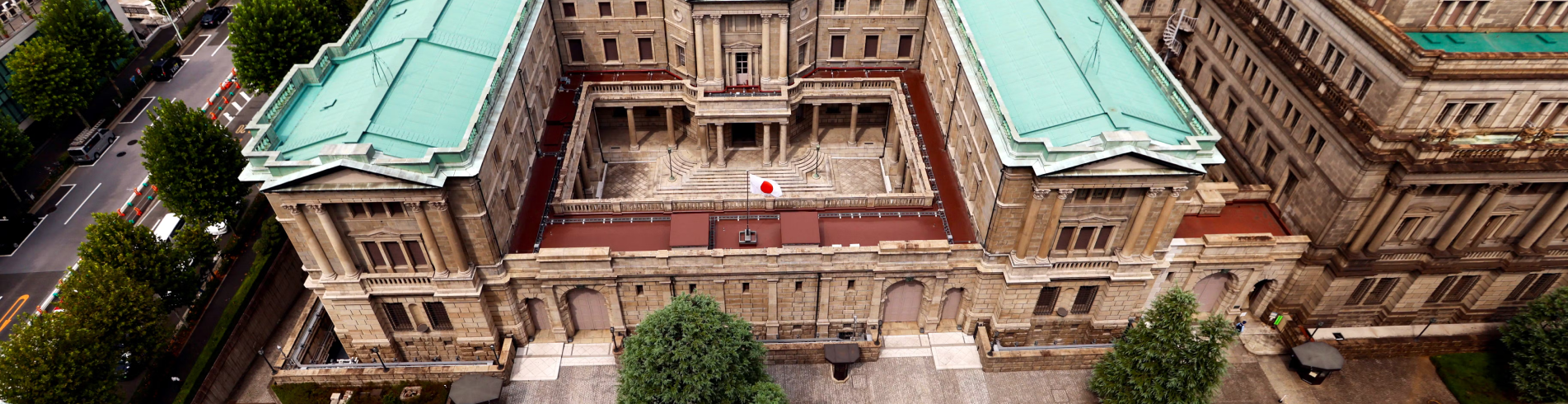

Bank Of Japan Hold Policy And Remains Dovish – Mastermind

The odds that the Bank of Japan will probably tweak its extremely loose policy settings or guidance were long enough to begin with, and quite sure that the Bank of Japan had stuck to the script with a decision on Friday that will not change.

The yen has fallen as a response to this, and even the Finance Minister of Japan, Shunichi Suzuki, opened up about the urgency to contain this fall.

As per Yahoo Finance,

“focus now shifts to what BOJ Governor Kazuo Ueda says in his news briefing, given that the uncertainty over when this laggard in a global monetary cycle will move – torn between opposing domestic and global forces – is gnawing at Japanese markets and global investors.”

A major number of economists at a Reuters poll anticipate that the central bank will supposedly abolish their ten-year yield control scheme within 2024. More than half of them feel that the negative interest policy will also be ending in the next year as well.

“The 10-year Japanese Government Bond yield hit a 10-year high of 0.745% on Thursday, while the yen is fast heading back towards the new 2023 low of 148.45 per dollar, also hit on Thursday,”

as per the reports published in Yahoo Finance. World stocks, as well as the risk assets, had collapsed for a second time on Thursday, and the United States bond yields ascended to its multi year highs as the investors had adjusted to the revised rate outlook of the Fed, which has hammered home for its “higher for longer” position on the rates of interest.

Read Also: