- How Does The Social Security Disability 5 Year Rule Benefit Work?

- You Have A Qualifying Disability

- Apply For SSDI Benefits Before Your Full Retirement Age

- You Must Have Worked For At Least Five Of The Ten Years Before You Became Disabled

- You Are Disabled For Five Months Straight

- How To Apply For A Social Security Disability 5 Year Rule?

- You Will Continue To Receive Disability Benefits During The "Trial Work Period"

- The Bottom Line

What Is The Social Security Disability 5 Year Rule? – Let’s Find Out

According to the Social Security Disability 5 year rule, you may skip a certain waiting period to receive disability benefits if you had previously received these benefits, stopped receiving them, and then again became disabled to work within the five years.

This might be tough to understand, so let me simplify it more, which will be more understandable for you.

So under the social security disability 5 year rule, anyone that has been working intermittently and yet has a disability that occurs more than once in the span of five years and prevents them from working will have a much easier reapplication process while accessing these benefits in a five-year span.

Here is everything you need to know to qualify and re-qualify for the social security disability 5 year rule and avail all its benefits.

How Does The Social Security Disability 5 Year Rule Benefit Work?

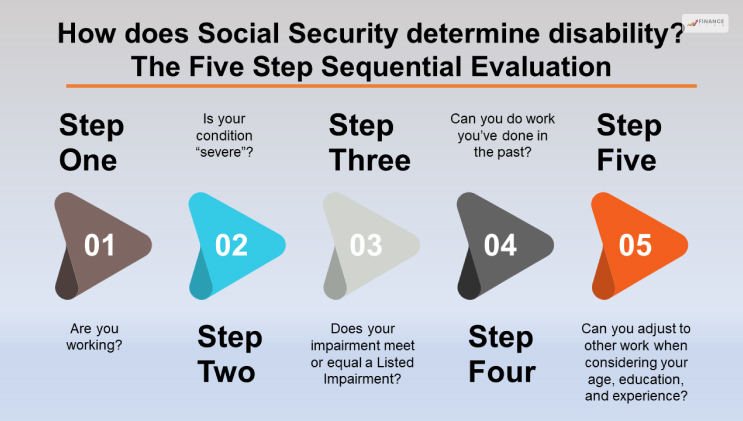

The qualification rules of SSDI are strict. These rules are inclusive of factors regarding the duration of your disability, when you applied, how long you have actively worked before you became disabled, and so on.

These are the following requirements that you must meet in order to receive disability benefits:

You Have A Qualifying Disability

According to the Social Security Administration, a disability is a “medically determinable physical or mental impairment” which continues for at least 12 months.

The concerned situation must make you unable to do your existing work or any other substantial work that exists in the nation’s economy. However, the rules are different in case of blindness or if you apply for survivors’ benefits.

Read More: What Is Social Security Socialism?

Apply For SSDI Benefits Before Your Full Retirement Age

The full retirement age for receiving social security is the age at which an individual gets 100% of the monthly social security retirement benefit.

The age ranges from 66-67 years. The full retirement age of an individual is determined based on their birth year.

You Must Have Worked For At Least Five Of The Ten Years Before You Became Disabled

People get “credits” when they work and pay social security taxes. They can earn up to four credits per year of your work.

You will require 40 work credits to qualify for SSDI benefits, amongst which 20 will be the ones you were receiving in the first ten years before getting down with disability.

You Are Disabled For Five Months Straight

In this rule, you are to receive the benefits from the sixth month since you apply for the benefits. However, you may receive retroactive payments for up to the previous 12 months if you are eligible for the benefits earlier due to the early appearance of the disability.

And finally, if you’ve received SSDI benefits previously, the social security disability 5 year rule cancels out the five months waiting period hence resuming your benefits immediately.

How To Apply For A Social Security Disability 5 Year Rule?

The SSA recommends that you apply for the said benefits as immediately as you become disabled. However, if there is a delay, you will be able to get back-paid benefits for up to 12 months previously.

This is how you can apply:

- Fill out an application on the Social Security website.

- Make a call on the Social Security Administration phone line.

- Pay a visit to your nearest Social Security office.

You may be able to help a third person get disability benefits despite being an unauthorized representative. This may require you to answer additional queries regarding your relationship with the recipient of the benefits.

The recipient will have to either electronically or physically sign the application.

You Will Continue To Receive Disability Benefits During The “Trial Work Period”

While learning about the social security disability 5 year rule, there are certain other rules that you must be aware of. Knowing these will only help you get better outcomes.

You must know that you will still continue to receive disability benefits while being on the “Trial Work Period.”

The government discovered that under the old disability program, people were often scared to return to work because they thought that they would no longer be receiving the disability benefits.

They thought if they found themselves incapable of resuming work after rejoining, they would have to reapply for their SSD benefits and that the SSA would consider that their disability had been majorly healed since they decided to get back to work.

But you have to understand that the SSA wants you to at least try. The government wants to save its social disability funds for those individuals whose disability remains severe. They would not want to continue to provide benefits if the recipient is well enough to resume work.

The Trial Work Period program was therefore introduced to motivate disabled workers to make an effort to work if they feel they are ready for it.

Under the TWP program, a worker with disability may resume his work and would receive a full income and, alongside, receive the SSD benefits for a continuity of nine months. The nine months do not require to be consecutive.

You can use these nine months within a timeframe of five years.

For any of the months where the disability recipient earns a minimum of $1,050 (as per in 2023), it then calculates as one of the nine months under the Trial Work Period month.

Read More: 10 Ways To Protect Your Social Security Number

The Bottom Line

The social security disability rule is a vast concept; however, I have provided you with all the necessary information that I could through this article.

If you are looking for more detailed knowledge, you must talk to a professional that has high expertise in this field to help you out with the said matter.

Read Also: