- More on the Use of AI in Finance

- AI Companies in Finance

- Gynger

- Enova

- Ocrolus

- Scienaptic AI

- Zest AI

- How does AI in finance work?

- Speech recognition

- Sentiment Analysis

- Detect Anomalies

- Recommendations

- Translation

- Docs Processing

- Image Recognition

- Conversations

- Predictive Modeling

- Generative AI

- Prime benefits of AI in finance

- Accuracy

- Speed

- What’s in stock going forward?

AI in Finance May Change How Your Bank Works! Applications, Benefits, and Future Uses

Who can ignore the need for data analytics in finance? And who is better than AI for effortless data analytics? But that’s not the only use of AI in Finance. We need it for better performance measurement.

AI can find them if some of our funds are not performing as expected. Similarly, AI can predict which financial instruments will perform better. Also, use AI for better real time financial calculations.

Whether customer service or data management, AI in finance has limitless uses. Meanwhile, AI in finance can be used for better decision-making as well. Use AI to understand the market better. Hence, you can land improved investment decisions. Most importantly, you can check out Alternative Investments that are best for your financial profile.

But why AI in finance is growing big? We all know that AI mimics human intelligence. Using the same model, AI can mimic the investment approaches of the best financial masterminds.

More on the Use of AI in Finance

The market of AI in finance is booming. It will grow by 16.5% by 2030. Already, it is valued well above $10 billion this year. But why is it getting so much momentum? Indeed, there are ample use cases of AI in finance.

But I found the five most vital uses of AI in finance. Firstly, it can personalize your financial instruments and services. Secondly, you can create many opportunities using AI in finance. At the same time, you can stall financial frauds and similar risks using AI in finance. However, banks and unions use AI to maintain compliance, automate functions, and reduce costs.

AI Companies in Finance

These AI companies are helping finance firms underwrite the way the sector works:

Gynger

This AI platform is innovative. It allows you to open an account to buy tech flexibly. Meanwhile, AI will scan the market for compatible payment terms for hardware and software products.

You will get natural feeds about the best offers on this platform. And getting approved on Gynger is easy.

Enova

If there’s one platform the modern fintech would want to sync with, that’s Enova. This is a classic AI to create better financial analytics alongside credit assessment. However, there is another thing about Enova that I like the most.

They always help small credit unions and fin corps to emerge. For example, you can manage your emergency costs with Enova. Considering the volatility in the finance sector, measuring emergency costs is crucial. Moreover, no lender or borrower has lately reported financial dismay after using this AI app.

Ocrolus

Are you an emerging bank, short of staff? Worry not. Ocrolus is here. You can use it to process documents and do customers’ KYC. Hence, you can register more new customers in no time. But what about accuracy?

Recent reports and customer feedback say that Ocrolus’ error rate is almost 0. Upon inquiring people from Yodlee and Lendflow, I found that Ocrolus has a 0-error rate, as per the last two months’ performance.

These two are the two top clients of Ocrolus.

Scienaptic AI

Need a reliable app for credit underwriting? Well, it can be the most eminent use of AI in finance. And the AI app that does that with conviction is Scienaptic AI. Banks and credit companies can use this app when they want more transparency. Firstly, Scienaptic AI lets you cut down on losses through accurate financial measurements. Secondly, it can track your non-tradeline data and use adaptive models to help you make credit decisions.

Zest AI

Zest Ai is another AI underwriting platform. If you want to assess borrowers with no or minimal credit history, you may go by this app. There are numerous data points on Zest AI. Hence, you can easily mark the borrowers who are “at risk.”

Zest claims that auto lenders can minimize losses by 23%. Firstly, they assessed the risk. Then aimed to reduce lending risk by 25%. As a result, auto lenders faced 23% less risk.

Customers can also get an auto loan pre approval for used car, when they can skip the manual checking process.

How does AI in finance work?

If you were wondering about how AI can actually contribute to developing finance into a detailed process, read them here! AI can solve some real challenges in financial services. Let’s check out how-

Speech recognition

To know your customers in-depth, you must read between the lines. I mean, you should track insights from your customer interactions. But you need tracking software that can catch keywords. At the same time, convert text to speech.

Now, all that’s possible with AI.

The AI apps can track customers’ intentions when attending sales calls.

Sentiment Analysis

As a human, it’s barely possible to tactfully trace the emotions in a text perfectly. Meanwhile, we are all clouded by emotion and biases. So that’s a next-to-impossible task for us. But AI can do that without breaking a sweat. The apps that can do sentiment analysis are natural language AI apps.

These apps can also research investments, analyze chat data sentiments, etc.

Detect Anomalies

AI apps can trace anomalies easily. For example, trace fraudulent transactions, detect chances of financial crime, and spoofing in economic trade. In conclusion, anomaly detection can reduce the percentage of cyber threats.

