- Going ahead

- Current Cryptocurrency Market Trends in the USA

- Analysis of market growth and investor interest

- Key factors influencing cryptocurrency prices

- Global economic trends and market sentiment

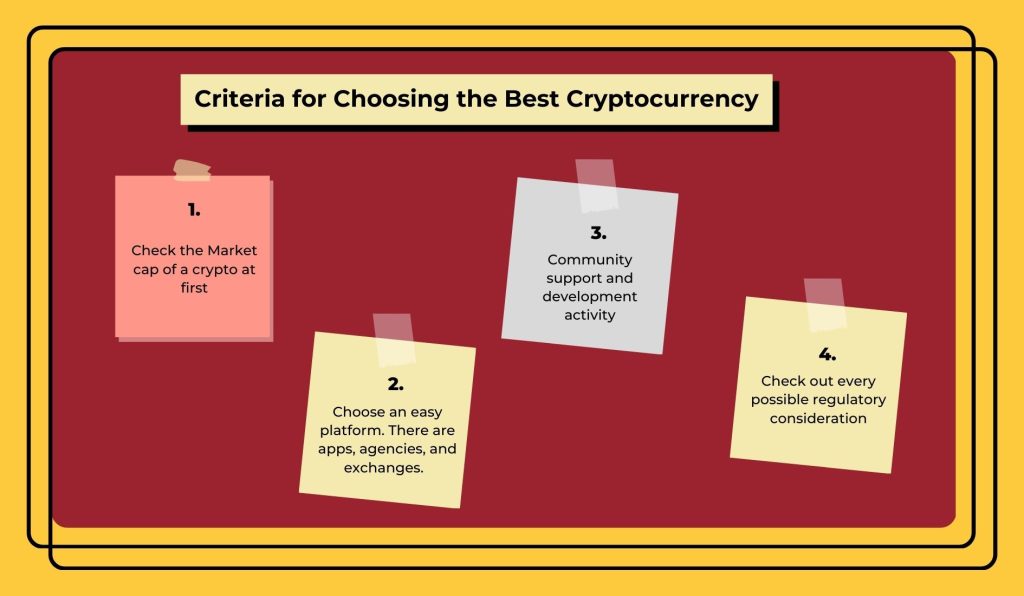

- Criteria for Choosing the Best Cryptocurrency

- 1. Check the Market cap of a crypto at first

- 2. Choose an easy platform. There are apps, agencies, and exchanges.

- 3. Community support and development activity

- 4. Check out every possible regulatory consideration

- Top Cryptocurrencies to Consider for Investment

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Solana (SOL)

- Ripple (XRP)

- Dogecoin (DOGE)

- Polkadot (DOT)

- SHIBA INU (SHIB)

- Additional cryptocurrencies to consider

- Risks and Considerations in Cryptocurrency Investment

- Volatility and market risks

- Potential for significant losses

- The three main risks are:

- Security and fraud concerns

- Potential for future regulatory changes in the US crypto regulation

- Conclusion

- Call to action!

The Colossal Crypto: Is It the Right Time for Beginners to Invest???

The US crypto market is buzzing now. The market is estimated to grow at a CAGR of 12% till 2030. People already hold $1.19 billion worth of crypto in the US. This staggering growth will only continue as more people become aware of blockchain.

Blockchain is the principal technology that keeps crypto transactions safe. And now institutional investors are growing inquisitive about the same, too.

About 4 out of 10 institutional investors are intrigued about the earning opportunities with crypto now. In addition, 30% of them have skimmed the Best cryptocurrency to invest in USA already, a survey unfolds.

But investors say- a sheer interest in crypto may have some looming downsides. Like other investments, you should have a diverse crypto profile. You must invest in Bitcoin, Ethereum, etc.

At the same time, you must put 5 to 10% of your funds in emerging cryptos, too. Meanwhile, consider investing in various sectors in the crypto market, like DeFi, NFTs, etc.

Going ahead

Some individual investors clamor about crypto being a volatile investment. It might be so. But crypto has also yielded high returns in the last decade. Hence, FinanceTeam feels it is the right time to seek the best crypto and place your bets actively.

Current Cryptocurrency Market Trends in the USA

The crypto market is booming, no doubt. However, we must ensure that the growth is steady before you put your pennies in. Here’s our take on the crypto market growth. Once you see how crypto has grown over the years, you’ll also know why it is the right time to dig in.

Analysis of market growth and investor interest

The last summed crypto market in the US was worth $1.19 billion. The same indicated that institutional and individual investors have invested this much into crypto investments. Moreover, the crypto investments market will keep growing at a CAGR of 12.0% till 2030.

Among recent trends, you must know of some fascinating facts. Firstly, Top cryptocurrency brokers in the US are making it big. All upfront US banks and asset managers are taking sheer interest in crypto. And that is helpful for the individual investors.

Take my case, for example. I got some excellent leads from my BoA asset manager. Taking advice from managers, I invested in DogeCoin and Avalanche. You’ll know how much I recently gained if you’ve closely followed these two crypto.

More individual investors like me are intrigued by the high yield of crypto. Likewise, more mainstream adoption would follow.

Key factors influencing cryptocurrency prices

The government policies regulate crypto prices to a great extent. The US FinCEN regulation checks values transmitted between people and entities. Hence preventing the black marketing of crypto. However, supply and demand are the key price determinators in the crypto market.

Bitcoin is still the Best cryptocurrency to invest in USA. But its demand far surpasses the supply. Therefore, Bitcoin prices are sky-high. Beginners can understand how crypto price fluctuations work with this example.

Global economic trends and market sentiment

There are some significant upheavals in the crypto market that investors should take note of. Some countries, including the US, are turning bullish about Bitcoin. Its rising price is tinkering caution in the market. But there are other crypto tokens to substitute Butcoin.

In the US, 30% of the market’s attention has shifted to cryptos like Ethereum, DogeCoin, Cardano, XRP, etc. Mordor’s Global forecast says that the crypto market will grow with a CAGR of 7.77% till 2029. Meanwhile, net investments worldwide would reach $64.41 billion simultaneously.

Criteria for Choosing the Best Cryptocurrency

1. Check the Market cap of a crypto at first

- Liquidity and market stability

- Potential for long-term growth

2. Choose an easy platform. There are apps, agencies, and exchanges.

- Read more on the innovation and uniqueness of blockchains

- Gather leads on Real-world applications and adoption potential of a crypto

3. Community support and development activity

- There are active developer communities and updates to keep you informed

- Strong social media presence and community engagement of crypto brands make them trustworthy.

4. Check out every possible regulatory consideration

- Check out your compliance with Cryptocurrency tax laws in the US

- Consider the potential for future regulatory changes

Top Cryptocurrencies to Consider for Investment

Here are the cryptos that you can bank upon. However, check out the growth trends and further details in the following section.

Bitcoin (BTC)

- Brief description: The first and most prominent cryptocurrency, widely recognized and accepted

- Use case: Store of value, medium of exchange

- Current market performance and trends: Stable and increasing adoption

Ethereum (ETH)

- Brief description: Largest altcoin, decentralized application platform

- Use case: Smart contracts, decentralized finance (DeFi)

- Current market performance and trends: Strong developer activity and adoption

Binance Coin (BNB)

- Brief description: Native cryptocurrency of the Binance exchange

- Use case: Discounted trading fees, payment processing

- Current market performance and trends: Strong exchange performance and adoption

Solana (SOL)

- Brief description: Fast and scalable blockchain platform

- Use case: Decentralized applications, DeFi

- Current market performance and trends: Strong developer activity and adoption

Ripple (XRP)

- Brief description: Cross-border payment processing platform

- Use case: Fast and cheap international transactions

- Current market performance and trends: Strong partnerships and adoption

Dogecoin (DOGE)

- Brief description: Community-driven cryptocurrency with a strong social media presence

- Use case: Micropayments, charitable donations

- Current market performance and trends: Volatile but strong community support

Polkadot (DOT)

