- What Is The Sukanya Samriddhi Yojana?

- The Perks That Tag Along With A Sukanya Samriddhi Account

- a) You Will be Saving Up on Taxes

- b) It's a Haven for the Long Run

- c) It Has a Motive

- d) The Interest In this Scheme is a God-Send

- e) Your Daughter's Educational Expenses are Covered

- f) Your Premiums are Affordable

- g) It is Quite Simple to Make a Transfer

- How To Get Started?

- Conclusion

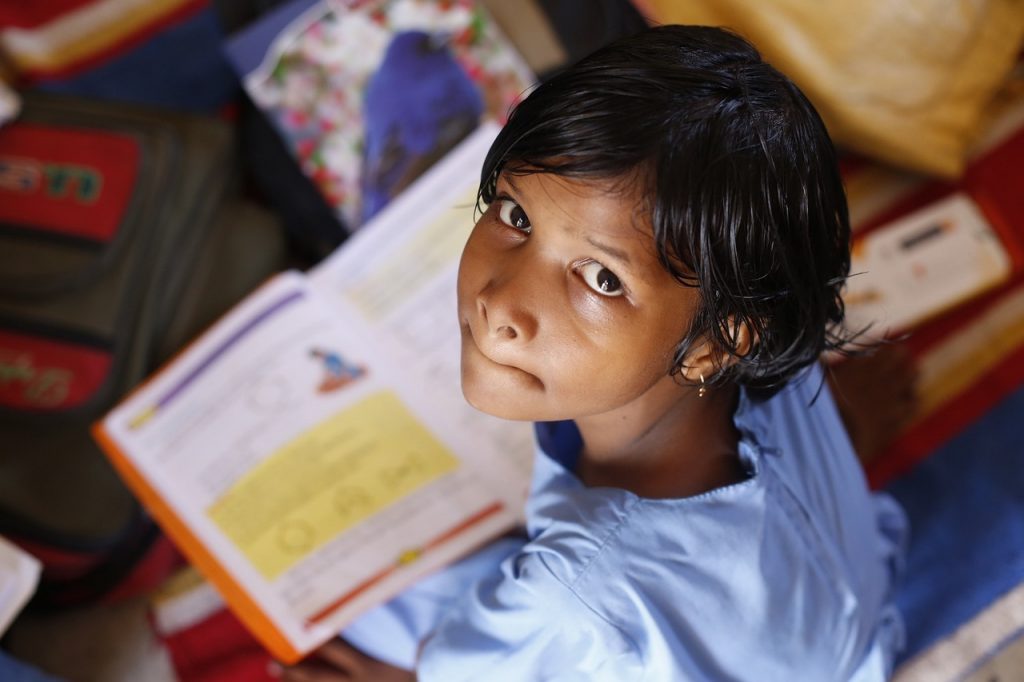

How Can Sukanya Samriddhi Yojana (SSY) Help Your Girl Child?

As the legend goes, we all want to make sure of a better future for the next generations – irrespective of a boy or girl.

As tradition goes, though, it is a given that the Indian system has a lot more in store for a girl child when it comes to stabilizing the financial future – one of them is the Sukanya Samriddhi Yojana. Haven’t you heard of it? Then you might want to.

What Is The Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana scheme is aiming for improving the individual lifestyle of girls in the country. The Sukanya Samriddhi scheme was first time introduced to provide a simple way of saving for every girl child in the country. SSY is valid for at least 21 years from the starting date of the account. Or the girl reaches the marriage age, which is 18.

Prime Minister Mr. Modi announced the Sukanya Samriddhi Yojana Scheme is part of the Beti Bachao and Beti Padhao campaign with the primary goal of safeguarding the fate of the girl child.

The following are the key advantages of the SSY scheme:

- The interest was cut from 8.4% to 7.6%.

- Tax breaks of up to Rs.1.5 lakh are available.

- Account transfers are possible.

Investments in the scheme can be used to fund the marriage and education of girls. Banks and post offices can open an SSY account. Tax advantages of up to Rs.1.5 lakhs are offered under Section 80C for donations made to the scheme.