Recommendations

AI apps can recommend the best financial products for customers. For example, you may be unsure whether to pass a customer’s unsecured loan claim or ask him to avail of secure loans at first.

Don’t sweat. Let AI do that for you. There are numerous types of AI in finance now. These apps can trace the customers’ financial status, future needs, and ability to repay a loan. And then suggest what’s best for each customer. AI can also shuffle various US loan options to suggest the best one for a customer.

Some banks allow a customer interface of the AI apps too. They provide customers with Factor-Based Investing advice and tailored banking offers.

Translation

Do you want your financial products to reach a wider audience? That’s also possible with AI in finance now. AI apps can make your apps, newsletters, and notifications multilingual. The fast and accurate machine learning functions can help in the process.

Hence, your bank can reach more customers.

Docs Processing

Scanning each document can be a real drag. So, skip that for now. Let AI apps do that on your behalf. Now, you can extract structured and unstructured data from customers’ docs.

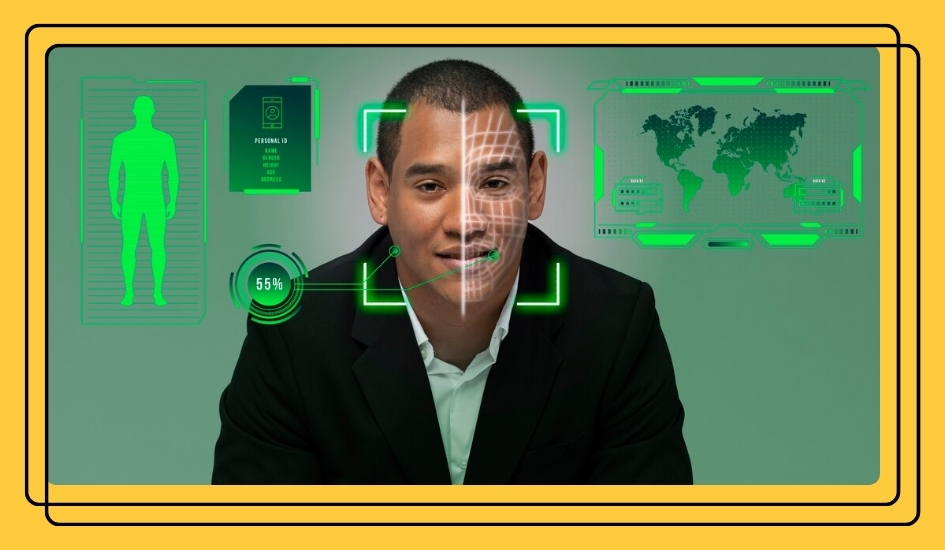

Image Recognition

Verifying insurance claim images can be detailed and time-consuming. So, accelerate the process with AI for finance. AI apps analyze pictures and videos to tell if it’s real. The apps can also expedite customers’ onboarding process. Meanwhile, AI-based KYC is also possible now. Featured virtual AI bots can conduct AI sessions with customers.

Conversations

Falling short of staff in your contact center? Now offer banking concierges and run customer helpdesks with AI-powered bots. Such apps can manage your crisis and allow you to operate at much lower costs.

The apps can also free human agents. Hence, you can smoothly manage the workload.

Predictive Modeling

Do you want to run the future prediction of your current financial scheme? AI in finance has numerous ways to predict whether your scheme will gather traction. AI tracks customer data, loan risks, transaction patterns, and other data from customers to decide whether they will avail of your scheme.

Generative AI

Generative AI in finance can engage with customers naturally and responsibly. When you synthesize and analyze data quickly, you quickly reach more customers.

Prime benefits of AI in finance

Banks can increase revenue and improve customer service with AI in many ways. At first, they can try automation. Automation AI apps can enhance the quality of digital banking. It can also help in faster decision making.

Accuracy

In the US, even innocuous errors like clerical mistakes cost banks around $500 million. Meanwhile, simple typos cost the banking sector around $78 million annually. In this situation, controlling errors during manual data processing becomes invincible.

AI in finance can also automate algorithms that accurately track data each time.

Speed

AI can process facts efficiently. Hence, 47% of companies use AI-powered chatbots to handle customer service. Moreover, AI chatbots can detect patterns in chats that human representatives might miss.

At the same time, AI uses that data to send tailored suggestions to customers.

What’s in stock going forward?

AI in finance is going through evaluation. Many banks are fully digital now. They use AI bots for various services and manual handling jobs. In the future, AI can personalize customer experience and improve sales.

Meanwhile, the AI apps will be vital in sending accurate service recommendations. In addition, AI in finance also improves concierge services. Now, you can expect 24×7 services from banks. But that’s been only possible with AI.

When AI leverages human engagement seamlessly, the bank creates a unique experience for banking customers.

For More Business Related Articles Click Below!!