- Aditya Birla Sun Life Insurance

- Aditya Birla Sun Life AMC:

- What Is The Venture All About?

- The Financial Status Of The Venture: [INR In Million]

- What Do We Mean When We Say Equity Share And Whether You Are The Right Person To Invest In It :

- So, Now You Have Finally Made A Rational Decision To Apply. But, What To Do From This Point?

- Why Is It Profitable?

Aditya Birla Sun Life AMC IPO Review, Date & IPO Price

Has your mind shifted from its original impulsiveness to more responsible thoughts of starting a business? Have you wondered whether to invest in the stock exchange to understand the market better and test the waters first? Although, you are overwhelmed with the options presented in front of you.

If you are a novice to this venture, you should always go for a company with its name that has a name behind it. Firstly, because you have an ample amount of reviews to read from before you invest in anything, and secondly, you will have years and years of record to back up their credibility.

In that case you should check out the new Aditya Birla Sun Life AMC IPO Review.

Aditya Birla Sun Life Insurance

Aditya Birla Life Insurance is one of the Fortune 500 companies under Aditya Birla Capital. It has been in the life insurance business for more than twenty years now. They can confidently provide you with the most personalized insurance scheme that will cater to your needs.

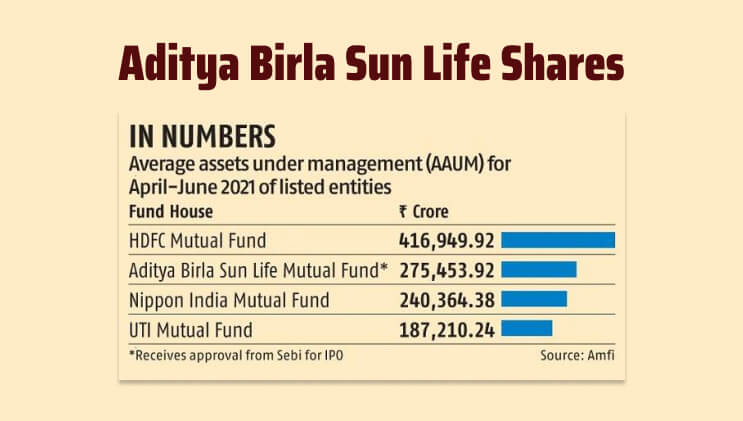

It is an investment managing company that is recorded under the Security And Exchange Board Of India.

It has more than 150 mutual fund schemes. Many of them have been reputed to be of superior quality to most of their competitors.

Aditya Birla Sun Life AMC:

In 2021 Aditya Birla Sun Life Insurance came up with its newest venture known as the Aditya Birla Sun Life AMC IPC.

Underneath you will find the detailed Aditya Birla Sun Life AMC IPO Review. It will include launch date, IPO Price, and pointers you need to know before deciding to invest in it:

The Aditya Birla Sun life AMC share price is 146879680 [Aditya Birla] and 141120000 [Sun Life], bringing the percentage to a 51% to 49% equity share, respectively.

What Is The Venture All About?

Aditya Birla Sun life AMC is solely for company owners and retail investors. It’s IPO [Initial Public Offering] is all about Retail investors buying shares of a company acquired by the two companies.

The Aditya Birla sun life AMC share price for Aditya Birla Capital will sell at a 13.5% stake, making it the minor seller. On the other hand, Sun Life [India] will be selling the majority of 36.03 million shares.

The launch date for this scheme is yet to be announced. However, retail and institutional investors can start participating in its IPO.

This is an excellent initial investment, as it is expected by the Aditya Birla Sun Life IPO to raise an approximate capital of Rs. 22,000 crores to Rs. 24,000 crores.

The expected share price has not been announced yet. But, now, coming to the investors planning to invest in the scheme, an estimation has been declared to be Rs. 5 Face value for every equity share listed underneath the stock exchange.

The listings have been established to be in Bombay Stock Exchange and National Stock Exchange.

The Financial Status Of The Venture: [INR In Million]

Underneath quoted are the financial status posted by far for the IPC.

March 21

- Total Assets: 19,845.51

- Total Revenue: 12,058.41

- Total Expense: 5,099.53

- Profit After Tax: 5,262.80

30th June 21

- Total Assets: 20,875.78

- Total Revenue: 3,362.45

- Total Expense : 1,303.56

- Profit After Text: 1,549.44

Earnings Per Equity Share [In Million]

30 June 2021

Basic Diluted: 5.38

March 2021

Basic Diluted: 18.27

What Do We Mean When We Say Equity Share And Whether You Are The Right Person To Invest In It :

As we all know that when invested in a company’s share, you buy a part of that ownership. So, you have a fair say in their decision-making process and a right to claim profits if the company makes any. But the results aren’t always that positive because you will fall prey to the same loss with the company going into a loss.

Buying a company share is about increasing your capital and having all the responsibilities that come from being a partial owner of the company. It is an investment that has a significant amount of risk. Although, the risk doesn’t always imply a negative investment.

Suppose you are a new investor in the market. Whether you are a youngster or not, this investment can pose as a starting point for you. Yes, the risk is there, but you can power through them if you want to learn something in the long run.

If you are a confident risk-taker and evaluate every pros and cons of the investment, this Aditya Birla Sun Life AMC IPO is a good path for you.

Companies don’t always fall into loss; sometimes they have skyrocketing profits so if you are a businessman trying to earn some quick profit you can invest in a small share. However, you can increase the share amount later after a proper evaluation of the company.

Businessmen with established business ventures or retired businessmen who will lose a lot shouldn’t invest in such a new scheme.

So, Now You Have Finally Made A Rational Decision To Apply. But, What To Do From This Point?

With the advent of new technology applying for such investment, schemes have become less and less complicated. Follow the steps enlisted below to understand the process.

- Firstly, you go to the UPI app Tradesmart and log in to the back office [BOX]. Then under the Portfolio menu, you select the IPO option.

- Choose the option BID from the action section in the Current and Upcoming IPOs.

- Then you have to enter your UPI Id. This UPI Id has to be linked to your bank account.

- Note: That only your own Bank Account can be used, the domain will reject any other bank ID.

- Now you have to select the IPO you wish to apply for and place your bid.

- You can either choose the cut-off price or enter a different price you want to invest in.

- The mandate request on your UPI has to be accepted.

- The day after you have applied for the IPO, you will be receiving an SMS with a confirmation.

Why Is It Profitable?

Firstly, the Stock Exchange always creates a safe environment for transactions of assets if you invest with good companies. Understanding Sun Life and Aditya Birla’s reputed efforts, only the best companies will be allowed to share their stock in this scheme.

Stock Exchange means liquid assets, con, names that represent the profit acquired by the company can be altered into capital that can be transferred into your bank account at any time.

Stock Exchange will always give you a better understanding of the market as you see someone else’s company growth in such a close personal view. Aditya Birla Sun Life AMC IPO could be a stepping stone for your entrepreneurship.

Read Also: