- What Is a Destiny Credit Card?

- Why Should You Use The Destiny Credit Card?

- 1. Easier Access

- 2. Payment Security

- 3. Options For Paying Automatically

- 4. Easily Build Credit

- 5. Zero Balance Transfer

- How To Register For Destiny Credit Card Login?

- Destiny Credit Card Login Process

- How To Reset Destiny Credit Card Login Username And Password?

- Carrying a Balance on Your Destiny Card

- Logging Off

Destiny Credit Card Login – Payment And Customer Services

The destiny card is commonly referred to as an unsecured credit card. This type of unsecured credit card is designed for clients and customers whose credit standings are low. Here, your credit standing is determined by three different credit bureaus.

Learn more about this credit card and its login and registration processes by reading this post till the end! Did you know! You can maintain a balance on your Destinay card too!

Haven’t heard of it? It’s easy and secure. But there are stipulated fees chargeable. The charges can vary.

What Is a Destiny Credit Card?

Destiny credit card charges an annual fee between $59 to $99 from every cardholder. Destiny Credit Cards also charge an Annual Percentage Rate (APR) of 24.90%, like other credit cards in similar ranges. But the APR varies if you wish to maintain a balance. The minimum balance APR is 35.9%.

However, unbeknownst to many, the Destiny Credit card is provided by First Electronic Bank. However, its operations regarding this card are overseen by Genesis FS Card Services.

The Destiny Credit Card headquarters are in Beaverton, New Orleans. This card has become popular because of its two primary benefits to users. One of them is Zero Liability Protection. The other benefit is Identity Theft Protection. Therefore, Destiny provides high security to all their credit card users.

Why Should You Use The Destiny Credit Card?

There are various benefits provided by Destiny Credit Cards that make it an enticing credit card for people to use. Some of the main advantages of using the Destiny Credit balance are:

1. Easier Access

It is easy to access various functions and features of the Destiny credit card from anywhere, at any time. This is because you can download and use the Destiny Credit Card App from your smartphone.

Your balance allows you to make faster transactions. In case your available limit is low, you can still make a purchase. There, you can add up your balance with the CC limit while paying.

Using this application, you can do various essential tasks, like:

- Check your credit balance.

- View your Destiny Credit passbook, which records data regarding all your transactions so far, along with various other statements.

- In case of balance discrepancy, you can tally the passbook data.

- Schedule payments ahead of time so that you can focus on doing other important things.

2. Payment Security

The Destiny credit card balance has various security systems that make all your transactions more effortless and secure. Credit cards like Mission Lane login and Carter’s Credit Card provide similar measures.

3. Options For Paying Automatically

One of the best benefits of using a Destiny credit card lies in its autopay function. This function works, even if you are maintaining a balance. Here, you can schedule various payments ahead of time to live tension free. Therefore, you can enjoy going to the theater with your family, all the while setting up payments to take place later automatically.

4. Easily Build Credit

Destiny Credit cards are available to users who have lower credit scores. Therefore, by using this card, you can look forward to improving your credit score and creditworthiness.

5. Zero Balance Transfer

This credit card is perfect for people who wish to use something other than secured credit cards. This is because when you start using it, you do not need any balance transfer from previous accounts and cards.

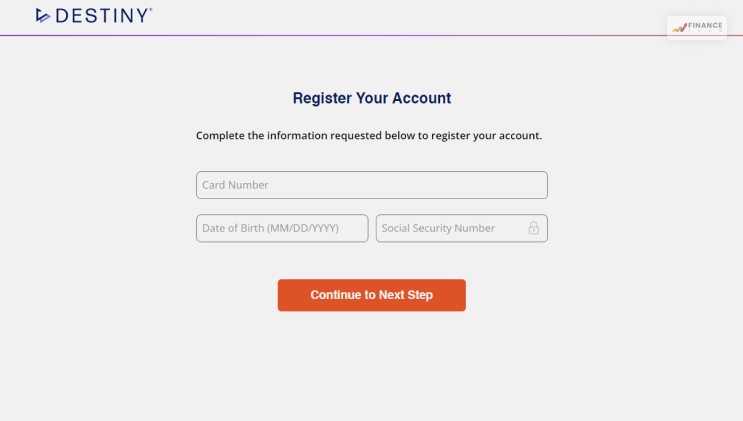

How To Register For Destiny Credit Card Login?

There are a few steps to check your Destiny card balance. The steps are:

- Logging into the online account

- Alternatively call your customer helpline at 1-800-583-5698.

Online checking is always recommended. This is faster as there are no automated follow-through processes online. So, you are not kept waiting. You do not need to wait for any representatives to reply to a post or query.

Experts say that it is always better to frequently use this feature. It is not time taking and way simple too. In case your balance is higher than what it should be, there can be something suspicious. In any such instance, minutely check all the transactions made recently. Contact customer care or lodge an online complaint if you find any discrepancy in balance.

Destiny Credit Card Login Process

In the previous section, I explained how you need to complete the Destiny Credit card registration process. But first you must log in to your account. Here’s how you can do so:

- Go to the website www.destinycard.com.

- Then click on My Account.

- Next, click on Log In.

- Now, you must enter your username and password, and you are done!

How To Reset Destiny Credit Card Login Username And Password?

If you forget your Destiny Credit Card login credentials, like your username and password, you cannot access your Destiny Card balance. But you can easily reset them anytime. Here’s how you can do so:

- First, open the official webpage of Destiny Mastercard from your browser –www.destinycard.com.

- Once you open the homepage of this website, navigate to the My Account option and click on it.

- Now, click on Sign In.

- On the Login screen, click on Forgot Password.

- A new page will open, where you must enter three details – your username and 16-digit Destiny Credit Card number. You must also enter your date of birth and your Social Security Number.

- After giving all the details above, click on Reset Password.

- Now, you can enter your new password and click Done to complete this process!

Carrying a Balance on Your Destiny Card

Many people ask me if you can carry an actual balance on your destiny card. The answer to all your queries is Yes! There are multiple benefits of carrying a balance. Firstly, it allows you to pay for impromptu purchases, wiithout taking much time. Secondly, it helps in making miscellaneous other transactions too.

To maintain your Destiny card balance, you need to make a small payment on a monthly basis. The remaining balance stays in your account.

Carrying a balance can have some demerits too. For instance, you may have to pay interest charges if you carry a balance with your card every time.

Common enquiries on Destiny card balance:

- Is it possible to carry Destiny card balance?

Yes! You can certainly do that, for a monthly fee. To know the fees, log into your account or call customer service.

- What is the least monthly payment to maintain Destiny card balance?

It is variable. But it is $40 or approximately 7% of the balance shown in the statement. This is the interest charge component of the total charge taken. If you are facing additional deductions, contact customer care immediately. The fees for balance maintenance are additionally applicable.

If you have any dues from the past, then the same will be deducted from the balance. A minimum $40 will be deducted as interest, if 7% of your balance is below $40.

- What is the APR

At a regular basis, the APR is 35.9%

- Any cash advance APR needed?

The applicable APR in this case is the same as well.

Logging Off

You must learn how to use the Destiny Card balance maintenance and Destiny Card balance enquiry process. This will help you to withdraw cash and purchase various goods on credit. You will also receive many offers like cashback on goods purchased if you use this service.

Read Also:

All Comments

neet and angel apk

15 June, 2024

I'm glad I found this article because I was having trouble logging into my Destiny credit card account. The step-by-step guide was super helpful and now I can access my account easily. Thanks for sharing!