The Perks That Tag Along With A Sukanya Samriddhi Account

Well, Sukanya Samriddhi Yojana Scheme is quite a boon to many – here are some of the benefits that you just have to know about.

a) You Will be Saving Up on Taxes

To encourage people to register Sukanya Samriddhi Yojana Accounts, the government has exempted contributions to these accounts under Section 80C. This scheme will almost certainly be EEE, which means that exemption will also be available on interest income and at the time of withdrawal.

It is being considered by the Department of Revenue (DOR). The DOR will soon introduce a legislative amendment to that effect. It will be the most tax-effective method.

b) It’s a Haven for the Long Run

This, in my opinion, is the BEST aspect of this system. The maturity date of the account is 21 years from the time that it was opened or the marriage of the girl child, whichever comes first. The girl should be 18 years old at the time of marriage. Account activity is not permitted after the day of marriage.

Only one premature Sukanya Samriddhi Yojana withdrawal is permitted for a girl child upon reaching the age of 18 if funds are necessary for further education. Premature withdrawals are limited to 50% of the Sukanya Samriddhi Yojana interest rate balance by the end of the previous year.

Deposits in the account can be made until fourteen years from the date that the account has been opened, with a maturity of 21 years from the date of account opening.

c) It Has a Motive

As previously stated, the Sukanya Samriddhi Yojana Account was created with the primary purpose of financial preparation for the marriage of a girl child. The social message is that if parents plan ahead of time, marriage or education for a girl child will not be a financial hardship.

With the lock-in term, as described in point 3, parents are not permitted to withdraw the allotted money for any purposes other rather than marriage or higher study for their daughter. As a result, it was stated at the outset of this piece that the Sukanya Samriddhi Account cannot be compared to any other financial instrument or small savings scheme.

Pals who are comparing this account to PPF, have forgotten that partial withdrawals are permitted after six years in PPF. Furthermore, PPF is a tax-saving mechanism rather than a goal in itself. They are oblivious to the goal of this operation.

d) The Interest In this Scheme is a God-Send

In contrast to other financial Sukanya Samriddhi Yojana schemes, interest is not paid on the maturity of the deposit/investment program. Sukanya Samriddhi Account has a unique feature in that interest is payable in the account even after maturity if the account is not closed by the account holder.

e) Your Daughter’s Educational Expenses are Covered

You can take 50% of the account balance at the conclusion of the preceding fiscal year to cover your girl child’s educational expenditures. This can be obtained by showing proof of enrollment.

f) Your Premiums are Affordable

The Sukanya Samriddhi Yojana account requires a minimum deposit of Rs.250 per fiscal year. You can deposit up to Rs.1.5 lakh per fiscal year whenever it is convenient for you.

The payments appear to be fairly cheap for people from all walks of life. Even if you fail to pay for a year, a penalty of Rs.50 will be assessed on the missing minimum payment of Rs.250, but the account will be kept open.

g) It is Quite Simple to Make a Transfer

The Sukanya Samriddhi Yojana account can be moved from any post office to any bank in India or vice versa.

How To Get Started?

A Sukanya Samriddhi Yojana account could be opened at any participating banking branch or Post Office branch.

To open the account, please follow the steps below:

- Step 1: Go to the bank or even the closest post office where you want to open the account.

- Step 2: Fill out the application form with essential information and attach supporting papers.

- Step 3: Pay the first cash deposit through a check or demand draught. The payment term ranges are Rs.250 and Rs.1.5 lakh.

- Step 4: Your application and other payment will be processed through a bank or the nearest Post Office.

- Step 5: Your SSY account will be opened after processing. A passbook will be supplied for this account to commemorate the account’s opening.

Conclusion

Making investment and savings choices for your children is inevitable – and one way you can make that a better move is by choosing the right kind of investment vehicle. One such reliable path for you to start investing is the Sukanya Samriddhi Yojana Scheme.

Read Also: