to $6.99 per month but you will get a free trial of 34 days if you are starting off. It will allow you to save sufficient funds so that you are always one month ahead. The App has a proven track record of successfully helping people pay off their debts.

6.Unbbury. me

Unbbury.me is the best app for people who feel like they are being buried in debts. This web-based application allows people to visualize their debt payoff so that they can understand that it is possible to get out from under. The use of Unbury.me is exclusively free and all you need to do is enter your debts in Unbury.me. You can then choose the debt avalanche method to pay off the debt or select the debt snowball technique. The avalanche method starts with the high-interest debts while the debt snowball starts by paying off the smaller debts. These are encouraging quick wins that will bring your back on track. It is one of the best finance apps that you can find in the market.

7. Acorns

Like Chime, Acorns rounds up the purchases of the individual to the nearest dollar and invests what remains instead of putting it in a basic savings account. The services of this App have grown to include traditional retirement accounts that have tax benefits. You will pay $1 per month for the roundup feature and $2 monthly for the tax benefit retirement account. You can set up automatic transfers with any of these two accounts to make sure that your money goes to the right investment account.

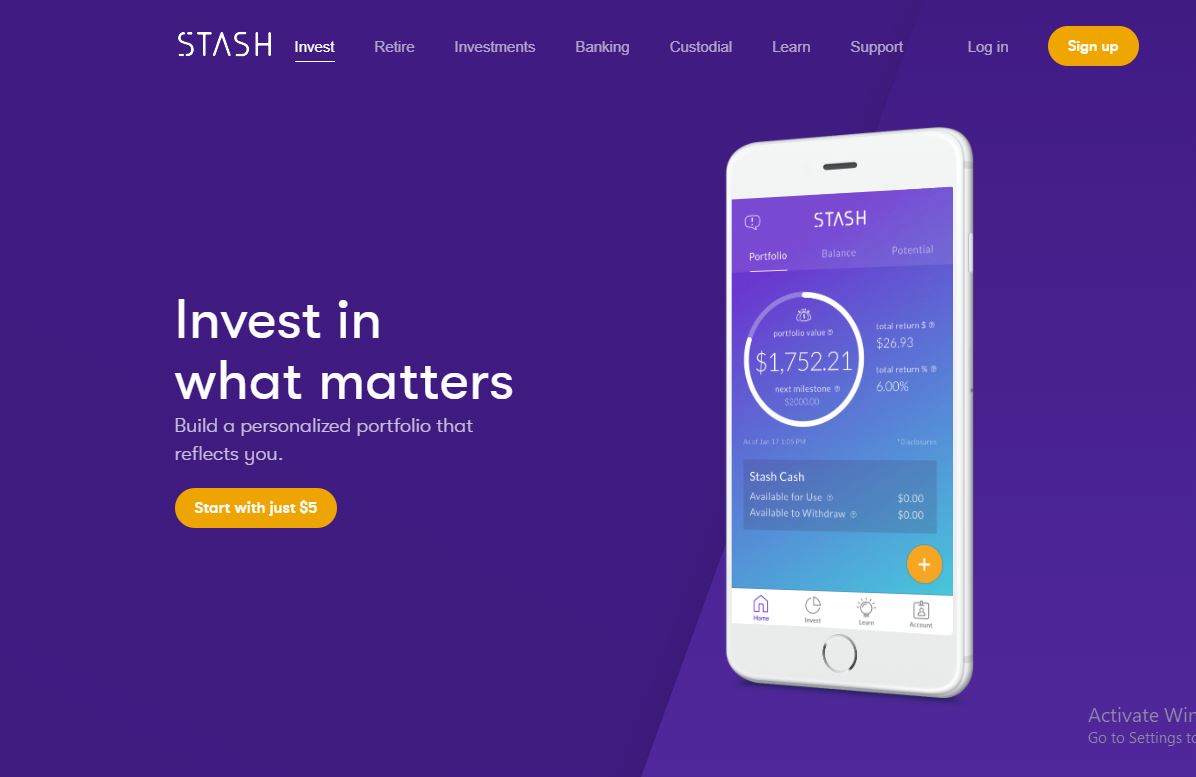

8. Stash

This App is used to facilitate investment. Stash allows you to invest either in a tax advantage or taxable investment account even though it does not have a round-up program. The App has investment categories that match the values of different people. The App attracts a small monthly fee depending on the type of account and outstanding balance. The App allows you to set up automatic transfers so that your money goes to the right account.

9. The Zebra

If you don’t have a background in insurance, it can be hard to do comparison shopping. This web-based app allows users to compare auto-insurance offers from different companies and make the right decision. It is one of the best Finance Apps for people who want to get auto insurance coverage. You will key in the basic information about your car, place of residence, and the drivers to include in the policy. The Zebra will also filter any discounts that you qualify for. It also allows you to check your insurance score free of charge.

10. Tomorrow

It is good to have an idea of what will happen to your money when you are no more. You should have legal documents that inform the state where your money needs to go and the person to take care of your kids when you are not around. The Tomorrow Application gives users free will. It also has a free feature that lets you calculate your net worth. If you upgrade the App to Tomorrow Plus, it will draft for you a living trust. Tomorrow services are free but Tomorrow Plus will cost you $39.99 per annum. It can only take you 20 minutes to create your will.

With all this information, you now how knowledge of the best Finance Apps. You can choose any of them depending on your consumption needs.

Read Also: