- Are Private Student Loans beneficial?

- What are Private Student Loans?

- Comparison with federal student loans

- Benefits and Drawbacks of Private Student Loans

- Advantages of private student loans

- Disadvantages of private student loans

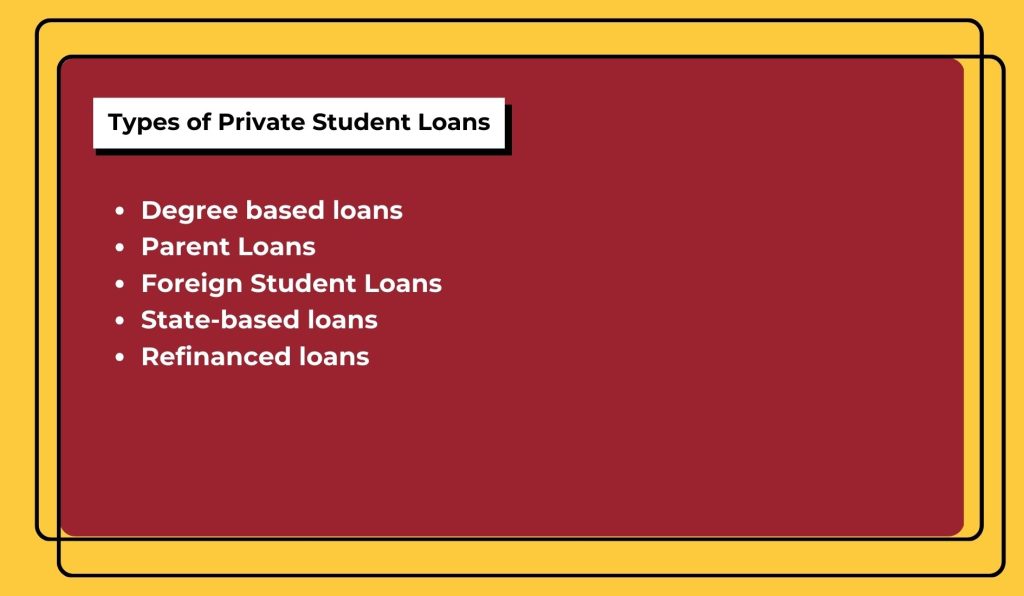

- Types of Private Student Loans

- How to Choose the Best Private Student Loan?

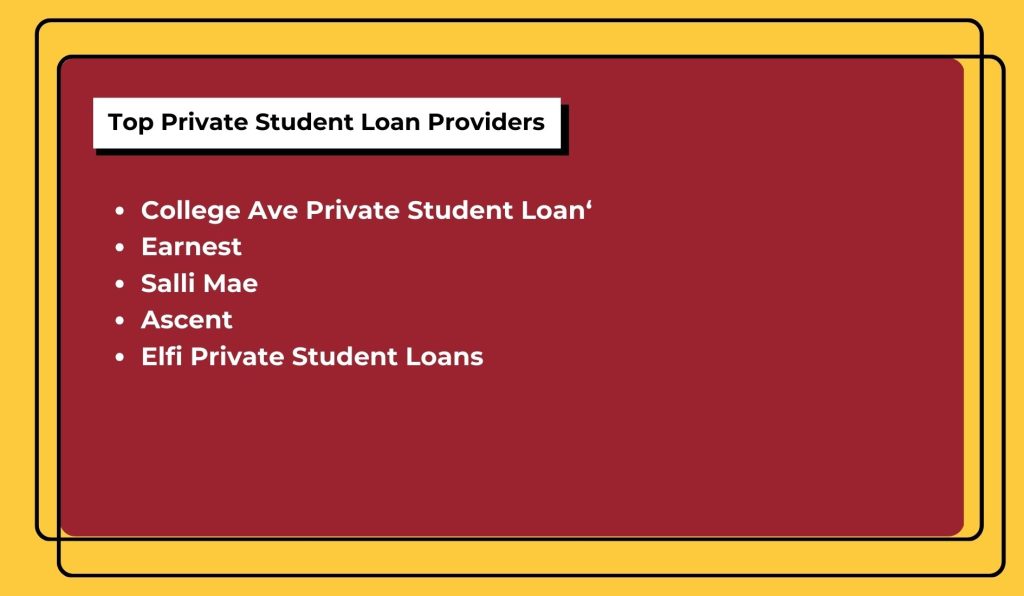

- Top Private Student Loan Providers

- 1. College Ave Private Student Loan

- 2. Earnest

- 3. Salli Mae

- 4. Ascent

- 5. Elfi Private Student Loans

- Risks and Considerations

- Conclusion

Private Student Loans: Are They Worth? Best Guide for First Timers

The US provides federal student loans to more than 45 million students. But what about the rest? You won’t get federal loans if you are not a strong match. In that case, private student loans are your only hope.

Private bodies like banks, credit unions, and affiliate credit companies convey these private loans. But the stark difference is that each lender sets their term here.

This year, 13% of the students in private colleges applied for private student loans. With more flexible and tailored schemes in the pipeline, more of them will take advantage of private loans in the future.

But experts advise against that. As a financial researcher, I would never recommend you go for private student loans in the first place. Sure, private loans are easy to apply for. However, there are two significant issues.

The interest rates are not fixed. And there are no income-driven flexible repayment plans. Without these two, the loan payback becomes quite a hustle.

Are Private Student Loans beneficial?

I may not consider private student loans as my first choice. But there are many bang-on benefits that you can’t ignore. The federal lender will evaluate your academic costs and decide how much you need.

Meanwhile, private lenders approve higher limits much more quickly. Wait! There’s one more catch; not many know of it. If you and your co-signer (parents preferably) have outstanding credit scores, your interest rate could be lower than federal parent PLUS loans.

So, let’s explore the private student loans offered in the US in detail.

What are Private Student Loans?

Private Student Loans help you to cover your academic and related expenses. It is similar to the federal student loans. However, private loans are conveyed by private bodies like banks, credit unions, etc.

Two basic checks let you qualify for private student loans. The direct borrower or the student must have an excellent credit score. There are rarely any private student loans for bad credit.

But one thing may still work out if your credit score is not up to the mark. Your co-signer must have an excellent credit score or a good financial portfolio. In that case, you may also get the best private student loans.

Comparison with federal student loans

| Criteria | Federal Student Loans | Private Student Loans |

|---|---|---|

| When repayment is due | Your payment will be due after you’ve graduated. | Generally, it needs you to start repayment, as soon as the loan is disbursed to your account. |

| Interest rates vary | The interest rates are much lower than any private credit scheme. The rates are static as well. | Generally, you’d expect your private loan interest rate to be higher than that of federal student loans. |

| Subsidy | There are multiple subsidized loan options under the federal scheme. | Private student loans are mostly not subsidized. |

| Tax benefits | The interest you pay on the loan is generally tax deductible. | The benefits are the same here. |

| Loan consolidation and refinancing options | You can consolidate your loans into a direct consolidation loan account. | You can refinance the private loans. But direct or indirect consolidation is impossible. |

Benefits and Drawbacks of Private Student Loans

Private student loans are mostly considered the second fiddle in the US. Its benefits do not surpass that of federal student loans. However, there are some impeccable benefits, absolutely on-money. Let’s check out both sides of private student loans.

Advantages of private student loans

- It can be cheaper than federal student loans if you and your co-signer have excellent credit scores.

- Federal loans have limits. For instance, undergraduates can’t expect more than $12500 per year. However, private student loans have no such impairments. Your credit score and credit history make the call here.

- You can apply and get your loan approved in 24 hours.

- Anybody not qualifying for federal loans can easily apply for private loans.

Disadvantages of private student loans

- Generally, private loans demand higher interest rates, barring those with exceptional credit scores.

- There are no income-driven repayment plans,

- Private loans don’t qualify for teacher loan forgiveness and similar schemes.

Types of Private Student Loans

Let’s check out the best private student loan options for students in the US. There are millions of students in private colleges every year. They can easily avail private student loans. But which is tailored to your needs? Learn more here.

| Loans | Features |

|---|---|

| Degree based loans | Offer variable rates, repayment tenure, and loan terms depending on your degree. For example, the loan options for medical, dental, and business schools are different. Medical loans would be eligible for greater limits. Meanwhile, the grace period for medical loans is also longer. |

| Parent Loans | Parent loans are the same as any other credit loan like personal or mortgage. Here, the parent has all repayment liabilities instead of the student. However, interest rates are generally higher than other private and federal loan options. |

| Foreign Student Loans | Are you a foreign national in the US for higher studies? Formally, it’s hard for you to get federal or private student loans. All lenders consider you a high-risk borrower. However, some lenders will approve your loan if you have a US-based co-signer with a good credit score. |

| State-based loans | There are particular state agencies to disburse loans within the concerned state border. For example, the Rhode Island Student Loan Authority (RISLA) will handle state loans for students in their area. If you are attending a college within the state’s borders, you may apply for this private loan for students. |

| Refinanced loans | Refinancing loans make your monthly premiums more affordable. It consolidates your existing student debts into a new scheme. In addition, the refinanced loan will qualify for a low interest rate under most probabilities. |

How to Choose the Best Private Student Loan?

You must follow some basic rules to select the best private student loan provider. Firstly, check the standard loan interest rate that applies to you. Secondly, check who’s offering a lower interest. Some lenders offer flexible payback terms and tenure.

Choose them if their interest rates are higher by 0.5 to 0.75%. After rigorous research, our experts on Student Financing came up with these tips for you:

- Review the APR rates that a bank or credit union charges. Remember, APR combines the additional fees and other payables, including the interest charged. So, track the APR to understand better how much you must pay back.

- Choose the one that gives flexible repayment tenure and terms over someone offering longer. Similarly, a longer tenure means you have to pay more interest.

- Check all the fees that a student loan body demands. Usually, they may charge four types of fees from you. These are:

- Origination fees for processing your loanLate fees for missing the due datesReturned patent fees for the occasions when your ECS bounce

- Collection fees

Top Private Student Loan Providers

According to FinanceTeam expert reviews, these loans would be the best for you:

1. College Ave Private Student Loan

They have a fixed APR of 3.4 to 17.99%. If you qualify for variable APR, it may go up to 17.99% as well. People with mid-credit scores (600 or above) can be eligible for this type of loans from College Ave.

2. Earnest

They have a fixed APR of 3.69% to 16.49%. If you qualify for variable APR, it may go up to 16.85%. People with a low credit score of 650 can also be eligible for private student loans from Earnest.

3. Salli Mae

They have a fixed APR of 3.49% to 15.49%. If you qualify for variable APR, it may vary from 4.92% to 15.08%. People with mid-credit scores (600 or above) can also be eligible for private student loans from Salli Mae.

4. Ascent

They have a fixed APR of 3.69 to 14.41%. If you qualify for variable APR, it may vary from 5.50 to 14.56%. People with low to mid 600s can also be eligible for Ascent Loans.

5. Elfi Private Student Loans

They have a fixed APR of 3.69 to 14.22%. If you qualify for variable APR, it may vary from 5.00 to 14.22%. However, borrowers need to have a minimum credit score of 680.

Risks and Considerations

There are some acute risks that you must be aware of. Firstly, there are limited repayment options for private student loans. Moreover, you won’t be eligible for federal forgiveness options, if you avail private loans.

When you can’t repay or keep delaying payments, the debts keep piling up. And late fees keep counting up. So do your bounce charges. Hence, you must lend the amount you need.

Imagine your academics will cost you $75,000 for the whole term. And you can afford $2500 every month through a part time job. In that state, either borrow less or keep paying back as soon as possible.

Conclusion

Private student loans offer higher loan amounts. However, most of the loans are unforgivable. They also come with a higher interest rate. Hence, I recommend trying all federal loan options before applying for private loans.

Carefully read the guide before you choose a loan option. Don’t forget to compare the lenders I mentioned. Also, try and understand all terms and conditions for repayment before you apply.

If you face doubts, you can post your queries below. Our financial experts will evaluate your doubts and document reasonable solutions.

For More Finance Related Articles Click Below!!!