- What are debt relief companies?

- Reasons behind the growth of debt settlement companies

- How do debt settlement companies work?

- Things to remember before you enroll with debt settlement companies

- Your credit score will be devastated.

- Creditors will keep on piling up additional fines.

- Don't forget the taxes on the forgiveness amount

- Don't forget to file the receipt form along with your tax return.

- Your debt may increase as well.

- Debt relief programs can be a scam.

- The best-accredited debt settlement companies

- Accredited debt Relief program

- Freedom Debt Relief

- National Debt Relief

- Alternatives of debt settlement

- Credit cards for balance transfer

Trapped in Debt? Complete Guide to Debt Relief Programs of The Best Debt Settlement Companies in the US

The average American suffers from a debt of $104,215. Shocked? I know most people won’t believe the figures. But I am quoting federal reserve data here. Thanks to debt relief companies, Americans can finally come out of this vicious cycle of debt. Let’s check out how these companies work. We will also explore the top-rated Debt settlement companies in the US.

Americans are not serious about the way they handle debt. That’s why average Americans have at least $6501 in credit card debts.

Americans are not good at handling loans at all. It may be a mortgage or home equity credit line. It might also be your average credit card, auto, or student loan. Experian records show payback failures and recurring penalties in all kinds of accounts in the US.

What are debt relief companies?

The US government started the National Debt Relief to help Americans quickly manage their loans and clear their long-standing dues. The low fee structure of this scheme and the referral service make it so lucrative. However, the National Debt Relief scheme is not the end of the debt relief industry in the US. There are private companies as well.

They also charge similar fees. In most cases, you will see the cost range from 15 to 25% of your net debt amount. However, there are some minimum eligibility criteria for most debt relief companies.

Few private companies allow you to enroll when you have more than $10000 in debt. They can offer you many schemes or leverage to help you reduce the amount owed.

Often, credit counseling companies also offer debt management help. Their plans might be less costly compared to the organic debt settlement companies. However, credit counseling companies cannot help you with debt forgiveness.

Reasons behind the growth of debt settlement companies

After searching the schemes from 50 debt settlement companies, we found some critical parameters for choosing one for you. Firstly, you will check the cost of their services. Secondly, you should look into the availability of their service options.

Thirdly, you might consider their existing market reputation. In the end, they also read their company portfolio to check if they have stable funding to pull off their projects.

Good debt settlement companies will maintain payment transparency, frequent accreditation, and a constant customer support trajectory. Don’t choose a company which does not have even one of these.

How do debt settlement companies work?

These companies negotiate your debt amount on your behalf with your creditors. Once you enroll with them, the companies advise you to stop making any repayments to the creditors.

Instead, they ask you to put money in a particular savings account based on your financial leverage.

Meanwhile, debt settlement companies will negotiate with creditors continuously. Once they can successfully find a middle ground with them, they will use the funds in your account to pay off the creditors.

Don’t think it is a charity program from their end. Most debt settlement companies charge 15 to 25% of your total debt.

Now, you may choose not to enlist the whole debt you owe in the market. If you can manage at least 30 to 40% of your debt by yourself, you can enroll the rest.

But there is a catch. Most debt settlement companies need you to enroll at least $10000 of debt with them to qualify for their program. This means that they earn at least $1500.

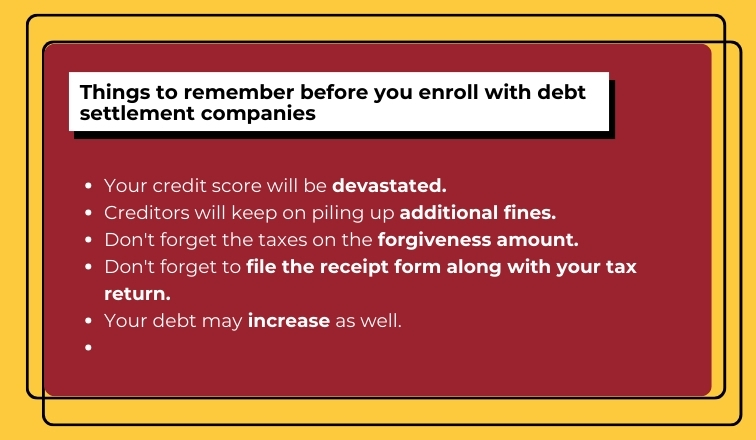

Things to remember before you enroll with debt settlement companies

Remember, there are numerous scammers in the industry. There might be some typical troubles even when you work with any legitimate debt settlement company. So, choose wisely and track how they work.

Your credit score will be devastated.

The debt settlement companies encourage you to stop making any payments to the creditors. When you do so, the creditors will post adverse reports to the credit authority. Meanwhile, your credit score will drop seriously.

Your credit payback history is responsible for 35% of your credit score. If you stop making repayments, it will leave a dent in your credit card report. Average Americans take at least 7 years to get rid of poor credit scores after availing of debt relief programs.

Creditors will keep on piling up additional fines.

Most creditors, from credit card companies to personal loan apps, charge interest and additional files when you repetitively fail payments. When you stop payments completely, the creditors might take legal action or pester you with constant calls.

Their CFPB highlights that debt settlement companies may not help you with all kinds of debts.

Don’t forget the taxes on the forgiveness amount

US law says that any forgiven debt over a threshold of $600 is taxable. The creditor will give you the 1099 C cancellation of debt form whenever your debt is forgiven.

Don’t forget to file the receipt form along with your tax return.

Let’s take an example here. Imagine you have 20000 pending debts in your credit card bills. But you pay only 10000 to settle the debt. So the remaining 10000 is your forgiven amount. This amount will be shown as your income for the running financial year.

It can increase your income bracket at the end of the day. Meanwhile, your tax obligation will also increase. So, I suggest consulting with tax professionals before you go on and file your taxes the same year.

Your debt may increase as well.

The debt settlement companies charge high. They can charge as much as 25% of your current debt. You can also charge separate fees to maintain your particular savings account on your behalf.

Already, you have a hefty debt burden on your shoulders. During the primary time, you must pay the fees and go to the tax liabilities of your settled debt amount. Unless your creditor significantly lowers your repayable clearance amount after settlement, the debt relief assistance is useless.

Debt relief programs can be a scam.

More than 1000 debt settlement companies are working legitimately in the US now. However, you cannot ignore that several debt relief scams also exist. So, check for red flags and stop paying such companies immediately when you find anything unscrupulous:

- Any unsolicited contact is a big Red flag. Any reputed debt management company will never make cold calls to clients (potential).

- Debt relief companies never ask for an upfront payment. Instead, they will deduct their fees from your particular savings account.

- Check out for unrealistic promises. Avoid companies that promise they will make your debt vanish. No company can guarantee to relieve you from 100% of your debts upfront.

- The debt settlement companies will never ask you to stop attending to calls from your creditors. When any debt relief company tells you to do such a thing, consider stopping further business transactions with them. The CFPB also recommends the same.

The best-accredited debt settlement companies

Many companies offer this scheme to people suffering from loans in the US. But there are some criteria for choosing the best among them. Firstly, check the company’s minimum debt enrollment criteria. Secondly, check how much of the debt settlement fee they ask you.

Accredited debt Relief program

Accredited is one of the most popular financial instruments bodies in the US. So, you can also rely on their debt settlement company. Their minimum debt enrollment value is meager. Meanwhile, recharge the debt settlement fee as low as 15%.

Freedom Debt Relief

It is one of the other most popular debt settlement companies in the US now. They will settle a minimum debt of $7500. Their minimum settlement fee is 15%. However, it can increase when your debt value is reasonably low.

National Debt Relief

The one debt relief program you can trust blindfoldedly is the national debt relief program. Its terms are the same as those of the Freedom Debt Relief scheme. However, the added benefits include free consultation and absolutely no upfront fees.

Alternatives of debt settlement

Debt settlement should be your last option. It can damage your credit score like nothing else. It can also go through the same harassment and calls from creditors you would otherwise face. So, you may choose alternatives to debt settlement, too. Firstly, you can consider debt management plans.

You need planned progress to consolidate your debts into a single monthly payment program. Hence, you can pay off everything you owe in 3 to 5 years. Your credit counseling agencies can create and help you manage this plan until your debt is cleared.

You can also consider debt consolidation loans. It is a loan account that pays off your existing loans in the market. It also offers a meager interest rate and lower monthly repayment options.

Credit cards for balance transfer

Some credit cards allow you to move your debt from other cards to a new card. People with good credit scores can use this service against 0% APR.

Choose your options wisely.

For More Financial Articles Click Below!!!