- Brief description: Decentralized platform for interoperability between blockchains

- Use case: Cross-chain transactions, DeFi

- Current market performance and trends: Strong developer activity and adoption

SHIBA INU (SHIB)

- Brief description: Community-driven cryptocurrency with a strong social media presence

- Use case: Micropayments, charitable donations

- Current market performance and trends: Volatile but strong community support

Additional cryptocurrencies to consider

Some new cryptos are also making it to the charts. To name some, we can talk of MORTY (trading at $0.00156), Neurolance NEROX ($2.06), WeWing WINGS ($0.633), EXTO+ ($1.21), etc.

Risks and Considerations in Cryptocurrency Investment

There are bountiful crypto investment risks. Rain or shine, you can never rest assured if you’ve put your money in the crypto market. But, we can ward off the risks with better knowledge and prompt CTAs.

Volatility and market risks

Today, the global crypto market cap is $3.82 trillion, marking a 1.34% change in the last 24 hours. So, you can guess how volatile it is. So, trading in crypto is not free from market risks.

For example, Bitcoin has increased 5.42% in the last 24 hours. But it slumped 0.26% in the last 1 hour. However, the recent cryptos are even more volatile. For example, DogeCoin’s value dropped 2.45% in the last 1 hour. However, it gained 4.49% in the previous 24 hours.

Potential for significant losses

There is a grave chance of losing your stash when talking crypto. Several fraudsters can hack into your crypto wallet keys. Moreover, we must remember that crypto is a byproduct of blockchain. So, the risks and threats applicable to blockchain are also practical in crypto.

The three main risks are:

- Decentralized market, making it prone to cyber attacks

- Highly scalable, making it an appealing fodder for fraudsters

- Lose security

Security and fraud concerns

US cryptocurrency exchanges hold a massive stash of cryptocurrencies. Hence, hackers target them big time. In 2011, we witnessed a landmark phishing event in the crypto market. Mt. Gox, a reputed crypto exchange, lost 25,000 Bitcoins worth $400,000.

Exchange hacks and wallet security risks are also shared in crypto. You will receive fake emails and messages from imposters posing as your wallet providers. Or masking as crypto exchanges.

The messages contain fake website links. Once you enter your login credentials after clicking the link, the scammers can track your crypto wallet.

Potential for future regulatory changes in the US crypto regulation

The SEC’s actions on crypto will show the path to cleansing crypto of scams. However, the regulatory measures that would be critical in the current market are:

- Mandate on cryptocurrency exchange and token registration.

- Exchanges have to publicly share their financial details, operations details, and risks related to the crypto assets they are dealing in.

- To avoid deception moves, the SEC opened a portal for crypto-related grievances. You can easily report wash trading and pump and dump schemes.

Conclusion

Several options exist to track and put your pennies into the Best cryptocurrency to invest in USA. My first choice would be crypto exchanges. If you’re a beginner, they can guide you throughout. Meanwhile, there are several apps and platforms, you can also invest in.

For example, Robinhood, Fidelity, and M1 Finance are popular names. You can also invest in crypto ETFs to minimize the investment risks.

All the Best cryptocurrency to invest in USA have their listing in popular ETFs. But, the US crypto market has a vid semblance to the Wild West. So, don’t invest money you can’t afford to lose. Maybe the market will be more stable in the future. But it is not as secure as scalable it is.

I recommend investing not more than 10% of your crypto investment. The Best cryptocurrency to invest in USA is hard to determine. Bitcoin and Ethereum are saturated. Meanwhile, the new ones are having difficulty minimizing the rate of volatilities.

Call to action!

The bottom line is to have a mixed and diverse financial dashboard. Don’t enter the crypto market unthinkingly. You may face roadblocks. Often, sudden slumps like 2 to 3% may deter your investment motive. But stick around.

Crypto is a long-drawn game, like growth stocks. Contact me if you need further guidance on getting into the crypto game!

For More Business Related Articles Click Below!!!