- How Do I Get Qualified For Apple Card Pre Approval?

- How To Apply For Apple Credit Cards?

- Age & Geographic Requirements

- Technical Requirements

- Do You Need a Credit Score To Apply For Apple Credit Cards?

- Get Apple Card Pre Approval

- Accept The Terms Offered To You

- Frequently Asked Questions !! (FAQs):

- Final Words

How Can I Qualify For Apple Credit Card Pre-approval? – Let’s Find Out

So, you want to apply for Apple Cards. But do you know what are the steps for Apple Card Pre Approval? Wait, is there any pre approval program for Apple Cards? Actually, there is none.

However, there are different eligibility criteria that you can meet and see if you qualify for Applying to Apple Credit Card.

Go through this article to understand how to apply for Apple Credit cards and to know if you can get Apple Card Pre Approval.

How Do I Get Qualified For Apple Card Pre Approval?

There is no way to qualify for Apple Credit Card’s Pre Approval. The issuers themselves do not offer any options for that.

However, there are some eligibility criteria based on which you can analyze if you qualify for the credit card or not. Also, rest assured that checking for qualifications will not damage your credit score.

However, you should know that when they confirm the approval they will do a hard pull on the Credit report which might temporarily affect your credit score.

However, if you see that your application gets declined they will send you an invitation to join the Path for Apple Card program. You can use it to improve your personal financial situation and qualify for Apple Card.

Once you complete this program, you will earn the invitation to apply for Apple Card again.

How To Apply For Apple Credit Cards?

If you want to apply for credit cards you need to meet some of the eligibility criteria mentioned for the credit card. Here are some of the different eligibility areas you need to meet.

Age & Geographic Requirements

Here are some primary requirements you need to meet –

- First of all, you have to be a U.S. citizen. You also should have a physical address in the US.

- It would help if you were at least 18 years young or above.

- You may also need to provide your Photo ID for identification.

Read More: 5 Easy Steps To Pay Off Credit Card Debt Over $10,000

Technical Requirements

Here are some technical requirements that you need to meet to be eligible for Apple Pay.

- Your iPhone or other Apple device you are using needs to be compatible with Apple Pay.

- Also, update your device to the latest iOS update.

- Sign in to your Apple Device with the Apple ID. you also have to go through the two-factor authentication.

Do You Need a Credit Score To Apply For Apple Credit Cards?

We have not found any data on credit scores when looking for eligibility for Apple Credit cards. The issuer of the card or Goldman Sach has not mentioned anything in terms of credit score requirement for the issuance of the credit scores.

Apple has also suggested that credit needs to be widely accessible. However, there is no mention of you needing an excellent credit score to qualify for an Apple Credit card.

Get Apple Card Pre Approval

So, you do have all the required areas ready. You have the age requirement, the geographical requirements and all that is mentioned above. Now, it is time to move on to the next step – pre approval.

Yes, you are applying for Apple Card. but at this point, you do not have to qualify for any hard credit inquiry. This means you can see the interest rates, the credit limits you will be allowed, and more. However, this will not affect your credit score.

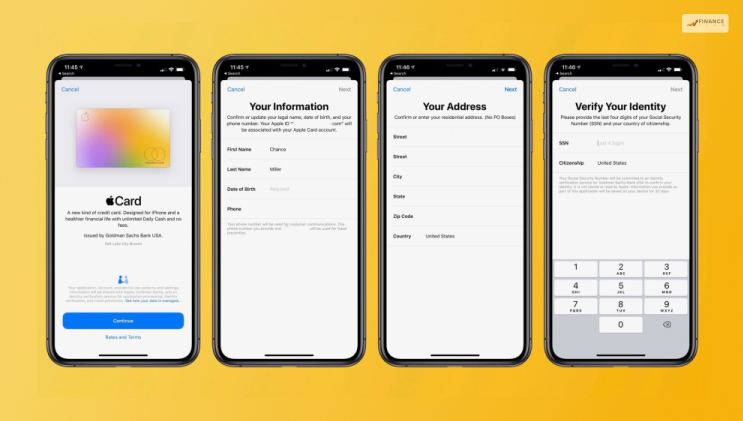

Here is how you start this process –

- Open the Apple Wallet Application and click on the Plus sign symbol at the top right corner of the screen.

- Now select the “Apply For Apple Cards” Option. This will take you to the “Continue” option which you need to click on.

- Next, you will review your personal information. The personal information includes your date of birth, total annual income, home address, and the last four digits of your personal social security number. You have to fill in now or update any missing information during this period.

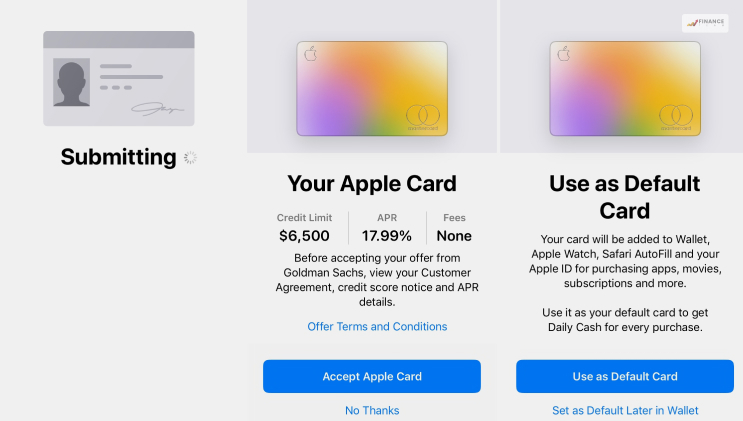

- When you agree to the terms and conditions applied by the issuer, you will finally see if you qualify for the credit card or not. If you see that you got approved, they will offer you with a credit limit and an annual percentage limit. You can either accept this offer or decline it.

Accept The Terms Offered To You

Now, this is the annual part of getting an Apple Card. if you get approved and have a credit limit and percentage offered to you, you should accept it. There will be a 30 days window for you to accept the credit card offer. When you accept the offer they will run a hard enquiry on your credits and credits scores which will temporarily affect your credit scores.

When you accept, you also get an instant access to the Apple Card in the Apple Wallet. There is also an option to request a physical card if that is what you want. Users can also assign a co-owner or authorize a new user. They also allow options for setting up Apple Card Family.

Frequently Asked Questions !! (FAQs):

Here are some queries I answered on your behalf. I hope that they are helpful.

Ans: Applicants need to have a credit score of above 660 to be approved for Apple Card.

Ans: You need to pass both geographical and age related eligibilities to get Apple Card. First, you need to be a citizen of the U.S.

Ans: Your credit scores, credit age, and income when you are applying are detrimental to what your credit limit at Apple Card looks like. According to the reports shared by the card holders the credit limits are as low as $50. And it can also be as high as $15000. If you have an Apple Card, you an share with your family using Apple Card Family.

Read More: How Does Kohl’s Bill Pay Work?

Final Words

If you are looking for Apple Card Pre Approval, you should know that there is not one such program. Also, if you apply and your application gets declined, it also does not mean that you can apply for Apple credit cards. They have the Path for Apple Card program to allow you to be eligible for Apple Card Programs.

So, did you find the answer to your query? Please let us know your answer on the same. Also, if you have any feedbacks to share, please put them down in the comment box.

Read Also: